Shipping Containers Market Key Takeaways

- Asia Pacific dominated the global market with the largest share around 50% in 2024

- Europe is estimated to expand at a considerable CAGR between 2025 and 2034

- North America is anticipated to witness notable growth over the forecast period.

- By product, the ISO containers segment contributed the biggest market share in 2024.

- By product, the non-standardized containers segment is expected to grow at the fastest CAGR during the forecast period

- By type, dry containers segment held the largest market share in 2024

- By type, reefer containers segment is anticipated to show fastest growth during the predicted timeframe

- By size, 40’ containers segment captured the highest market share in 2024

- By size, high cube containers segment is predicted to grow at the fastest rate over the forecast period

- By size, 20’ containers segment is expected to grow at a notable CAGR during the predicted timeframe

- By flooring, wood flooring segment held the largest market share in 2024.

- By flooring, bamboo flooring segment is anticipated to grow at a remarkable CAGR between 2025 and 2034

- By application, industrial transport segment accounted for the biggest market share in 2024

- By application, consumer goods segment is anticipated to witness significant growth over the forecast period

Market Overview

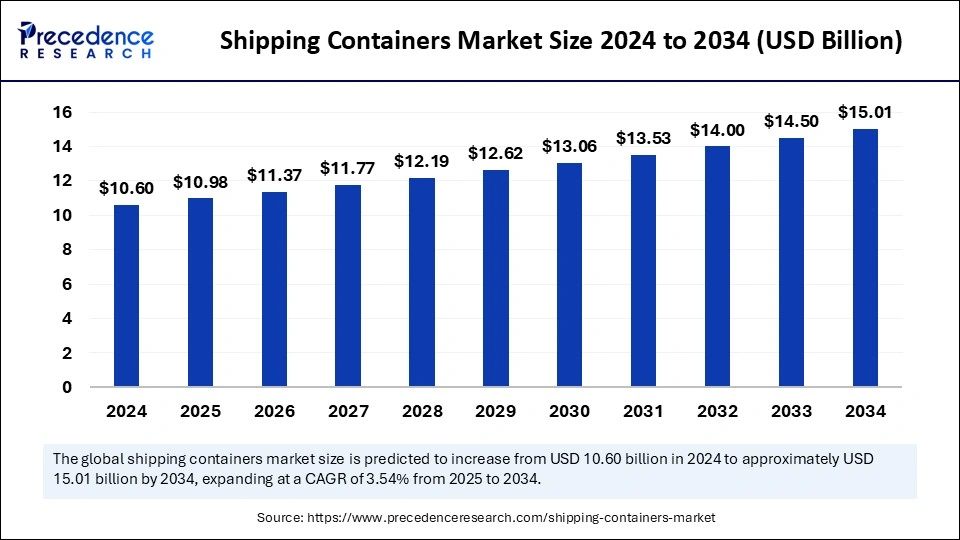

The global shipping containers market continues to be a vital component of the international logistics and transportation industry. Shipping containers have revolutionized how cargo is handled, ensuring goods are transported efficiently, securely, and cost-effectively across sea, rail, and road networks.

These standardized containers support intermodal transportation, significantly reducing the need for repackaging and manual handling of goods. The shipping containers market has evolved alongside growing global trade volumes and increased supply chain integration across continents.

Drivers

Several strong drivers are pushing the expansion of the shipping containers market. One of the primary drivers is the continual growth in international trade and globalization. As emerging economies expand their production capacities and developed countries increase imports, the need for efficient and scalable container-based logistics systems intensifies.

The proliferation of e-commerce and the growing reliance on digital platforms for international trade are also major drivers. The surge in online retail and direct-to-consumer shipping models necessitates highly efficient freight systems, with shipping containers playing a central role in supporting large-volume goods transportation. Furthermore, the increased use of containers in military logistics, humanitarian aid, and infrastructure development projects is contributing to market growth.

Another critical driver in the shipping containers market is the modernization of port infrastructure and the integration of smart technologies, which enable faster turnaround times, real-time tracking, and better container management systems. These innovations have made container shipping more attractive and cost-effective.

Opportunities

The shipping containers market offers numerous untapped opportunities that can significantly boost its future outlook. One of the key areas is the repurposing and upcycling of used containers for alternative uses, such as modular homes, pop-up shops, mobile offices, and disaster relief shelters. These sustainable solutions offer an environmentally friendly way to reuse containers, creating new revenue streams and extending their lifecycle.

