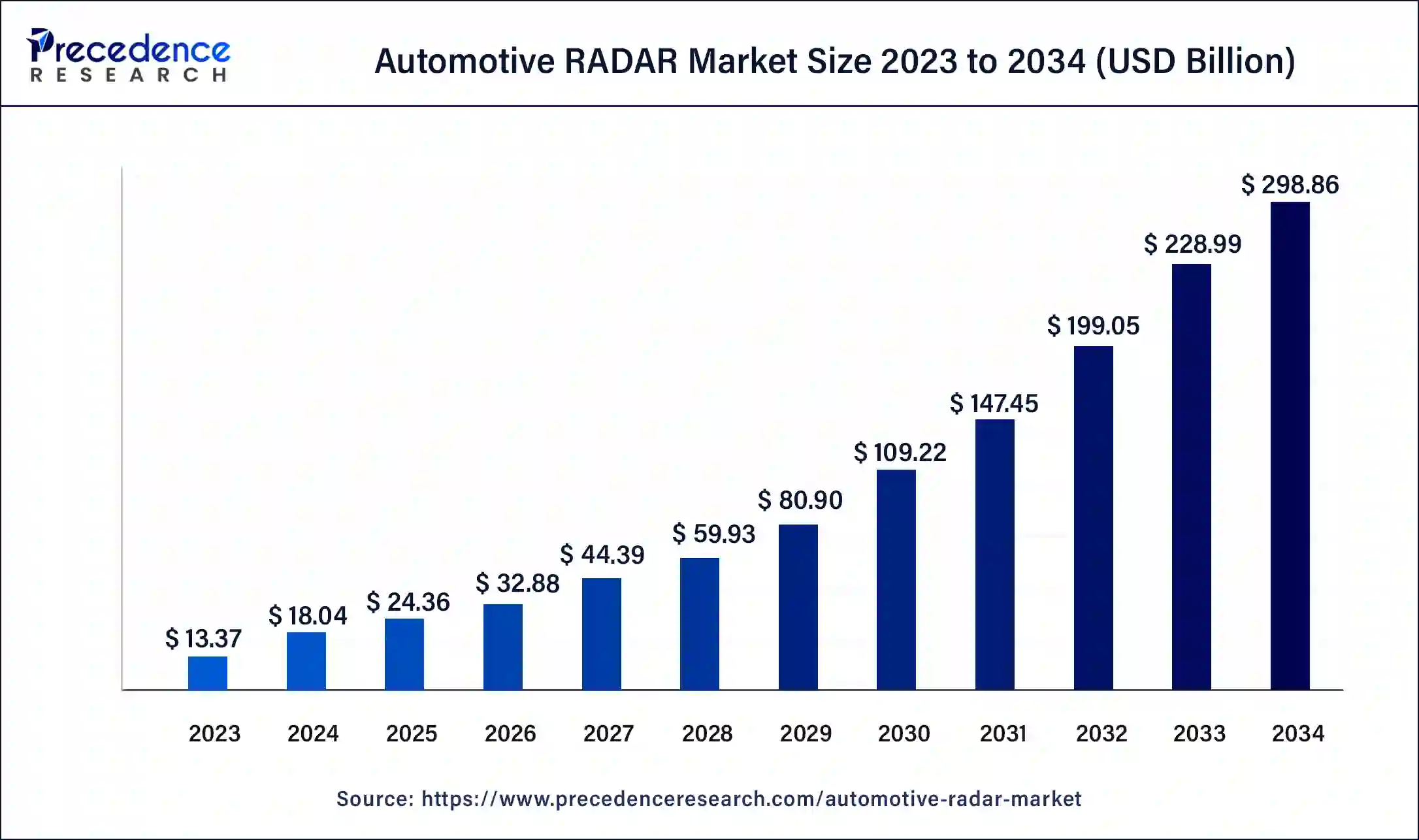

The global automotive RADAR market is valued at USD 18.04 billion in 2024 and is projected to grow at a CAGR of 32.4%, reaching approximately USD 298.86 billion by 2034.

Automotive RADAR Market Key Takeaways

- Asia Pacific Leads: Held the largest market share in 2023.

- Europe’s Rapid Growth: Expected to grow at the fastest CAGR during the forecast period.

- Dominant Range Segment: Short & Medium Range RADAR (S&MRR) had the largest market share in 2023.

- Top Application in Revenue: Intelligent Park Assist generated over 52% of revenue share in 2023.

- Fastest-Growing Application: Adaptive Cruise Control (ACC) is projected to expand at the fastest CAGR.

Overview

The automotive RADAR market is expanding rapidly due to the growing emphasis on vehicle safety and the increasing adoption of advanced driver assistance systems (ADAS). RADAR (Radio Detection and Ranging) technology plays a crucial role in enabling autonomous driving features such as adaptive cruise control, blind-spot detection, lane departure warning, and automatic emergency braking. This technology enhances vehicle perception by detecting objects, measuring distances, and determining the speed of surrounding vehicles, ensuring a safer driving experience.

