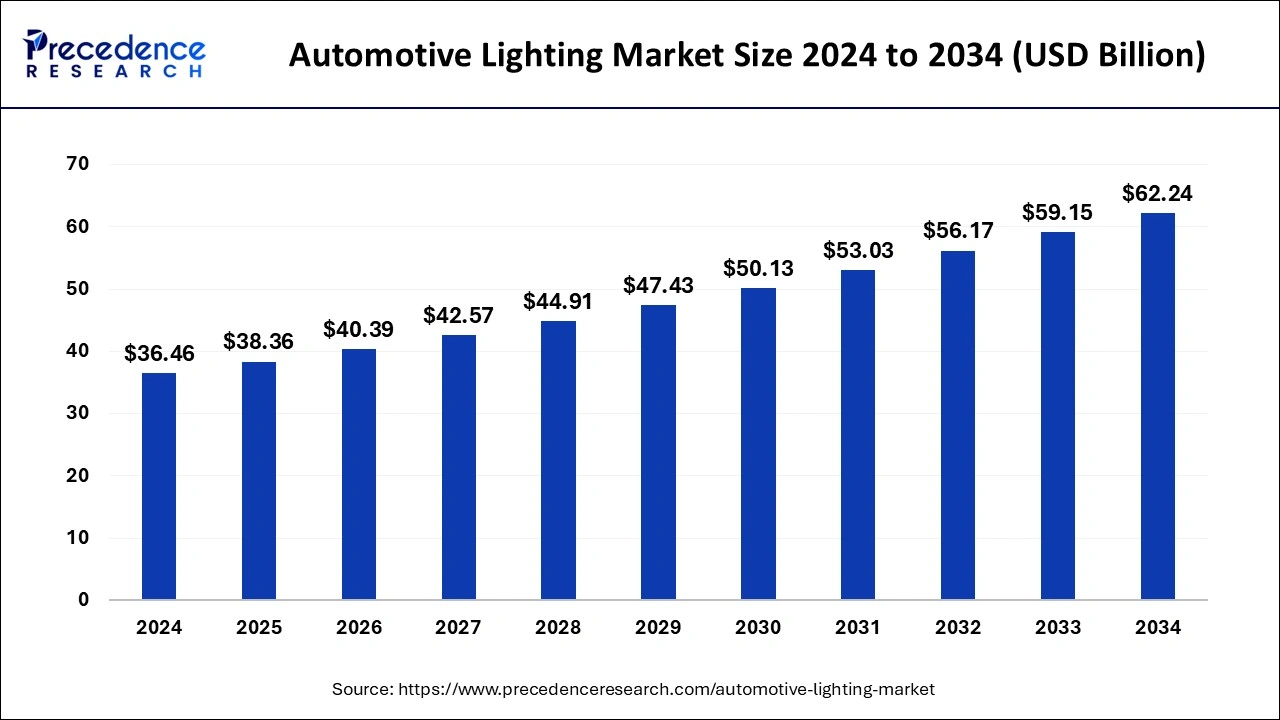

The global automotive lighting market is projected to reach USD 62.24 billion by 2034, growing from USD 36.46 billion in 2024 at a CAGR of 5.49%.

Automotive Lighting Market Key Takeaways

- Asia Pacific held the largest market share of 40.11% in 2024.

- The halogen segment dominated the market by technology in 2024.

- The Light Emitting Diode (LED) segment is anticipated to grow at the fastest CAGR during the forecast period.

- The front/headlamps segment is expected to experience the fastest growth by application.

Market Overview

The automotive lighting market is witnessing significant growth driven by increasing safety concerns and advancements in vehicle technology. Automotive lighting includes various types of lights integrated into vehicles to improve visibility, enhance vehicle aesthetics, and ensure road safety. The market is segmented based on technology, application, vehicle type, and region. Growing adoption of LED and adaptive lighting systems is contributing to the market expansion. Furthermore, stringent government regulations promoting vehicle safety and energy efficiency have accelerated the adoption of advanced automotive lighting systems.

Rising consumer demand for connected and autonomous vehicles is fueling innovation in intelligent lighting solutions that offer adaptive and dynamic features. Manufacturers are also focusing on energy-efficient solutions that comply with government regulations while improving driving experience and aesthetics. As a result, the automotive lighting market is projected to expand steadily over the forecast period.

Drivers

-

Rising Vehicle Production and Sales

The increasing global demand for passenger and commercial vehicles has significantly contributed to the growth of the automotive lighting market. The expansion of the automotive sector, particularly in developing economies, is driving the demand for advanced lighting solutions. -

Stringent Government Regulations on Safety Standards

Government initiatives and regulations aimed at improving road safety are pushing automakers to integrate advanced lighting systems. Regulations mandating the use of daytime running lights (DRLs), adaptive headlights, and rear-view cameras are promoting market growth. -

Growing Adoption of LED Technology

The growing preference for LED technology due to its energy efficiency, longer lifespan, and improved brightness has been a major driver in the market. LED lighting systems also offer design flexibility, making them suitable for modern vehicle designs. -

Increased Demand for Advanced Driver Assistance Systems (ADAS)

The integration of ADAS in vehicles has led to increased adoption of intelligent lighting systems. Adaptive headlights, automatic high beams, and matrix LED technologies are becoming standard features in vehicles equipped with ADAS.

Opportunities

-

Development of Smart and Connected Lighting Systems

The rise of connected and autonomous vehicles presents an opportunity for smart lighting systems that can adapt to environmental conditions and enhance safety. Manufacturers are exploring innovations such as LiDAR-based lighting systems and vehicle-to-vehicle communication to improve road safety. -

Growing Demand for Electric Vehicles (EVs)

The rapid growth of electric vehicles is creating opportunities for energy-efficient and lightweight lighting solutions. As EVs continue to gain traction, manufacturers are focusing on integrating innovative lighting designs that enhance the overall aesthetics and functionality of these vehicles. -

Emerging Markets in Asia-Pacific and Latin America

Developing regions, particularly Asia-Pacific and Latin America, are witnessing increased vehicle sales and infrastructure development. The rising disposable income and urbanization in these regions present opportunities for automotive lighting manufacturers.

Challenges

-

High Initial Costs of Advanced Lighting Systems

The implementation of advanced lighting technologies such as matrix LEDs and adaptive headlights increases the overall vehicle cost. This poses a challenge, especially in price-sensitive markets where affordability is a key concern. -

Complex Integration and Compatibility Issues

The integration of advanced lighting systems with modern vehicle designs poses technical challenges. Ensuring compatibility with existing vehicle architectures and maintaining consistent performance can be complex. -

Supply Chain Disruptions and Component Shortages

The automotive industry has been impacted by supply chain disruptions and semiconductor shortages, which have led to delays in production and increased costs. The availability of key components affects the timely delivery of lighting systems.

Regional Insights

-

North America

North America dominates the automotive lighting market, driven by the presence of major automotive manufacturers and the early adoption of advanced technologies. Stringent safety regulations and a high demand for luxury vehicles contribute to the market growth in this region. -

Europe

Europe holds a significant market share due to the strong presence of leading automotive lighting manufacturers and the growing trend of vehicle electrification. The region is witnessing increased adoption of adaptive lighting systems and OLED technology. -

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth, driven by rapid urbanization, rising disposable income, and increasing vehicle production in countries such as China, India, and Japan. The growing focus on vehicle safety and technological advancements is propelling the market forward. -

Latin America and Middle East & Africa

These regions are experiencing gradual growth in the automotive lighting market due to rising vehicle sales and improved infrastructure. The increasing demand for commercial vehicles and two-wheelers in these regions is contributing to the market expansion.

Recent News

- January 2025: Leading automotive lighting manufacturer announced the launch of its new OLED taillight technology designed to enhance vehicle aesthetics and energy efficiency.

- March 2025: A European automaker introduced an innovative adaptive matrix LED lighting system aimed at improving nighttime visibility and reducing glare.

- February 2025: A key player in the automotive lighting industry partnered with a semiconductor company to develop LiDAR-based intelligent lighting solutions for autonomous vehicles.

Automotive Lighting Market Companies

- DENSO Corporation

- HellaKGaAHueck& Co.

- Hyundai Mobis

- Valeo

- Koito Manufacturing Co. Ltd.

- OsramLicht AG

- Koninklijke Philips N.V.

- Stanley Electric Co. Ltd.

- ROBERT BOSCH GmbH

- ZizalaLichtsysteme GmbH

Segments Covered in the Report

By Technology

- LED

- Halogen

- Xenon/HID

By Product Sale

- Aftermarket Products

- Original Equipment Manufacturers (OEMs)

By Vehicle Type

- ICE

- Commercial Vehicle

- Passenger Vehicle

- Electric Vehicle

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

By Application

- Front/Headlamps

- Side

- Rear Lighting

- Interior Lighting

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa