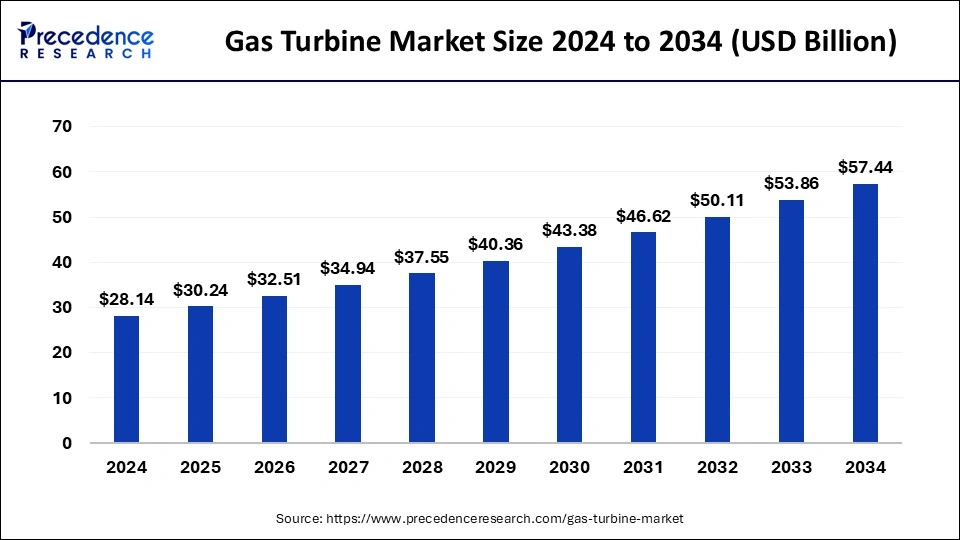

The global gas turbine market is valued at USD 28.14 billion in 2024 and is expected to reach USD 57.44 billion by 2034, growing at a CAGR of 7.48%.

Gas Turbine Market Key Takeaways

- Asia Pacific Leads the Market: In 2023, Asia Pacific accounted for approximately 37% of total revenue share in the gas turbine market.

- >200 MW Capacity Dominates: The >200 MW segment held a significant 66% revenue share in 2023.

- Combined Cycle Turbines on Top: The combined cycle turbines sector had the highest market share, contributing 74% of total revenue in 2023.

- Power & Utility Segment Drives Demand: The power & utility sector led the market with an 82% revenue share in 2023.

- Aero-Derivative Segment on the Rise: The aero-derivative segment is expected to grow at a CAGR of 9% from 2024 to 2033.

Market Overview

The gas turbine market plays a crucial role in power generation, aviation, and industrial applications due to its efficiency, reliability, and ability to operate on multiple fuels, including natural gas and liquid fuels. Gas turbines are widely used in thermal power plants and combined-cycle power generation, where they contribute to reducing carbon emissions compared to traditional coal-based power plants. The market has been experiencing steady growth, driven by increasing energy demand, advancements in turbine efficiency, and the shift toward cleaner energy sources. Additionally, the growing adoption of gas turbines in the aviation industry and industrial manufacturing is further accelerating market expansion.

Key Market Drivers

Several factors are driving the growth of the gas turbine market. One of the primary drivers is the global transition to cleaner energy sources, as gas turbines are considered a lower-emission alternative to coal-fired power plants. Governments worldwide are pushing for carbon reduction policies and cleaner power generation, leading to increased investment in natural gas-fired plants. Additionally, technological advancements in aero derivative and heavy-duty gas turbines have significantly improved efficiency, making them more attractive for large-scale power projects. The rising demand for distributed power generation and the expansion of industrial operations in emerging economies also contribute to the market’s growth.

Opportunities for Market Expansion

The increasing integration of gas turbines with renewable energy presents a major opportunity for market growth. Hybrid power plants, which combine gas turbines with wind or solar energy, offer a reliable and flexible power supply. The development of hydrogen-powered gas turbines is another key opportunity, as hydrogen is gaining traction as a clean fuel alternative. Additionally, the retrofitting of existing gas turbines with advanced digital control and monitoring systems is creating new business opportunities. The rising adoption of aero derivative gas turbines in the aviation and marine sectors is further expanding market potential.

Challenges in the Gas Turbine Industry

Despite its growth, the gas turbine market faces several challenges. The high initial investment and maintenance costs of gas turbine power plants can limit adoption, especially in developing regions. Fluctuations in natural gas prices also impact market stability, as the cost of fuel directly affects operational expenses. Additionally, increasing competition from renewable energy sources such as wind and solar, which have lower operating costs, poses a challenge to long-term market growth. Regulatory restrictions on carbon emissions and concerns over greenhouse gas production may also hinder expansion unless cleaner turbine technologies are widely adopted.

Regional Insights

- North America: The U.S. and Canada are investing in natural gas-fired power plants to replace aging coal infrastructure. The region also sees high demand for aeroderivative gas turbines in the aviation sector.

- Europe: The shift toward decarbonization and hydrogen-based gas turbines is driving market growth in countries such as Germany, the UK, and France.

- Asia-Pacific: China, India, and Japan are expanding their energy infrastructure, with increasing investments in gas turbine-based power generation. The aviation industry in this region is also a significant driver of demand.

- Middle East & Africa: Countries like Saudi Arabia and the UAE are investing in high-efficiency gas turbines to meet rising power demand while reducing emissions.

Recent News & Industry Developments

The gas turbine market has witnessed several important developments. Major manufacturers are launching next-generation gas turbines with improved fuel efficiency and lower emissions. Investments in hydrogen-compatible gas turbines are increasing as companies look for sustainable energy solutions. Additionally, governments are introducing new energy policies and incentives to promote natural gas-based power generation

Gas Turbine Market Companies

- Harbin Electric International Company

- Siemens AG

- Man Diesel & Turbo

- General Electric

- NPO Saturn

- Kawasaki Heavy Industries

- Solar Turbines

- Capstone Turbine

- Vericor Power Systems

Segments Covered in the Report

By Capacity Type

- > 500 kW to 1 MW

- > 1 MW to 30 MW

- < 50 kW

- 50 kW to 500 kW

- > 70 MW to 200 MW

- >30 MW to 70 MW

- > 200 MW

By Product Type

- Heavy Duty

- Aero-Derivative

By Technology Type

- Combined Cycle

- Open Cycle

By Application Type

- Process Plants

- Power Plants

- Oil & Gas

- Aviation

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website!