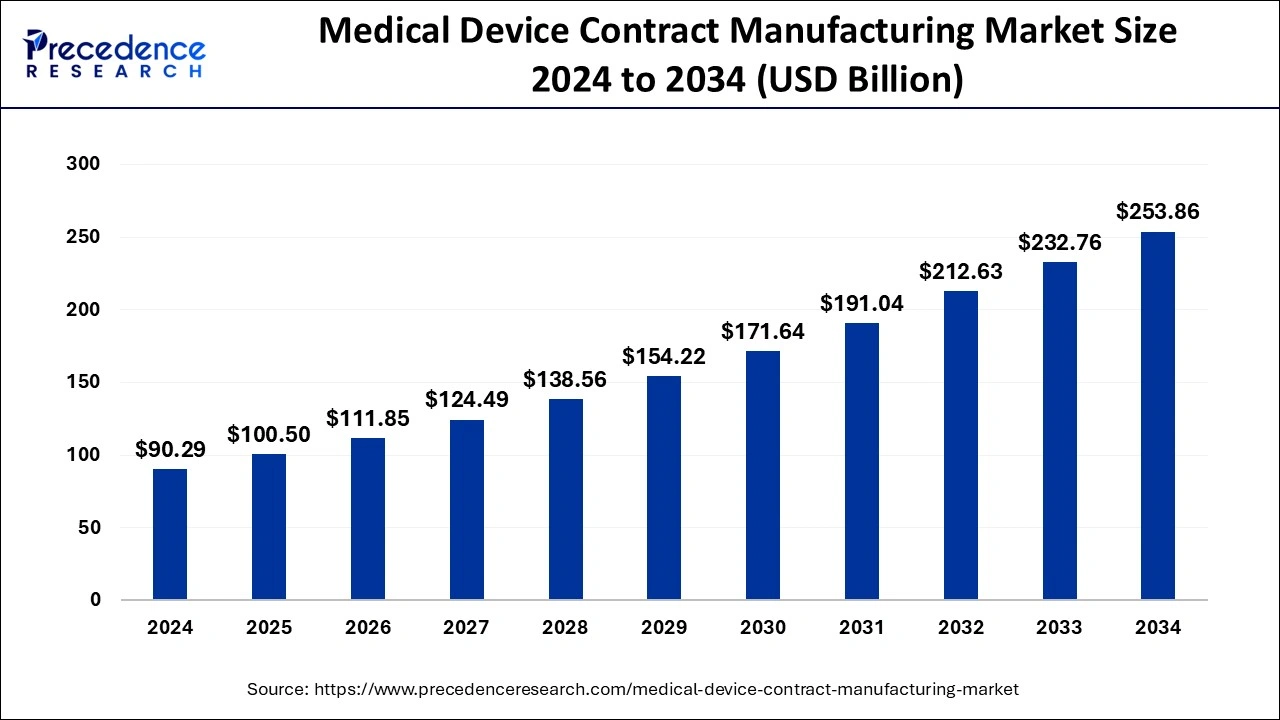

Discover the latest insights on the global medical device contract manufacturing market, projected to reach USD 253.86 billion by 2034 from USD 90.29 billion in 2024, growing at a CAGR of 10.89%

Medical Device Contract Manufacturing Market Key Takeaways

- Market Growth: The global medical device contract manufacturing market is projected to reach USD 253.86 billion by 2034, growing at a CAGR of 10.89%.

- Regional Leadership: North America dominates the market, holding a 41% share in 2024.

- Device Type: IVD devices lead the market in 2024.

- Service Segment: Device development and manufacturing services account for over 54% of revenue in 2024.

