Broaching Machine Market Key Takeaways

- Asia Pacific led the broaching machine market with the largest share of 35% in 2024.

- North America is estimated to grow at the fastest CAGR between 2025 and 2034.

- The European market has been expanding at a considerable rate in recent years.

- By material, the metal segment dominated the market in 2024.

- By material, the composite material segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By type, the horizontal broaching machines segment held the largest market share in 2024.

- By type, the vertical broaching machines segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the automotive segment contributed the biggest market share in 2024.

- By application, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the manufacturing segment held the major market share in 2024.

- By end-user, the repair and maintenance segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

Market Overview

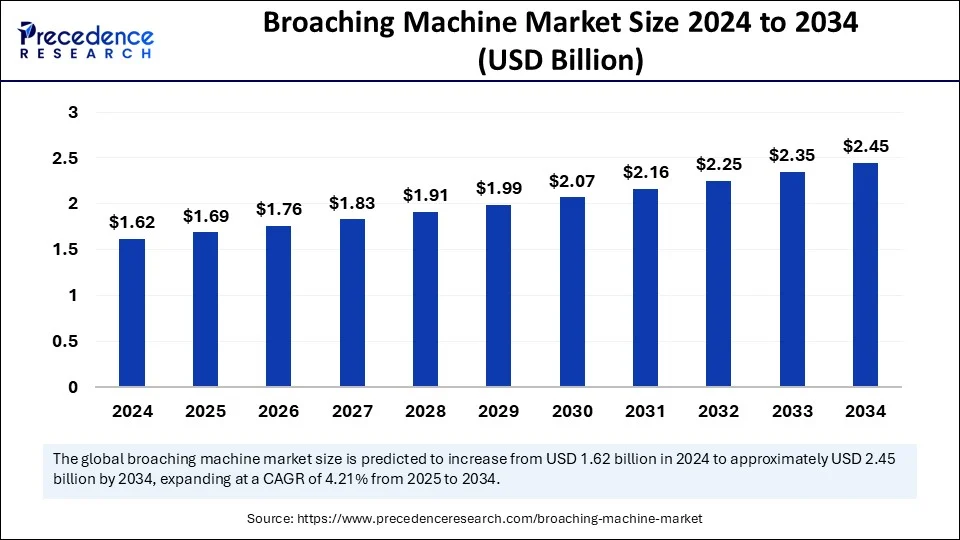

The broaching machine market has experienced significant growth, driven by the increasing demand for precision engineering and industrial automation. Broaching machines are essential in manufacturing processes that require high accuracy and efficiency, particularly in producing complex components for industries such as automotive, aerospace, and industrial machinery. The market’s expansion is attributed to the machines’ ability to deliver tight tolerances and smooth finishes, which are critical in high-performance applications.

Drivers

Key drivers of the broaching machine market include the rising need for precision machining solutions and the adoption of automation in manufacturing. Industries are seeking machines that can handle complex geometries with high repeatability, reducing manual intervention and increasing productivity. The automotive sector, in particular, relies heavily on broaching machines for producing components like gears and shafts, which require exact specifications to ensure performance and safety.

Opportunities

Opportunities in the broaching machine market are emerging from advancements in technology and the growing emphasis on automation. The integration of computer numerical control (CNC) systems has enhanced the capabilities of broaching machines, allowing for greater flexibility and precision. Additionally, the development of smart manufacturing practices and Industry 4.0 initiatives presents opportunities for manufacturers to incorporate broaching machines into more sophisticated production lines, improving overall efficiency and product quality.

Challenges

Despite the positive outlook, the broaching machine market faces challenges such as high initial investment costs and the need for skilled operators. The complexity of broaching operations requires specialized knowledge, and the shortage of trained personnel can hinder the adoption of these machines. Furthermore, the high cost of advanced broaching equipment may be a barrier for small and medium-sized enterprises looking to upgrade their manufacturing capabilities.

Regional Insights

Regionally, Asia-Pacific dominates the broaching machine market, with countries like China, India, and Japan leading in manufacturing activities. The region’s strong industrial base and increasing investments in automotive and aerospace sectors contribute to the demand for broaching machines. North America and Europe also hold significant market shares, driven by technological advancements and the presence of established manufacturing industries.

Recent Developments

Recent developments in the broaching machine market include the introduction of more energy-efficient models and the incorporation of IoT technologies for real-time monitoring and predictive maintenance. Manufacturers are focusing on developing machines that offer higher productivity while reducing operational costs. Collaborations between machine tool manufacturers and software developers are also enhancing the functionality and user-friendliness of broaching machines.

Broaching Machine Market Companies

- Star SU

- A. Dwyer

- Cincinnati Milacron

- Honnen Equipment

- CNC Broach Tool

- Mitsubishi Heavy Industries

- Schmidt and Heinzmann

- Komet

- Hegenscheidt

- Harris Machine Tools

- Gleason

- Broach Masters

Segments Covered in the Report

By Material

- Metal

- Plastic

- Composite

By Type

- Horizontal Broaching Machines

- Vertical Broaching Machines

- Continuous Broaching Machines

- Band Broaching Machines

By Application

- Automotive

- Aerospace

- Industrial Equipment

- Marine

- Oil and Gas

By End-Use

- Manufacturing

- Repair and Maintenance

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Ready for more? Dive into the full experience on our website!