Decentralized Finance Market Key Takeaways

-

North America led the market with the highest share of 37% in 2024.

-

Asia Pacific is forecasted to register the fastest CAGR during the projection period.

-

By component, the blockchain technology segment captured the largest market share (43%) in 2024.

-

The smart contracts segment is expected to see notable growth throughout the forecast period.

-

By application, the data and analytics segment was the leading contributor to the market in 2024.

-

The payments segment is projected to expand at the fastest rate in the coming years.

Decentralized Finance Market Overview

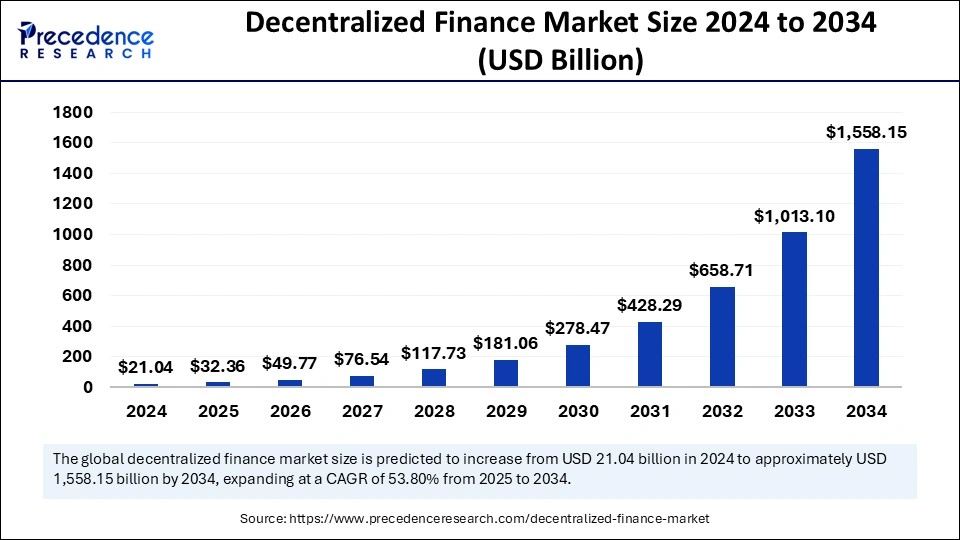

The Decentralized Finance market has emerged as a transformative force in the global financial landscape. By leveraging blockchain technology and smart contracts, DeFi offers open, transparent, and permissionless financial services that challenge traditional banking systems. The market has witnessed exponential growth, with total value locked (TVL) in DeFi protocols surpassing significant milestones. This surge is driven by the increasing demand for alternative financial solutions that provide greater accessibility, efficiency, and inclusivity.

Decentralized Finance Market Drivers

Several factors are propelling the growth of the DeFi market. The rise of cryptocurrencies and tokenization has created new avenues for financial transactions and investments. The demand for financial inclusion, especially in regions underserved by traditional banking, has led to the adoption of DeFi platforms that offer peer-to-peer lending, borrowing, and trading services. Additionally, the appeal of yield farming and staking opportunities has attracted both retail and institutional investors seeking higher returns.

Decentralized Finance Market Opportunities

The DeFi market presents numerous opportunities for innovation and expansion. The growing popularity of decentralized exchanges (DEXs) offers users increased control over their assets and reduces reliance on centralized intermediaries. Integration with Web3 technologies and the metaverse opens new possibilities for immersive financial experiences. Furthermore, the tokenization of real-world assets, such as real estate and commodities, can enhance liquidity and broaden investment options for a global audience.

Decentralized Finance Market Challenges

Despite its rapid growth, the DeFi market faces several challenges. Regulatory uncertainty remains a significant hurdle, as governments and financial authorities grapple with how to oversee decentralized platforms effectively. Security risks, including smart contract vulnerabilities and hacking incidents, pose threats to user funds and platform integrity. Additionally, scalability issues and the lack of user-friendly interfaces can hinder mass adoption, particularly among non-technical users.

Decentralized Finance Market Regional Insights

North America holds a substantial share of the DeFi market, driven by technological advancements and a robust startup ecosystem. The United States, in particular, has seen increased integration of DeFi protocols with other decentralized applications, enhancing user engagement.

Europe has made strides in establishing regulatory frameworks that support blockchain and DeFi innovation, with the European Union’s Markets in Crypto-Assets (MiCA) regulation providing clarity across member states.

The Asia-Pacific region is anticipated to experience significant growth, fueled by the rising adoption of cryptocurrencies and supportive government initiatives.

Decentralized Finance Market Recent Developments

Recent developments in the DeFi market include legislative actions impacting the regulatory environment. For instance, in April 2025, U.S. President Donald Trump signed a bill nullifying an IRS rule that sought to classify decentralized cryptocurrency exchanges as brokers, thereby exempting them from certain tax reporting requirements. This move reflects a broader trend of governments reevaluating their approach to DeFi regulation.

Additionally, the integration of artificial intelligence (AI) into DeFi platforms is enhancing automation, security, and risk management, paving the way for more sophisticated financial services.

Decentralized Finance Market Companies

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

Segments Covered in the Report

By Component

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

By Application

- Assets Tokenization

- Compliance and Identity

- Marketplaces and Liquidity

- Payments

- Data and Analytics

- Decentralized Exchange

- Prediction Industry

- Stablecoins

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Ready for more? Dive into the full experience on our website!