- Application Insights: The orthopedic segment holds the largest market share in 2024 and is expected to grow at a CAGR of 12.9%

Medical Device Contract Manufacturing Market Overview

The global medical device contract manufacturing market is experiencing significant growth, driven by increasing demand for advanced healthcare solutions, technological innovations, and the outsourcing trend among medical device companies. The market size is projected to expand from USD 90.29 billion in 2024 to USD 253.86 billion by 2034, growing at a CAGR of 10.89%. Contract manufacturers provide services such as product design, prototyping, regulatory support, and full-scale production, enabling medical device companies to focus on R&D and market expansion. The rising prevalence of chronic diseases, an aging population, and the growing need for cost-effective manufacturing are key factors fueling market expansion.

Market Drivers

One of the primary drivers of the medical device contract manufacturing market is the increasing demand for medical devices due to a growing global patient population and advancements in medical technology. Additionally, stringent regulatory requirements push companies to partner with contract manufacturers that specialize in compliance and quality assurance. The shift toward minimally invasive procedures and digital healthcare solutions, including wearable devices and telemedicine, further accelerates market growth. Moreover, the rising adoption of automation, AI, and robotics in manufacturing enhances production efficiency and reduces costs, making contract manufacturing an attractive option for OEMs (Original Equipment Manufacturers).

Market Opportunities

The increasing trend of outsourcing R&D and manufacturing creates lucrative opportunities for contract manufacturers to expand their service offerings. Emerging markets in Asia-Pacific, Latin America, and the Middle East present substantial growth potential due to lower production costs, improving healthcare infrastructure, and favorable government initiatives. Furthermore, rising investments in personalized medicine, 3D printing, and biocompatible materials provide new avenues for contract manufacturers to innovate and differentiate themselves in the industry. The expansion of home healthcare and point-of-care testing devices also opens up additional market opportunities.

Market Challenges

Despite its strong growth, the market faces several challenges, including stringent regulatory requirements and compliance burdens across different regions. Navigating complex approval processes, such as those set by the FDA (U.S.), EMA (Europe), and CFDA (China), can be time-consuming and costly. Additionally, supply chain disruptions, raw material shortages, and geopolitical tensions pose risks to manufacturing operations. Another challenge is the intense competition among contract manufacturers, requiring them to continuously invest in innovation and quality improvement to maintain their competitive edge.

Regional Insights

North America holds the largest market share (41% in 2024), driven by advanced healthcare infrastructure, high R&D investments, and the presence of key medical device companies. Europe follows closely, benefiting from strong regulatory frameworks and technological advancements. The Asia-Pacific region is expected to witness the fastest growth, fueled by low production costs, a skilled workforce, and increasing demand for affordable healthcare solutions in countries like China, India, and Japan. Latin America and the Middle East & Africa are also expanding due to government initiatives promoting medical device manufacturing and exports.

Recent News & Developments

The medical device contract manufacturing market has seen several notable developments recently. Many leading contract manufacturers are expanding their production facilities and adopting advanced automation technologies to meet growing demand. Strategic mergers and acquisitions are reshaping the competitive landscape, with companies focusing on vertical integration to enhance their capabilities. Additionally, regulatory agencies worldwide are introducing new quality standards and guidelines to ensure the safety and efficacy of medical devices. The rise of 3D printing and smart medical devices is also driving innovation, allowing manufacturers to produce complex components with greater precision and customization.

Medical Device Contract Manufacturing Market Companies

- Flex, Ltd.

- Nortech Systems, Inc.

- Sanmina Corporation

- Nipro Corporation

- Jabil Inc.

- Nemera Development S.A.

- TE Connectivity Ltd.

- Kimball Electronics, Inc.

- Viant Medical

- Celestica International Lp.

By Device Type

- IVD Devices

- Drug Delivery Devices

- Diagnostic Imaging Devices

- Patient Monitoring Devices

- Therapeutic Patient Assistive Devices

- Minimally Access Surgical Instruments

- Others

By Service

- Device Development and Manufacturing Services

- Quality Management Services

- Final Goods Assembly Services

By Application

- Laparoscopy

- Pulmonary

- Urology & Gynecology

- Cardiovascular

- Orthopedic

- Oncology

- Neurovascular

- Radiology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World