The demand for automotive RADAR systems is being driven by stricter safety regulations, rising consumer awareness regarding road safety, and the ongoing advancements in sensor technology. With automotive manufacturers investing heavily in self-driving vehicle development, the market is expected to witness robust growth in the coming years.

Drivers

One of the key drivers of the automotive RADAR market is the stringent regulatory framework enforced by governments worldwide. Many countries have mandated the inclusion of safety features such as collision avoidance systems and lane-keeping assistance, pushing automakers to integrate RADAR technology into their vehicles. Another significant factor driving market growth is the rising number of road accidents, which has increased the demand for proactive safety systems. The growing trend of vehicle electrification and connected cars has further accelerated the adoption of RADAR-based sensors, as they enhance the capabilities of autonomous and semi-autonomous driving features.

Additionally, technological advancements in RADAR technology, such as improved resolution, multi-mode sensing, and artificial intelligence-based object recognition, are making RADAR systems more efficient and cost-effective, encouraging their widespread use across different vehicle segments.

Opportunities

The increasing focus on autonomous vehicles presents a major opportunity for the automotive RADAR market. As automakers and technology companies continue to develop self-driving cars, RADAR technology is expected to play a crucial role in enabling high-precision navigation and obstacle detection. The emergence of high-resolution 4D imaging RADAR, which provides detailed environmental mapping, is another area of opportunity, as it significantly enhances the performance of autonomous and semi-autonomous vehicles.

Furthermore, the growing demand for smart mobility solutions, such as intelligent transportation systems and vehicle-to-everything (V2X) communication, is expected to create new avenues for RADAR adoption. Expanding automotive production in emerging markets, particularly in Asia-Pacific and Latin America, also offers lucrative opportunities for market growth, as these regions witness increasing consumer demand for advanced safety features.

Challenges

Despite the promising growth, the automotive RADAR market faces several challenges. One of the primary concerns is the high cost of advanced RADAR systems, which limits their adoption in low-cost and mid-range vehicles. While prices have been decreasing due to mass production and technological advancements, affordability remains a key issue for cost-sensitive markets. Another challenge is the performance of RADAR sensors in extreme weather conditions such as heavy rain, fog, and snow, which can impact their accuracy.

Additionally, the increasing number of vehicles equipped with RADAR systems has raised concerns about signal interference, potentially affecting the reliability of ADAS features. The market also faces intense competition from alternative sensing technologies such as LiDAR and camera-based vision systems, which offer similar functionalities at varying costs and levels of performance. Ensuring seamless integration of RADAR with other sensor technologies remains a technical challenge that needs to be addressed to enhance the overall efficiency of automotive safety systems.

Regional Insights

North America and Europe currently lead the automotive RADAR market, driven by stringent safety regulations and high consumer demand for advanced safety features. The United States, in particular, has witnessed significant adoption of RADAR-based ADAS, supported by government initiatives promoting vehicle safety. In Europe, regulatory bodies such as the European New Car Assessment Programme (Euro NCAP) have made it mandatory for new vehicles to include advanced safety features, further driving market growth. The Asia-Pacific region is expected to experience the fastest growth in the automotive RADAR market, fueled by the rapid expansion of the automotive industry in countries like China, Japan, and India.

Government policies promoting vehicle safety, increasing disposable incomes, and the growing adoption of electric and connected vehicles are contributing to the rising demand for RADAR-based safety systems in this region. Latin America and the Middle East & Africa are also witnessing gradual growth, primarily due to improving economic conditions and increased awareness of vehicle safety.

Recent News

The automotive RADAR market has seen several key developments in recent months. Leading technology firms and automakers have announced partnerships to develop next-generation RADAR sensors with enhanced detection capabilities. Several companies have introduced solid-state RADAR solutions, offering improved accuracy, lower power consumption, and reduced costs. In addition, multiple governments have implemented new safety regulations that mandate the integration of RADAR-based ADAS in upcoming vehicle models. The market has also seen significant investment in RADAR startups, with venture capital firms funding innovations in high-resolution imaging RADAR and AI-driven sensor fusion technology. Furthermore, recent testing of autonomous vehicles equipped with advanced RADAR systems has demonstrated promising results, accelerating the transition toward self-driving mobility solutions.

Automotive RADAR Market Companies

- Continental AG

- Autoliv Inc.

- DENSO Corporation

- Delphi Automotive Company

- NXP Semiconductors

- Texas Instruments

- Robert Bosch GmbH

- ZF Friedrichshafen

Segments Covered in the Report

By Frequency

- 24 GHz

- 77 GHz

- 79GHz

By Range

- Short & Medium Range RADAR (S&MRR)

- Long Range RADAR (LRR)

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Application

- Autonomous Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Forward Collision Warning System

- Intelligent Park Assist

- Blind Spot Detection (BSD)

- Others ADAS Applications

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World