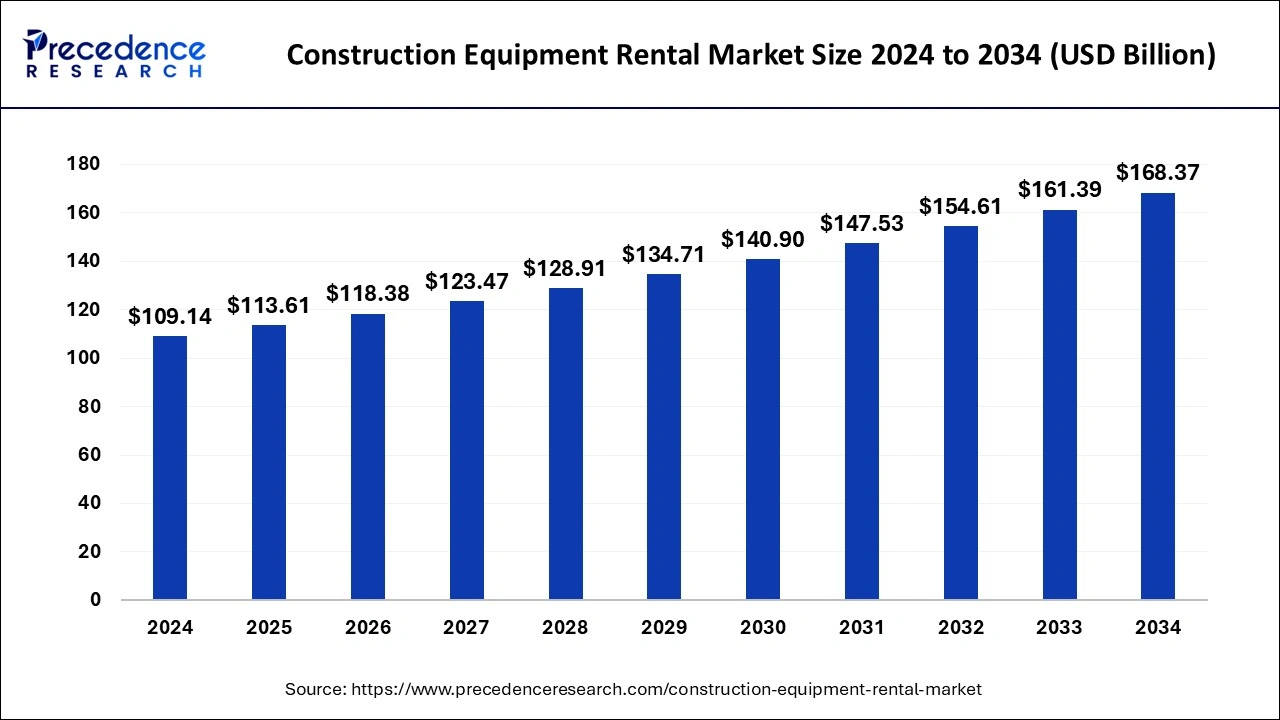

The construction equipment rental market is expected to hit USD 168.37 billion by 2034, growing at a CAGR of 4.43% from USD 109.14 billion in 2024.

Construction Equipment Rental Market Key Takeaways

- In 2024, North America accounted for the highest market share of 31.64%.

- North America is anticipated to experience the fastest growth rate from 2024 to 2034.

- The earthmoving machinery segment dominated the market by product category in 2024.

Market Overview

The construction equipment rental market is witnessing significant growth, driven by the need for flexible, cost-effective, and high-performance machinery in construction projects. Renting equipment offers several advantages over ownership, including lower capital costs, reduced maintenance expenses, and improved project flexibility. The market encompasses a wide range of equipment such as earthmoving machinery, material handling equipment, road construction machinery, and concrete equipment.

The growing adoption of advanced construction technologies, coupled with the rising focus on sustainable building practices, is boosting the demand for construction equipment rentals. Moreover, the increasing prevalence of digital platforms that facilitate equipment rentals and enhance operational efficiency is transforming the market landscape. As construction activities continue to rise globally, the construction equipment rental market is poised for steady expansion.

