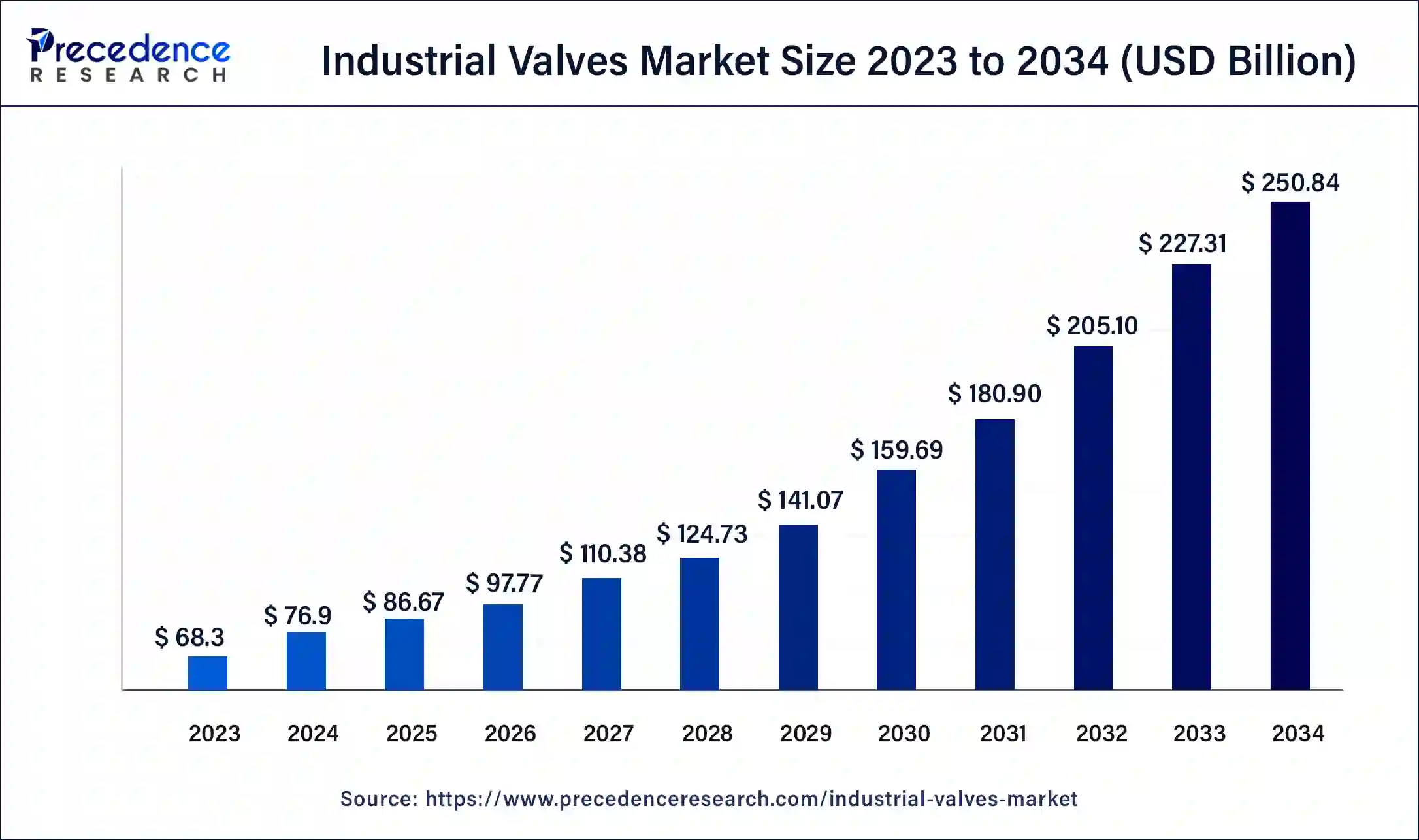

The industrial valves market will grow at a CAGR of 12.6%, increasing from USD 76.9 billion in 2023 to USD 250.84 billion by 2034.

Industrial Valves Market Key Takeaways

- In 2023, Asia Pacific led the industrial valves market with the largest 36% share.

- The steel industrial valves segment recorded the highest revenue share by material type in 2023.

- The oil and gas segment held a significant market share by application in 2023.

- The water and wastewater segment is forecasted to grow at a CAGR of 6% during the projection period.

Market Overview

The industrial valves market is witnessing robust growth due to the rising demand for advanced flow control systems across various industries, including oil and gas, chemicals, power generation, and water treatment. Industrial valves are essential for controlling and regulating the flow of fluids, gases, and slurries in pipelines and process systems. These valves are used in critical applications that require high reliability, precision, and durability.

