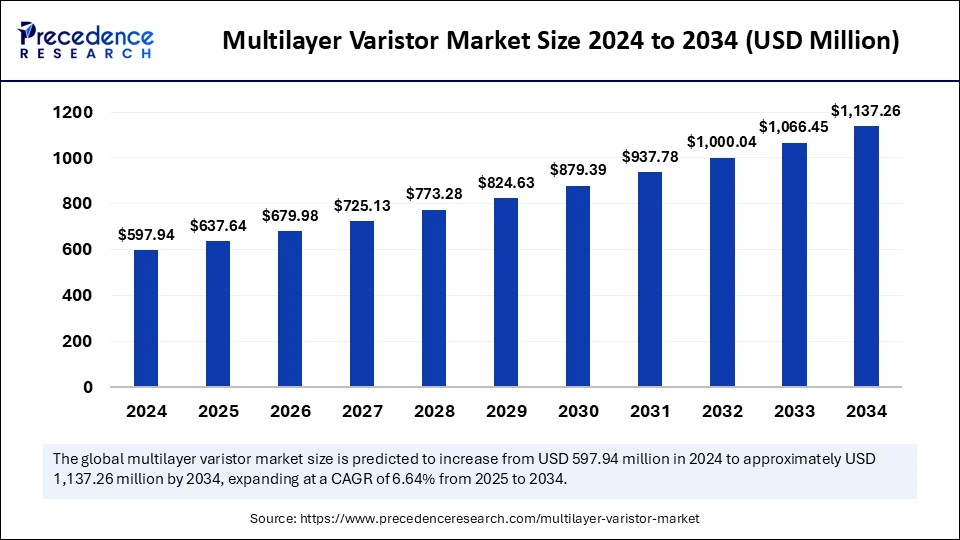

The global multilayer varistor market is projected to grow from USD 597.94 million in 2024 to USD 1,137.26 million by 2034, with a CAGR of 6.64%.

Multilayer Varistor Market Key Takeaways

- Asia Pacific dominated the multilayer varistor market with the largest market share in 2024.

- North America is the fastest growing market expanding at a significant CAGR from 2025 to 2034.

- By type, the standard multilayer varistors segment dominated the market with the largest market share in 2024.

- By type, the low capacitance multilayer varistors segment is the fastest growing segment projected to expand at the highest CAGR.

- By end user, the automotive end-user segment dominated the market with the largest market share in 2024.

- By end user, the consumer electronics end-user segment is the fastest growing segment projected to expand at the highest CAGR.

Multilayer Varistor Market Overview

The multilayer varistor market is witnessing steady growth due to the rising demand for electronic devices and the increasing need for effective circuit protection solutions. Multilayer varistors (MLVs) are advanced surge protection components that offer superior protection against transient voltage spikes in electronic circuits. They are widely used in consumer electronics, automotive systems, industrial equipment, and telecommunication devices to protect sensitive electronic components from voltage surges and electrostatic discharge (ESD).

The global multilayer varistor market is expected to grow significantly between 2024 and 2034, driven by the increasing proliferation of electronic devices, growing adoption of smart home technologies, and rising demand for automotive electronics. The miniaturization of electronic devices and the advancement of 5G technology are further driving the need for compact and reliable circuit protection components such as multilayer varistors. With their ability to provide high-speed response and robust protection, multilayer varistors are increasingly being integrated into modern electronic systems, contributing to the market’s growth.

Drivers

-

Rising Demand for Consumer Electronics:

The growing adoption of smartphones, tablets, smart TVs, and other consumer electronics is driving the demand for multilayer varistors. These devices require effective protection against voltage surges, and MLVs play a critical role in safeguarding sensitive components. -

Increased Penetration of Automotive Electronics:

The increasing use of electronic control units (ECUs), infotainment systems, and advanced driver assistance systems (ADAS) in modern vehicles is boosting the demand for multilayer varistors. As vehicles become more connected and automated, the need for reliable circuit protection solutions is increasing. -

Proliferation of IoT and Smart Home Devices:

The rapid growth of the Internet of Things (IoT) and the adoption of smart home technologies are driving the need for robust circuit protection in connected devices. Multilayer varistors provide essential protection against power surges, ensuring the reliability of IoT devices and smart home systems. -

Advancements in 5G Technology:

The deployment of 5G networks and the increasing use of high-frequency communication devices are creating a strong demand for multilayer varistors. These devices are used to protect communication equipment from transient voltage surges and electromagnetic interference (EMI).

Opportunities in the Multilayer Varistor Market

-

Expansion of Electric Vehicle (EV) Market:

The growing adoption of electric vehicles (EVs) presents significant opportunities for the multilayer varistor market. EVs rely on a range of electronic systems that require protection from voltage spikes, making MLVs an essential component in EV circuits. -

Emergence of Smart Cities and Industrial Automation:

The development of smart cities and the increasing adoption of industrial automation are driving the demand for reliable circuit protection solutions. Multilayer varistors are expected to play a crucial role in ensuring the safety and stability of critical infrastructure and automated systems. -

Increasing Demand for Compact and Miniature Components:

The trend toward miniaturization of electronic devices is creating opportunities for the development of smaller and more efficient multilayer varistors. As manufacturers continue to design compact electronic systems, the demand for space-saving circuit protection components is expected to rise.

Challenges Facing the Multilayer Varistor Market

-

High Competition and Price Pressure:

The multilayer varistor market is highly competitive, with several established players offering similar products. Price pressure and the need for cost-effective solutions pose challenges for manufacturers seeking to maintain profit margins. -

Technical Limitations in High-Power Applications:

While multilayer varistors are effective in protecting low to medium-power circuits, they have limitations in handling high-power applications. This restricts their use in certain industrial and high-voltage environments, creating a challenge for market expansion. -

Raw Material Supply Chain Disruptions:

The production of multilayer varistors relies on the availability of raw materials such as ceramic materials and metal oxides. Supply chain disruptions and fluctuations in raw material prices can impact the production and availability of MLVs, posing a challenge for manufacturers.

Regional Analysis of the Multilayer Varistor Market

North America:

North America is a major market for multilayer varistors, driven by the high demand for consumer electronics, the presence of key automotive manufacturers, and the growing adoption of IoT technologies. The United States, in particular, is witnessing increased deployment of MLVs in smart home devices and automotive systems.

Europe:

Europe is experiencing significant growth in the multilayer varistor market, driven by the increasing adoption of electric vehicles and the growing emphasis on industrial automation. Countries such as Germany, the UK, and France are leading the adoption of MLVs in automotive and industrial applications.

Asia Pacific:

Asia Pacific is expected to dominate the multilayer varistor market, with rapid growth in consumer electronics, automotive, and telecommunications sectors. Countries such as China, Japan, and South Korea are investing heavily in the development of 5G technology, driving the demand for MLVs in communication equipment and electronic devices.

Middle East and Africa:

The Middle East and Africa region is gradually adopting multilayer varistors, particularly in the energy and telecommunications sectors. The increasing focus on improving power infrastructure and ensuring reliable communication networks is driving the demand for MLVs in this region.

Recent News in the Multilayer Varistor Market

-

In February 2025, a leading electronics manufacturer introduced a new range of multilayer varistors designed to provide enhanced protection for high-frequency communication devices.

-

In March 2025, a global semiconductor company announced the expansion of its multilayer varistor production capacity to meet the growing demand from the automotive and consumer electronics sectors.

-

In January 2025, a partnership was formed between a leading automotive OEM and a multilayer varistor supplier to develop advanced surge protection solutions for electric vehicles.

Multilayer Varistor Market Companies

- Eaton Corporation Plc

- KYOCERA (AVX Corporation)

- TDK Corporation

- Akahane-Stackpole Manufacturing Group

- Littelfuse, Inc.

- Panasonic Corporation

- INPAQ Technology Co., Ltd.

- Vishay Intertechnology, Inc

- SFI Electronics Technology Inc

- Cham How Corporation

- KOA Speer Electronics, Inc.

- Bourns, Inc.

- Thinking Electronic Industrial Co.,Ltd.

Segments Covered in the Report

By Type

- Standard Multilayer Varistors

- Low Capacitance Multilayer Varistors

- High Energy Multilayer Varistors

By End-User

- Automotive

- Consumer Electronics

- Industrial

- Telecommunications

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa