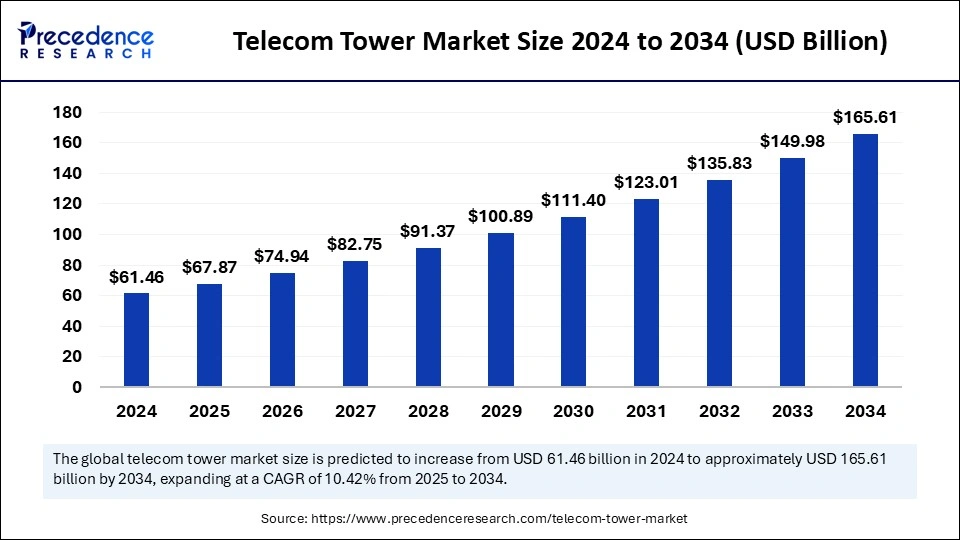

Telecom tower market size to expand from USD 61.46 billion in 2024 to USD 165.61 billion by 2034, registering a 10.42% CAGR.

Telecom Tower Market Key Takeaways

- Asia Pacific led the global market with the largest share of 45% in 2024.

- North America is expected to witness the fastest growth over the studied period.

- By deployment type, the shared infrastructure deployment segment held the biggest market share of 68% in 2024.

- By deployment type, the owned deployment segment is anticipated to grow at the fastest rate during the projection period.

- By type, the lattice towers segment accounted for the major market share in 2024.

- By type, the monopole towers segment is projected to grow rapidly in the coming years.

- By installation, the ground-based segment dominated the market in 2024.

- By installation, the rooftop segment is expected to grow at the fastest rate during the forecast period.

- By application, the communication segment contributed the biggest market share in 2024.

- By application, the radar segment is expected to grow at the fastest rate in the market during the projection period.

Telecom Tower Market Overview

The Telecom Tower Market is expanding rapidly as telecom operators focus on strengthening their network infrastructure to meet the rising demand for high-speed connectivity. With increasing mobile subscriptions, digital transactions, and remote work solutions, the demand for robust telecom networks has never been higher.

The ongoing shift toward 5G technology and the expansion of fiber-optic networks are further accelerating the growth of telecom tower installations worldwide. Governments and telecom providers are also working together to improve connectivity in underserved regions, fueling market expansion.

Telecom Tower Market Drivers

Key factors driving the telecom tower market include the increasing adoption of digital services, the rise in mobile data consumption, and the rapid expansion of telecom networks. The growing trend of smart homes, connected vehicles, and industrial automation is pushing telecom companies to expand their infrastructure.

Additionally, partnerships between telecom operators and technology firms are leading to the development of next-generation network solutions that require more telecom tower deployments.

Telecom Tower Market Opportunities

There are multiple opportunities for growth in the telecom tower market. The rising adoption of smart towers equipped with remote monitoring and automation capabilities is improving network efficiency.

The shift toward energy-efficient telecom infrastructure is encouraging investments in green towers powered by renewable energy sources. Additionally, the increasing deployment of private 5G networks for enterprises and industrial applications is creating new demand for customized telecom tower solutions.

Telecom Tower Market Challenges

Despite its growth potential, the telecom tower market faces several challenges, including land acquisition difficulties, environmental concerns, and regulatory restrictions. The high costs associated with telecom tower deployment and maintenance can also be a constraint for telecom operators, particularly in developing regions.

Furthermore, the competition among telecom providers to secure the best tower locations can lead to operational inefficiencies and delays.

Telecom Tower Market Regional Insights

The telecom tower market is witnessing strong growth across various regions. North America and Europe are leading markets, with extensive 5G network rollouts and strong regulatory frameworks supporting telecom infrastructure expansion.

The Asia-Pacific region is growing at a rapid pace, driven by large-scale investments in telecom networks by China, India, and Japan. Africa and Latin America are also emerging as high-potential markets, with increasing investments aimed at expanding mobile broadband coverage.

Telecom Tower Market Recent Developments

Recent advancements in the telecom tower market include the introduction of AI-powered predictive maintenance solutions and the expansion of fiber-to-the-tower (FTTT) networks. Companies are also focusing on enhancing security measures for telecom infrastructure to prevent cyber threats. The growing trend of telecom infrastructure sharing and joint ventures among telecom operators is further shaping the future of the industry.

- In December 2024, Transcelestial, a Singapore-based telecom service provider, announced plans to test advanced laser communication technology in Northern Australia. With an emphasis on space communications and defense assets, this initiative seeks to improve remote connectivity. By delivering high-speed data transmission without requiring substantial ground-based infrastructure, the technology has the potential to transform connectivity in underserved areas completely.

- In November 2024, Telefonica Germany collaborated with Amazon Web Services to pilot quantum technologies within its mobile network. The initiative focuses on optimizing mobile tower placements and enhancing network security through quantum encryption. This collaboration is part of Telefonica’s broader strategy to explore advanced technologies that could underpin future 6G networks, aiming to improve service delivery and maintain a competitive age in the rapidly evolving telecom landscape.

Telecom Tower Market Companies

- American Tower Corporation (U.S.)

- AT&T, Inc.

- Cellnex Telecom S.A. (Spain)

- China Tower Corporation Limited

- Crown Castle

- GTL Infrastructure Limited

- Helios Tower Plc

- IHS Holding Limited

- Indus Towers Limited (Bharti Airtel)

- SBA Communications Corporation

- Telesites S.A.B. de C.V.

- Viom Networks

Segments Covered in the Report

By Deployment Type

- Shared Infrastructure Deployment

- Owned Deployment

By Type

- Lattice Tower

- Guyed Tower

- Monopole Tower

- Stealth Tower

By Installation

- Rooftop

- Ground Based

By Application

- Radio

- Radar

- Communication

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa