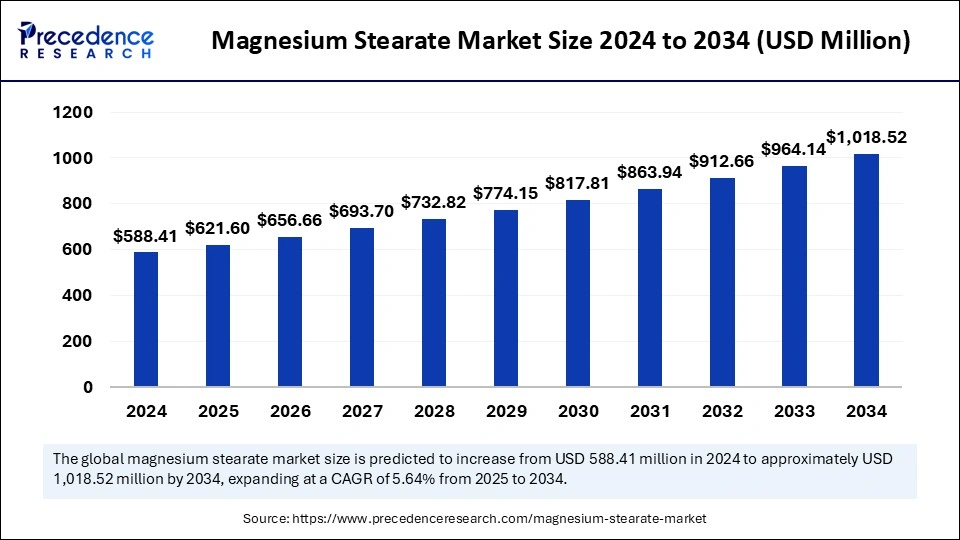

Magnesium stearate market is projected to grow from USD 588.41 million in 2024 to USD 1,018 million by 2034, at a CAGR of 5.64%.

Magnesium Stearate Market Key Takeaways

-

Asia Pacific led the global magnesium stearate market with a 37% share in 2024.

-

North America is projected to experience the fastest growth during the forecast period.

-

The European market is expected to witness steady expansion throughout the forecast period.

-

The powder segment held the largest market share by form in 2024, while the flakes segment is forecasted to grow significantly.

-

The pharmaceutical segment dominated by application in 2024, with the personal care segment anticipated to experience notable growth over the coming years.

Magnesium Stearate Market Overview

The Magnesium Stearate Market is experiencing steady growth due to its widespread applications across the pharmaceutical, food, and personal care industries. Magnesium stearate is a widely used additive that functions as a lubricant, anti-caking agent, and emulsifier. It is produced by the reaction of magnesium salts with stearic acid, resulting in a fine, white powder that is insoluble in water but easily dispersible in oils and organic solvents.

The pharmaceutical industry is the largest consumer of magnesium stearate, where it is primarily used in tablet formulations to prevent ingredients from sticking to manufacturing equipment and to ensure uniform blending. The food industry also utilizes magnesium stearate as a flow agent to maintain the consistency of powdered ingredients, while the personal care sector benefits from its smooth texture and stabilizing properties in cosmetics and skincare products.

The growing demand for processed foods, the rise of nutraceuticals, and the increasing adoption of dietary supplements have significantly contributed to the expansion of the magnesium stearate market. Additionally, technological advancements in pharmaceutical formulations and a growing focus on improving the efficiency of manufacturing processes have fueled the demand for high-purity magnesium stearate. Furthermore, the increased awareness of clean-label products and the use of plant-based stearates derived from palm or vegetable oils are reshaping the industry landscape, leading to a shift toward sustainable production practices.

Market Drivers

The primary driver for the magnesium stearate market is the growth of the pharmaceutical industry, which accounts for a significant portion of the global demand. As pharmaceutical companies continue to expand their product portfolios and introduce new formulations, the need for high-quality excipients such as magnesium stearate is rising. The increasing prevalence of chronic diseases, growing geriatric populations, and higher consumption of generic medicines are also driving the demand for tablets and capsules, further boosting the use of magnesium stearate in pharmaceutical applications.