A major opportunity lies in the development of lightweight and eco-friendly containers made from recyclable or composite materials. These containers reduce fuel consumption and carbon emissions, aligning with global sustainability goals. Companies that invest in such technologies are likely to benefit from regulatory incentives and growing consumer demand for green logistics.

Expansion into untapped markets such as Africa, Latin America, and Southeast Asia also presents growth opportunities. These regions are experiencing rapid infrastructure development and urbanization, which necessitate efficient transport and logistics networks. Establishing a local presence in these areas will allow companies in the shipping containers market to cater to rising regional demand effectively.

Challenges

While the outlook for the shipping containers market is optimistic, several challenges could impact its growth trajectory. One major challenge is the fluctuation in raw material prices, particularly steel, which is used extensively in container manufacturing. Volatility in steel prices can affect production costs and profit margins for manufacturers.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have exposed the vulnerabilities of global shipping systems. Port congestion, container shortages, and labor strikes can severely impact the flow of goods and lead to delays and increased costs. The shipping containers market must adapt to these disruptions with more resilient logistics solutions.

The environmental impact of container shipping, including emissions from vessels and the disposal of end-of-life containers, poses another challenge. Compliance with international environmental regulations, such as the International Maritime Organization’s emissions guidelines, requires significant investment in cleaner technologies and fuels, which may raise operational costs.

Regional Insights

The regional dynamics of the shipping containers market reveal distinct trends and growth patterns. Asia-Pacific held the largest share of the market in 2024, driven by its dominant role in global manufacturing and exports. Countries such as China, Japan, and South Korea have extensive port infrastructure and strong shipbuilding capabilities, making them central to global container logistics.

Europe is anticipated to experience robust growth over the forecast period due to its focus on sustainable shipping and intermodal transport. Major European ports are investing in green port infrastructure, automation, and digital systems to enhance container handling efficiency. Additionally, the European Union’s environmental regulations are prompting the adoption of cleaner technologies within the shipping containers market.

North America is poised for significant expansion, especially in the United States, where the revitalization of the manufacturing sector and growing exports are contributing to container demand. Investments in port modernization projects and trade agreements such as USMCA are enhancing the competitiveness of the region’s container logistics network.

Latin America and the Middle East also show promise for market expansion, with governments investing in seaport infrastructure and trade facilitation programs. In Africa, the development of economic corridors and special economic zones is expected to boost demand for shipping containers in the coming years.

Recent Developments

The shipping containers market has seen a flurry of strategic developments in recent times. Key players are adopting advanced technologies to enhance container design, tracking, and safety. The integration of Internet of Things (IoT) sensors and AI-powered analytics is enabling real-time monitoring of container conditions, improving cargo security and operational efficiency.

Several companies are expanding their fleets with more environmentally friendly container ships and investing in hybrid or electric-powered logistics solutions. For instance, recent initiatives include the construction of dual-fuel vessels and partnerships with renewable energy providers to power port operations.

In 2024, the ISO containers segment dominated the product category, while non-standardized containers demonstrated the fastest growth rate. The dry containers segment led by type, with reefer containers gaining momentum due to rising demand for temperature-sensitive goods. By size, 40’ containers held the largest share, with high cube containers registering the quickest growth.

The bamboo flooring sub-segment is becoming increasingly popular in container design, offering durability and sustainability. From an application standpoint, industrial transport accounted for the majority of demand, but consumer goods and food & beverage shipments are expected to drive future growth in the shipping containers market.

Shipping Containers Market Companies

- A.P. Moller – Maersk

- Bertschi AG

- BNH Gas Tanks

- Bulkhaul Limited

- Danteco Industries BV

- NewPort Tank

- China International Marine Containers (Group) Ltd

- COSCO SHIPPING Development Co., Ltd.

- CXIC Group

- IWES LTD.

- Norcomp Nordic AB

- Singamas Container Holdings Limited

- TLS Offshore Containers/TLS Special Containers

- W&K Containers, Inc.

- Thurston Group Limited

- OEG

- Sea Box, Inc.

Segments Covered in the Report

By Product

- ISO Containers

- Non-standardized Containers

By Type

- Dry Containers

- Reefer Containers

- Tank Containers

- Others

By Size

- 20’ Containers

- 40’ Containers

- High Cube Containers

- Others

By Flooring

- Wood

- Bamboo

- Metal

- Vinyl

- Others

By Application

- Consumer Goods Transport

- Food Transport

- Industrial Transport

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!