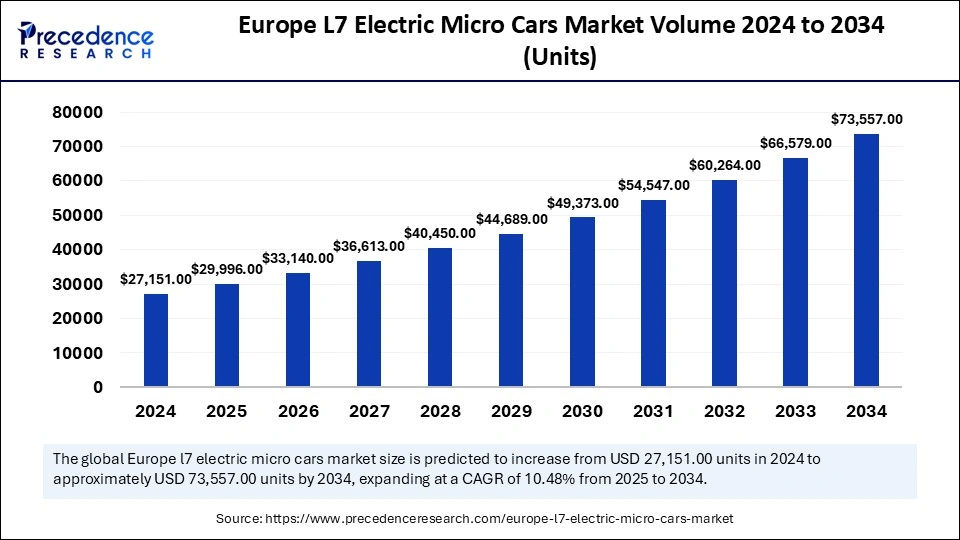

Europes L7 electric micro cars market volume to increase from 29,996 units in 2025 to over 73,556 units by 2034, with a steady 10.48% CAGR over the forecast period.

Europe L7 Electric Micro Cars Market Key Takeaways

-

Germany held the largest market share in 2024.

-

The UK is projected to witness the fastest CAGR in the forecast period.

-

The medium range (61-100KM) segment captured 45.55% of the market share in 2024.

-

The extended range (Above 100KM) segment is expected to grow at a notable CAGR.

-

The lithium-ion battery segment accounted for 72.31% of the market share in 2024.

-

The 2-seater segment led the market with a 54.34% share in 2024.

Europe L7 Electric Micro Cars Market Overview

The Europe L7 electric micro cars market is poised for significant growth in the coming years, driven by increasing urbanization, stringent emission regulations, and a growing preference for sustainable mobility. L7 electric micro cars, classified under the L-category vehicles in Europe, are small, lightweight, and typically operate at low speeds, making them ideal for urban commuting and short-distance travel. These vehicles are gaining popularity due to their affordability, minimal carbon footprint, and ease of maneuverability in congested city areas. Additionally, advancements in battery technology, improved charging infrastructure, and government incentives have propelled the adoption of electric micro cars in Europe.

Market Drivers

-

Stringent Emission Regulations: European governments are implementing stringent carbon emission regulations to curb environmental degradation. Countries like Germany, France, and the Netherlands have set ambitious targets for reducing CO2 emissions, driving the adoption of electric vehicles, including L7 micro cars.

-

Urbanization and Traffic Congestion: With rapid urbanization and increased traffic congestion in major European cities, the need for compact, efficient, and environmentally friendly transportation solutions has increased. L7 electric micro cars fit the requirements perfectly, offering easy parking and reduced travel time in densely populated areas.

-

Government Incentives and Subsidies: Several European countries offer financial incentives, such as tax credits, purchase subsidies, and reduced registration fees, to promote the adoption of electric vehicles. These incentives make L7 micro cars a more attractive and affordable option for consumers.

-

Advancements in Battery Technology: Continuous innovation in battery technology has led to increased energy density, longer driving ranges, and reduced charging times. These advancements address range anxiety concerns, further encouraging consumers to opt for electric micro cars.

-

Rising Fuel Prices: The volatility of fuel prices in Europe has prompted consumers to seek alternative modes of transportation. L7 electric micro cars, being cost-effective and energy-efficient, provide a viable alternative to traditional internal combustion engine vehicles.

Market Opportunities

-

Expansion of Car-Sharing Services: The growing trend of shared mobility in urban areas presents a lucrative opportunity for the adoption of L7 electric micro cars. Companies offering car-sharing and ride-hailing services can benefit by incorporating electric micro cars into their fleets.

-

Integration of Smart Technologies: Incorporating smart technologies, such as connectivity features, autonomous driving capabilities, and remote diagnostics, can enhance the user experience and improve the operational efficiency of L7 electric micro cars.

-

Increased Investment in Charging Infrastructure: The expansion of electric vehicle charging infrastructure across Europe opens opportunities for higher adoption of electric micro cars, ensuring that users have convenient access to charging facilities.

-

Innovative Leasing and Subscription Models: Leasing and subscription models provide consumers with flexible ownership options, reducing the financial burden of purchasing an electric micro car outright.

Market Challenges

-

Limited Range and Speed: Despite advancements in battery technology, L7 electric micro cars still face limitations in terms of range and speed, making them less suitable for long-distance travel.

-

High Initial Costs: Although government incentives reduce the cost burden, the initial purchase price of electric micro cars remains relatively high compared to conventional vehicles.

-

Lack of Consumer Awareness: Many consumers remain unaware of the benefits and capabilities of L7 electric micro cars, leading to slower adoption rates.

-

Regulatory Challenges: Differences in regulations across European countries regarding the classification and use of L-category vehicles pose challenges for manufacturers and distributors.

Regional Insights

-

Germany: Germany leads the European market due to its strong emphasis on electric vehicle adoption and robust government incentives. The country is home to leading automobile manufacturers actively investing in electric micro car technology.

-

France: France is witnessing rapid growth in the L7 electric micro cars market, driven by favorable government policies and increased consumer interest in sustainable mobility.

-

United Kingdom: The UK is expected to witness the fastest growth, with rising demand for compact, eco-friendly vehicles that cater to urban mobility needs.

-

Italy and Spain: These countries are showing gradual growth, supported by increasing awareness of electric mobility and government efforts to expand charging infrastructure.

Recent News

-

February 2025: A leading European automaker announced the launch of a new L7 electric micro car with enhanced range and connectivity features, catering to the growing urban mobility market.

-

January 2025: The European Commission introduced new guidelines to promote the adoption of L-category electric vehicles, ensuring uniformity in regulations across member states.

Europe L7 Electric Micro Cars Market Companies

- Citroen

- Renault

- Fiat

- Aixam

- Volkswagen

- Micro Mobility System AG

- TAZZARI EV

- Renault Group

- Space Options Limited (Siticars.com)

- Ariel Motor Company Ltd.

Segment covered in the report

By Range Per Charge

- Short Range (30-60KM)

- Medium Range (61-100KM)

- Extended Range (Above 100KM)

By Battery Type

- Lead Acid Battery

- Lithium-Ion Battery

- Others (Nickel-Cadmium Battery, etc.)

By Seats

- 2 Seats

- 4 Seats

Ready for more? Dive into the full experience on our website!