The increasing adoption of industrial automation and the development of smart valve technologies are enhancing operational efficiency and reducing maintenance costs. Furthermore, the growing emphasis on energy efficiency, environmental sustainability, and safety standards is driving the demand for innovative valve solutions. As industries continue to expand and upgrade their infrastructure, the demand for industrial valves is expected to rise steadily.

Drivers

- Rising Demand from the Chemical and Petrochemical Industry

The chemical and petrochemical industry relies heavily on industrial valves for managing complex processes involving hazardous chemicals and high-pressure systems. The increasing demand for chemicals and petrochemical products is driving the adoption of advanced valve solutions. - Expansion of Oil and Gas Exploration and Production Activities

The global expansion of oil and gas exploration and production activities, particularly in offshore regions, is fueling the demand for industrial valves. These valves are essential for maintaining safety and efficiency in high-pressure and high-temperature environments. - Growing Need for Water and Wastewater Management Systems

The rising demand for clean water and efficient wastewater management systems is contributing to the growth of the industrial valves market. Valves play a critical role in regulating the flow of water and chemicals in treatment plants, ensuring the effective management of water resources.

Opportunities

- Adoption of Digital Twin Technology for Valve Monitoring

The adoption of digital twin technology in the industrial valves market presents a significant opportunity for enhancing operational efficiency. Digital twins enable real-time monitoring, predictive maintenance, and simulation of valve performance, reducing downtime and improving reliability. - Increasing Focus on Energy Efficiency and Emission Reduction

Industries are increasingly focusing on reducing energy consumption and minimizing emissions. Advanced valve technologies that improve process efficiency and reduce environmental impact offer significant growth opportunities in the market. - Rising Demand for Safety and Control Valves in Critical Applications

The increasing focus on safety and regulatory compliance in critical applications, such as nuclear power plants and chemical processing facilities, is driving the demand for safety and control valves. These valves provide fail-safe operation and enhance system security.

Challenges

- Maintenance and Downtime Associated with Valve Failures

Industrial valves operating in harsh conditions are prone to wear and tear, leading to maintenance challenges and downtime. Addressing these challenges requires regular inspection, predictive maintenance, and timely replacement of critical components. - Complexity of Valve Design and Customization

The design and customization of industrial valves for specific applications require a high level of technical expertise and precision. Meeting diverse customer requirements while maintaining cost-effectiveness can be a challenge for manufacturers. - Supply Chain Disruptions and Raw Material Shortages

The industrial valves market is vulnerable to supply chain disruptions and raw material shortages, which can impact production schedules and increase manufacturing costs. Ensuring a stable supply chain and managing inventory efficiently is essential to mitigate these challenges.

Regional Insights

- North America

North America dominates the industrial valves market due to the high demand for flow control solutions in the oil and gas, chemical, and power sectors. The region’s focus on adopting smart valve technologies and enhancing process efficiency is driving market growth. - Europe

Europe is experiencing steady growth in the industrial valves market, driven by investments in renewable energy, water management, and industrial automation. Countries such as Germany, the UK, and Italy are focusing on upgrading their industrial infrastructure. - Asia Pacific

Asia Pacific is witnessing rapid growth in the industrial valves market, fueled by industrialization, urbanization, and increasing investments in infrastructure development. China, India, and Japan are major contributors to the market, with strong demand for advanced valve solutions. - Latin America and Middle East & Africa

Latin America and the Middle East & Africa are emerging markets for industrial valves, driven by ongoing investments in oil and gas exploration, power generation, and water treatment projects. However, regulatory complexities and economic uncertainties may pose challenges to market growth.

Recent News

- Launch of Next-Generation Control Valves for Industrial Applications

Leading valve manufacturers have introduced next-generation control valves equipped with advanced features such as real-time monitoring and remote operation. These innovations are expected to enhance process efficiency and reliability. - Government Initiatives to Strengthen Water Infrastructure and Energy Projects

Several governments have announced initiatives to strengthen water infrastructure and invest in renewable energy projects. These initiatives are expected to create significant opportunities for the industrial valves market.

Industrial Valves Market Companies

- Avcon Controls Private Limited

- AVK Holding A/S

- Crane Co.

- Metso Corporation

- Schlumberger Limited

- Flowserve Corporation

- Emerson Electric Co.

- IMI plc

- Forbes Marshall

- The Weir Group plc.

Segments Covered in the Report

By Valve

- Butterfly Valves

- Ball Valves

- Globe Valves

- Gate Valves

- Check Valves

- Plug Valves

- Diaphragm Valves

By Material

- Cast Iron

- Alloy-Based

- Steel

- Others

By Application

- Water & Wastewater

- Oil & Power

- Food & Beverages

- Chemical

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World