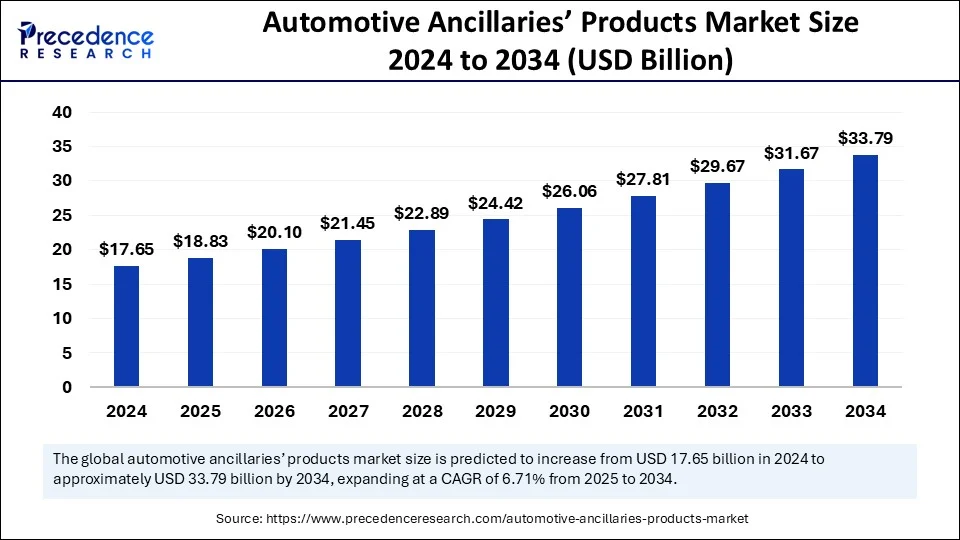

The global automotive ancillaries’ products market is projected to grow from USD 17.65 Bn in 2024 to USD 33.79 Bn by 2034, at a CAGR of 6.71%.

Automotive Ancillaries’ Products Market Key Takeaways

- Asia Pacific dominated the automotive ancillaries’ products market with the largest market share of 39% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecasted years.

- By component, the engine transmission and suspension components segment captured the biggest market share in 2024.

- By component, the electrical parts segment is expected to grow at the fastest rate during the forecast period.

- By application, the passenger vehicle segment held the major market share of 73% in 2024.

- By application, the commercial vehicle segment is anticipated to show considerable growth in the forecast period.

- By distribution channel, the aftermarket segment accounted for the kargest market share of 75% in 2024.

- By distribution channel, the OEM segment is anticipated to show considerable growth over the forecast period.

Market Overview

Automotive ancillaries’ products market forms an integral part of the global automotive industry, comprising manufacturers and suppliers that provide essential components such as filters, batteries, lighting systems, braking systems, radiators, and electrical components. These components are vital for the performance, efficiency, and safety of vehicles, and they cater to both the Original Equipment Manufacturers (OEM) and aftermarket segments.

The market has been experiencing steady growth, underpinned by the rise in global vehicle production and the increasing complexity of automotive systems. The sector’s expansion is also driven by the robust demand for passenger and commercial vehicles, especially in emerging economies.

Drivers

Several key drivers are propelling the growth of the automotive ancillaries’ products market. First, the rapid urbanization and growing middle-class population in developing countries have spurred an increase in automobile ownership. Second, the demand for enhanced vehicle performance and fuel efficiency has led to the development and adoption of high-quality ancillary components.

Third, stringent environmental regulations around the world are prompting automakers to source efficient and compliant parts, boosting the market for advanced ancillaries. Additionally, the continued investment by OEMs into expanding production capacities in cost-effective markets supports the growth of local ancillary suppliers.

Opportunities

The increasing demand for electric vehicles (EVs) offers new opportunities for the automotive ancillaries’ products market. As EVs require a different set of components compared to internal combustion engine vehicles, suppliers have the chance to diversify their portfolios and create specialized solutions. Furthermore, the rise in vehicle customization and the booming e-commerce sector for aftermarket products present considerable growth avenues. Technological advancements such as smart lighting, advanced driver-assistance systems (ADAS), and integration of sensors and electronics into conventional components offer opportunities for innovation and product differentiation.

Challenges

Despite promising prospects, the market faces several challenges. The ongoing volatility in raw material prices can impact profit margins for component manufacturers. Moreover, the intense competition among local and global players exerts pressure on pricing and quality standards.

The transition toward electrification and smart mobility also poses a challenge for traditional ancillary manufacturers that need to upgrade their technological capabilities and production processes. Additionally, disruptions caused by geopolitical tensions, trade wars, and supply chain inefficiencies can hinder the market’s growth trajectory.

Regional Insights

The Asia-Pacific region dominates the automotive ancillaries’ products market, led by countries such as China, India, Japan, and South Korea. This dominance is fueled by a strong manufacturing base, cost-effective labor, and increasing vehicle production. Europe holds a significant share, driven by stringent emission norms and the presence of major automotive OEMs and component manufacturers.

North America follows closely, with demand sustained by technological innovation and a mature automotive industry. Latin America and the Middle East & Africa regions are emerging markets showing gradual adoption, primarily due to improving economic conditions and rising vehicle sales.

Recent Developments

Recent developments in the market include strategic collaborations between OEMs and component manufacturers to develop next-generation automotive technologies. Many companies are investing heavily in research and development to create lighter, more efficient, and environmentally friendly components. Additionally, digitalization and automation are transforming manufacturing processes, leading to greater efficiency and scalability.

The trend of reshoring and building resilient supply chains has also influenced recent industry moves, especially in light of global disruptions caused by the COVID-19 pandemic and the ongoing semiconductor shortage.

Automotive Ancillaries’ Products Market Companies

- Magna International Inc

- Robert Bosch GmbH

- Uno Minda

- Lear Corporation

- DENSO CORPORATION

- ZF Friedrichshafen AG

- AISIN CORPORATION

- Continental AG

- Duncan Engineering Ltd

- Nippon

Segments Covered in the Report

By Component

- Engine Transmission and Suspension Components

- Electrical Parts

- Sheet Metal Parts and Body and Chassis

- Cleaning, Maintenance, and Repair of Products

- Others

By Application

- Commercial Vehicle

- Passenger Vehicle

By Distribution Channel

- OEM

- Aftermarket

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!