Drivers

- Cost-Effectiveness and Operational Flexibility

Renting construction equipment allows companies to optimize their operational budgets by avoiding high initial investments and ongoing maintenance costs. Construction firms can choose equipment based on project-specific requirements, ensuring operational flexibility and cost-efficiency. - Rapid Urbanization and Infrastructure Expansion

The rapid pace of urbanization and the growing need for modern infrastructure are driving the demand for construction equipment rentals. Governments worldwide are investing in large-scale infrastructure projects such as transportation networks, housing developments, and industrial zones, boosting the need for rental services. - Increased Adoption of Automation and Smart Technologies

The integration of automation and smart technologies in construction equipment is enhancing efficiency and reducing operational risks. Rental companies are increasingly offering advanced equipment equipped with IoT sensors, GPS tracking, and real-time data analytics to improve project management and decision-making.

Opportunities

- Growing Demand for Sustainable and Eco-Friendly Equipment

The rising emphasis on sustainability and reducing carbon footprints is driving the demand for eco-friendly construction equipment. Rental companies can capitalize on this trend by offering electric and hybrid machinery that meets environmental standards. - Expansion of Digital Platforms for Seamless Rental Services

The proliferation of digital platforms that facilitate seamless equipment rentals, real-time monitoring, and predictive maintenance is creating growth opportunities for the market. These platforms enhance customer convenience and optimize equipment utilization. - Emerging Opportunities in Developing Economies

Developing economies in Asia, Africa, and Latin America are witnessing increased infrastructure investments and industrial growth. Rental companies can expand their footprint in these regions by offering affordable and reliable equipment solutions.

Challenges

- High Maintenance and Repair Costs

The maintenance and repair of construction equipment involve high costs and technical expertise. Rental companies must invest in regular inspections and preventive maintenance to ensure the reliability and performance of their equipment fleet. - Market Volatility and Economic Uncertainty

The construction equipment rental market is vulnerable to economic fluctuations and industry slowdowns. Market volatility can impact demand for rental services, leading to revenue uncertainties and operational challenges. - Regulatory and Environmental Compliance Issues

Compliance with stringent regulatory and environmental standards poses challenges for rental companies. Adhering to safety protocols, emission standards, and industry regulations requires continuous monitoring and investment.

Regional Insights

- North America

North America leads the construction equipment rental market due to high infrastructure spending, advanced construction technologies, and the presence of major rental companies. The region’s focus on adopting digital platforms and enhancing operational efficiency is driving market growth. - Europe

Europe is witnessing steady growth in the construction equipment rental market, driven by government initiatives to modernize infrastructure and promote green construction practices. Countries such as Germany, the UK, and Italy are investing in sustainable building solutions. - Asia Pacific

Asia Pacific is experiencing rapid growth in the construction equipment rental market, fueled by large-scale infrastructure projects, urbanization, and industrial expansion. China and India are at the forefront of market growth, with increasing investments in smart city initiatives and transportation networks. - Latin America and Middle East & Africa

Latin America and the Middle East & Africa are emerging as lucrative markets for construction equipment rentals. Infrastructure development, oil and gas projects, and urban expansion are creating opportunities for rental companies in these regions.

Recent News

- Introduction of AI-Enabled Equipment for Improved Operational Efficiency

Major rental companies have launched AI-enabled construction equipment that enhances operational efficiency, reduces downtime, and improves project outcomes. - Expansion of Fleet Capacity to Meet Growing Demand

Leading players in the construction equipment rental market are expanding their equipment fleets and entering new regional markets to meet the rising demand for rental services.

Construction Equipment Rental Market Companies

- JCB

- Zahid Group

- Industrial Supplies Development Co. Ltd

- Ahern Equipment Rentals

- John Deere

- Caterpillar Inc.

- Gemini Equipment and Rentals (GEAR)

- Hertz Equipment

- Komatsu Equipment

- Maxim Crane Works

- Neff Rental

Segments Covered in the Report

By Product

- Material Handling Machinery

- Shelves

- Bins

- Silos

- Conveyors

- Pallet trucks

- Fork lifts

- Frames

- Sliding racks

- Bulk containers

- Platform trucks

- Hand trucks

- Cranes

- Others

- Earth Moving Machinery Concrete

- Excavators

- Loading shovels

- Site dumpers

- Dump trucks

- Others

- Concrete and Road Construction Machinery

- Pavers

- Trenchers

- Planers

- Rollers

- Hot boxes

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa