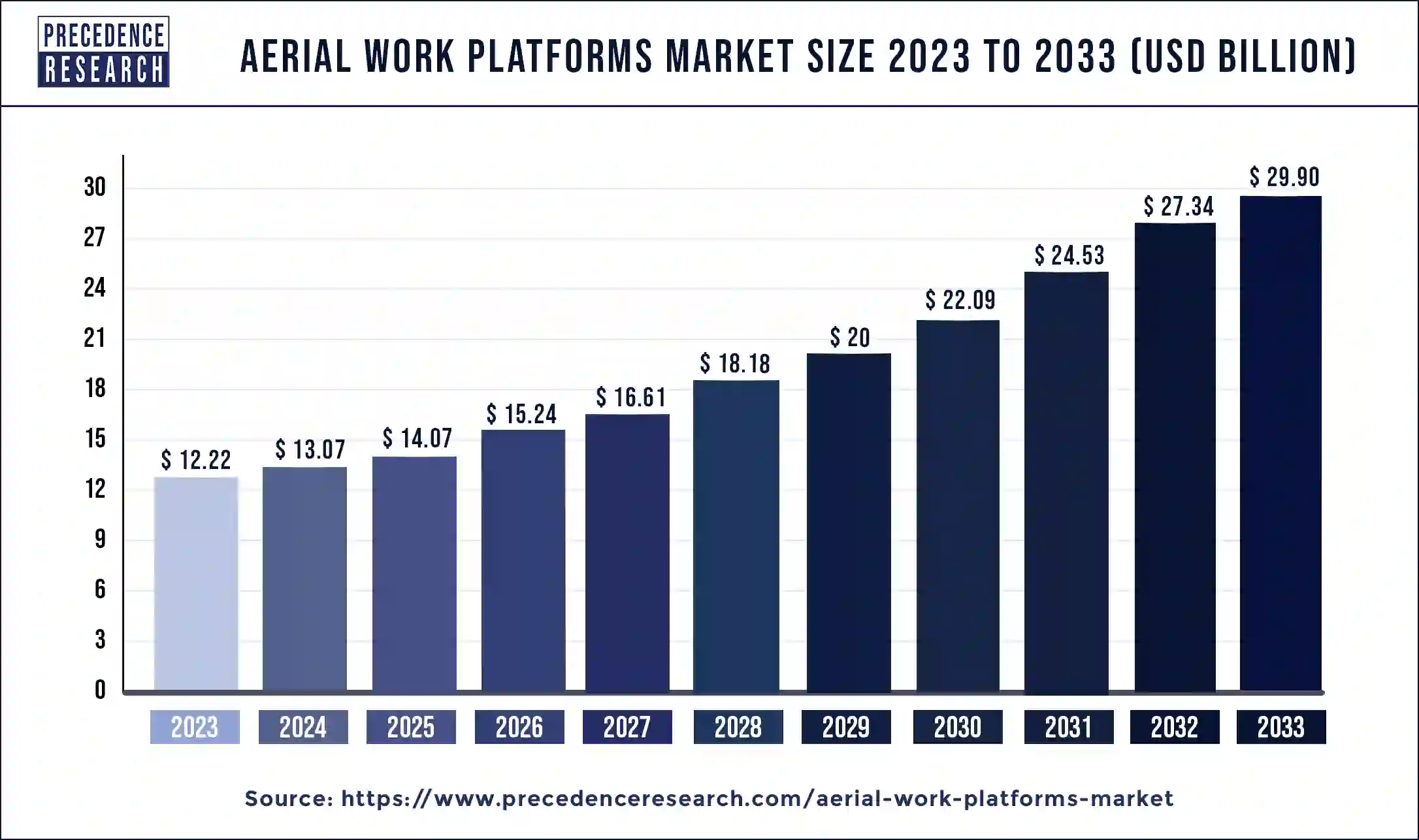

The aerial work platforms market is projected to grow from USD 12.22 billion in 2023 to USD 29.90 billion by 2033, with a CAGR of 9.3%

Aerial Work Platforms Market Key Takeaway

- North America accounted for the largest market share of 38.13% in 2023.

- Asia Pacific is projected to witness the highest CAGR during the forecast period.

- The construction segment led the market by end-user with a 45.53% share in 2023.

- The internal combustion engine segment dominated the propulsion type category with 83.20% market share in 2023.

- The scissor lift segment contributed over 49.28% of the revenue share in 2023.

Aerial Work Platforms Market Overview

The aerial work platforms market is experiencing significant growth due to the rising demand for efficient and safe access solutions across construction, maintenance, and industrial applications. Aerial work platforms (AWPs), also known as elevated work platforms or mobile elevating work platforms (MEWPs), provide temporary access to high or hard-to-reach areas for workers, equipment, and materials.

These platforms are extensively used in construction, infrastructure development, warehousing, and telecommunications for tasks that require elevated access. The increasing adoption of AWPs can be attributed to the growing emphasis on workplace safety, rising urbanization, and technological advancements in lifting equipment. Additionally, the need for efficient material handling, coupled with stringent government regulations regarding worker safety, is driving the demand for AWPs globally.

Drivers

-

Growing Construction and Infrastructure Development:

The rapid growth of the construction industry, especially in developing countries, is driving the demand for AWPs. Increasing investments in urban infrastructure, including smart cities, commercial buildings, and transportation networks, necessitate the use of elevated work platforms. -

Stringent Safety Regulations and Compliance Standards:

Governments and regulatory bodies worldwide are implementing stringent safety standards to protect workers at elevated heights. Compliance with occupational safety guidelines is boosting the adoption of AWPs in various industries. -

Technological Advancements in AWP Design:

Innovations such as electric-powered AWPs, hybrid models, and advanced control systems are enhancing the safety, efficiency, and environmental sustainability of aerial work platforms. -

Rising Demand for Warehouse Automation and Material Handling:

The increasing adoption of automation and e-commerce is driving the need for AWPs in warehouses and distribution centers to optimize material handling operations. -

Expansion of Telecommunication Networks:

The ongoing expansion of 5G networks and fiber optic installations requires elevated platforms for the maintenance and installation of communication infrastructure, driving market growth.

Opportunities

-

Increased Adoption of Electric and Hybrid AWPs:

The shift toward environmentally friendly and energy-efficient equipment is driving the adoption of electric and hybrid AWPs, creating growth opportunities for manufacturers. -

Emergence of Rental Services for AWPs:

The rising trend of renting AWPs instead of purchasing them provides a cost-effective solution for small and medium-sized enterprises, leading to increased market penetration. -

Growth of Smart City Initiatives:

Governments worldwide are investing in smart city projects that require the use of AWPs for maintenance and infrastructure development, creating new avenues for market growth. -

Integration of IoT and Telematics for Remote Monitoring:

The adoption of IoT and telematics in AWPs is enabling real-time monitoring, predictive maintenance, and improved operational efficiency, offering opportunities for innovation.

Challenges

-

High Initial Cost of AWPs:

The high initial investment required for purchasing advanced AWPs can be a deterrent for small and medium-sized enterprises, limiting market penetration. -

Lack of Skilled Workforce for Operation and Maintenance:

Operating and maintaining AWPs requires specialized training and expertise, and the shortage of skilled operators poses a challenge for market growth. -

Fluctuations in Raw Material Prices:

The volatility in raw material prices, especially steel and aluminum, impacts the overall cost of manufacturing AWPs, affecting market profitability. -

Safety Concerns and Operational Risks:

Despite safety advancements, the risk of accidents due to operator error, equipment malfunction, and unstable surfaces remains a concern for the industry.

Regional Insights

-

North America:

North America holds a significant share of the aerial work platforms market, driven by high adoption rates in construction, infrastructure maintenance, and industrial applications. The region benefits from stringent safety regulations and a mature construction industry. -

Europe:

Europe is witnessing steady growth in the AWP market due to the rising demand for efficient material handling solutions, increasing construction activities, and government initiatives promoting worker safety. -

Asia Pacific:

The Asia Pacific region is expected to experience the fastest growth, fueled by rapid urbanization, infrastructure development, and the growing e-commerce sector. Increasing investments in smart city projects and telecommunication networks are contributing to market expansion. -

Latin America and the Middle East & Africa:

These regions are gradually adopting AWPs for construction and maintenance activities, with growth driven by government initiatives aimed at improving infrastructure and enhancing workplace safety.

Recent News

-

JLG Launches Next-Gen Electric AWPs:

JLG Industries recently introduced a new line of electric-powered AWPs designed to improve energy efficiency and reduce carbon emissions, catering to the growing demand for eco-friendly equipment. -

Terex Acquires Key AWP Manufacturer to Expand Portfolio:

Terex Corporation acquired a leading AWP manufacturer to strengthen its product portfolio and expand its market presence globally.

Aerial Work Platforms Market Companies

- CTE

- Aichi Corporation

- Haulotte Group

- Dinolift OY

- Hunan Runshare Heavy Industry Company, Ltd.

- Zhejiang Dingli Machinery Co, Ltd.

- Holland Lift International bv

- JLG Industries

- Hunan Sinoboom Heavy Industry Co. Ltd.

- Niftylift Limited

- Manitou Group

- Snorkel

- Skyjack

- Tadano Limited

Segments Covered in the Report

By End-User

- Construction

- Maintenance and Cleaning

- Logistics and Transportation

- Manufacturing

- Aerospace and Defense

- Others

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Powered

By Platform Working Height

- Below 10 meters

- 10-20 Meters

- 20-30 Meters

- Above 30 Meters

By Type

- Boom Lift

- Articulating Boom Lift

- Telescopic Boom Lift

- Cherry Pickers

- Scissor Lift

- Electric Scissor Lifts

- Rough Terrain Scissor Lifts

- Pneumatic Scissor Lifts

- Atrium Lift

- Z-style Atrium Lift

- S-style Atrium Lift

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World