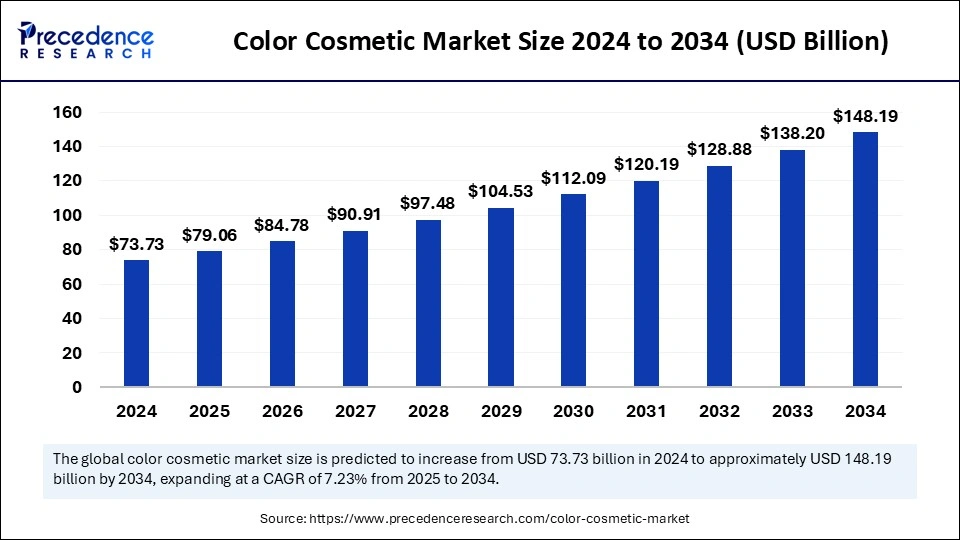

The color cosmetic market is anticipated to reach USD 148.19 billion by 2034, up from USD 73.73 billion in 2024, with a CAGR of 7.23%.

Color Cosmetic Market Key Takeaways

- Asia Pacific dominated the global market with the largest market share of 34% in 2024.

- Europe is expected to witness notable growth during the forecast period.

- By product type, the facial products segment led the global market in 2024.

- By product type, the lip products segment expects rapid growth during the predicted period.

- By price range, the mass segment contributed the highest market share in 2024.

- By age group, the millennial segment captured the biggest market share in 2024.

- By distribution channel, the modern trade segment held the largest market share in 2024.

- By distribution channel, the e-commerce segment expects significant growth in the predicted period.

Color Cosmetic Market Overview

The color cosmetic market is undergoing a transformation as brands embrace digital innovation, sustainability, and inclusivity. Consumers today demand high-performance beauty products that align with their ethical and environmental values. The market is witnessing a shift towards vegan and cruelty-free cosmetics, with brands focusing on sustainable ingredient sourcing and recyclable packaging.

Digital technology, including AI-driven shade matching and AR-powered virtual try-ons, is revolutionizing the shopping experience, making it more personalized and convenient. The increasing influence of TikTok, Instagram, and YouTube beauty creators has also played a crucial role in shaping consumer preferences, encouraging brands to launch trendy and limited-edition collections.

Color Cosmetic Market Drivers

The growing demand for ethical and sustainable beauty products is a major driver of market growth. Consumers are becoming increasingly conscious of the impact of their purchasing decisions, leading brands to develop eco-friendly formulations free from harmful chemicals. The expansion of direct-to-consumer (DTC) beauty brands, leveraging online platforms and influencer marketing, has enabled greater accessibility to color cosmetics.

Additionally, advancements in product formulation, such as lightweight, long-lasting, and skin-friendly cosmetics, have increased their appeal to a broader audience. The rise of gender-neutral beauty and inclusivity initiatives by major brands is further fueling demand across diverse consumer segments.

Color Cosmetic Market Opportunities

The market holds immense potential in the customization and personalization of makeup products, with brands developing AI-powered tools that allow consumers to create their own shades and formulas. The rise of skincare-infused makeup is another area of opportunity, with growing interest in hybrid beauty products that offer both aesthetic and skincare benefits.

E-commerce and subscription-based beauty services are expanding, providing brands with recurring revenue models and enhanced customer engagement. The demand for halal-certified and organic cosmetics in Middle Eastern and Southeast Asian markets is also rising, creating new growth avenues for beauty companies.

Color Cosmetic Market Challenges

A key challenge in the market is the need for brands to balance affordability and sustainability, as eco-friendly ingredients and packaging often come at a higher cost. The increasing regulatory scrutiny on cosmetic ingredients and claims requires brands to ensure compliance with evolving safety standards.

Counterfeit and imitation products remain a persistent issue, particularly in online retail channels, affecting both consumer trust and brand reputation. Additionally, shifting consumer preferences and rapidly changing beauty trends make it challenging for brands to maintain long-term relevance in the market.

Color Cosmetic Market Regional Insights

North America remains a dominant player in the color cosmetic industry, with a strong preference for clean beauty and luxury cosmetics. Europe is witnessing a rise in demand for organic and vegan beauty products, particularly in countries like Germany and France.

The Asia-Pacific region is emerging as a key market, fueled by increasing disposable income and the popularity of global beauty trends. Latin America and the Middle East are experiencing growing adoption of premium cosmetics, driven by changing consumer lifestyles and rising beauty awareness.

Color Cosmetic Market Recent Developments

Recent innovations include AI-powered foundation matching, customizable beauty products, and the expansion of sustainable beauty packaging. Brands are investing in influencer-led product collaborations and social commerce strategies to engage younger consumers. The trend of skincare-makeup hybrids is growing, with brands launching hydrating foundations, lip balms with SPF, and serum-infused concealers.

- In December 2024, Shoppers Stop’s subsidiary Global SS Beauty Brands announced to step into the private label segment with the launch of Joyology, a new-age color cosmetics brand with the millennials as their target consumers.

- In February 2025, Pradeep Banerjee, former executive director of Hindustan Unilever, and Nabeel Kadri, founder of Median, a celebrity endorsement agency, launched the premium color cosmetics brand ‘Hyue,’ focusing on the preference of Indian consumers.

- In July 2024, a leading personal care brand named Wow Skin Science’s subsidiary Body Cupid stepped up into the cosmetic category with the latest brand, ‘Color Cupid.’

Color Cosmetic Market Companies

- L’Oréal S.A

- Unilever

- Estée Lauder Inc.

- Avon Products, Inc.

- Shiseido Company, Limited

- Coty Inc.

- Revlon, Inc.

- CIATÉ

- KRYOLAN

- CHANTECAILLE BEAUTÉ

Segments Covered in the Report

By Product Type

- Facial Products

- Blush

- Tubes

- Pallets

- Dispensing Bottles (Pump-Based)

- Compacts

- Others (Blush Sticks, etc.)

- Foundation

- Tubes

- Pallets

- Dispensing Bottles (Pump-Based)

- Compacts

- Others (Foundation Stick, etc.)

- Concealer

- Tubes (Applicator and Pump-Based)

- Pots and Pallets

- Concealer Pen

- Concealer Sticks

- Others (Compacts, etc.)

- Face Powder

-

- Jars

- Compacts

- Others (Pallets, etc.)

-

- Facial Setting Spray

- Primer

-

- Tubes

- Dispensing Bottles (Pump and Dropper-Based)

- Others (Jars, etc.)

- Others (Highlighter, etc.)

-

- Blush

- Lip Products

- Lipstick

- Bullets

- Crayons

- Pallets

- Others (Container, etc.

- Lip Balm

- Tubes

- Roll On Containers

- Twist-Up-Sticks

- Others (Jars and Pots, etc.)

- Lip Liner Pencils

- Others (Lip Gloss, etc.

- Lipstick

- Eye Products

-

- Kajal

- Pens

- Bullets

- Jars

- Others (Tubes, etc.)

- Kajal

- Eyeliner

-

- Felt-tip Eyeliner

- Pallets

- Crayons/Pencil

- Others (Pots, etc.)

-

- Mascara

- Eyeshadow

-

- Pots

- Pallets

- Others (Stick, etc.)

-

-

- Nail Products

- Nail Paints

- Others

By Price Range

- Mass

- Premium

- Luxury

By Age Group

- Gen-Z

- Gen-X

- Millennials

- Baby Boomers

By Distribution Channel

- General Trade

- Local Beauty Stores

- Supermarkets

- Hypermarkets

- Modern Trade

- Department Stores

- Beauty Specialty Stores

- E-Commerce

- Others (Drug Stores, etc.)

By Geography

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East and Africa