Another major factor contributing to market growth is the increased consumption of processed and packaged foods. Magnesium stearate is used as an anti-caking agent in powdered food products such as spices, baking mixes, and confectionery items. With consumers gravitating toward convenience foods and ready-to-eat meals, the demand for food additives that ensure product stability and extend shelf life has surged.

Moreover, the rising demand for personal care and cosmetic products has positively influenced the magnesium stearate market. In cosmetic formulations, magnesium stearate acts as a thickener, stabilizer, and anti-caking agent, enhancing the texture and longevity of skincare products, foundations, and pressed powders. The increasing awareness of skincare and beauty trends, particularly in developing regions, has further fueled the growth of the personal care industry, indirectly benefiting the magnesium stearate market.

Market Opportunities

One of the most promising opportunities in the magnesium stearate market lies in the development of plant-based and sustainable alternatives. With growing consumer awareness about environmental sustainability and ethical sourcing, manufacturers are increasingly seeking plant-derived stearates produced from vegetable oils, such as palm, coconut, and soy. The adoption of sustainable and renewable raw materials not only aligns with the clean-label movement but also meets the regulatory requirements of environmentally conscious markets.

Another significant opportunity is the expansion of magnesium stearate applications in the nutraceuticals industry. The increasing popularity of dietary supplements, functional foods, and wellness products has created a robust demand for high-quality excipients that ensure the stability and efficacy of these formulations. As the global nutraceutical market continues to expand, the role of magnesium stearate in maintaining product consistency and enhancing manufacturing efficiency is expected to grow.

Market Challenges

Despite its promising growth, the magnesium stearate market faces challenges related to regulatory scrutiny and quality compliance. Regulatory agencies such as the U.S. FDA and the European Medicines Agency impose stringent quality standards on excipients used in pharmaceutical formulations. Ensuring compliance with these standards requires manufacturers to invest in robust quality control processes and adhere to Good Manufacturing Practices (GMP), which can add to production costs.

Another challenge lies in the perception of magnesium stearate as a synthetic additive, which has led to misconceptions about its safety. Although magnesium stearate is generally recognized as safe (GRAS), concerns about its potential impact on nutrient absorption have influenced consumer preferences, particularly in the clean-label and organic food segments. Addressing these concerns through transparent labeling and consumer education is essential to mitigate any negative impact on market growth.

Regional Insights

Asia Pacific holds the largest share of the global magnesium stearate market, driven by the booming pharmaceutical and food industries in countries such as China, India, and Japan. The region’s rapidly growing population, increasing disposable income, and expanding healthcare infrastructure contribute to the rising demand for pharmaceuticals and dietary supplements, thereby fueling market growth. The presence of major contract manufacturing organizations (CMOs) and excipient producers further enhances the region’s market position.

North America is another prominent market, driven by the strong presence of pharmaceutical companies and increasing consumer demand for dietary supplements and functional foods. The region’s regulatory focus on quality and safety standards ensures consistent demand for high-grade magnesium stearate in pharmaceutical and food applications.

Europe maintains a significant share of the market due to its advanced pharmaceutical sector and growing preference for organic and clean-label products. The region’s emphasis on sustainability and environmentally friendly production practices is also driving the demand for plant-based magnesium stearate alternatives.

Recent Developments

Recent advancements in magnesium stearate production include the introduction of plant-based and palm-free alternatives, catering to the rising demand for sustainable excipients. Leading manufacturers are focusing on diversifying their product portfolios to include clean-label solutions that meet evolving consumer preferences.

The expansion of pharmaceutical manufacturing facilities in emerging economies has also contributed to market growth. As pharmaceutical companies seek to optimize production costs and meet increasing global demand, the establishment of new manufacturing units in Asia and Latin America is enhancing the availability of magnesium stearate in these regions.

Magnesium Stearate Market Companies

- Croda International

- Unichem

- AkzoNobel

- Wacker Chemie

- Merck

- Evonik

- The Dow Chemical Company

- Siltronic

- T. Vanderbilt Company

- Sumitomo Chemical

- BASF

- PQ Corporation

- Tolsa Group

- Solvay

Segments Covered in the Report

By Form

- Powder

- Flakes

By Application

- Pharmaceuticals

- Personal Care

- Food and Beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!