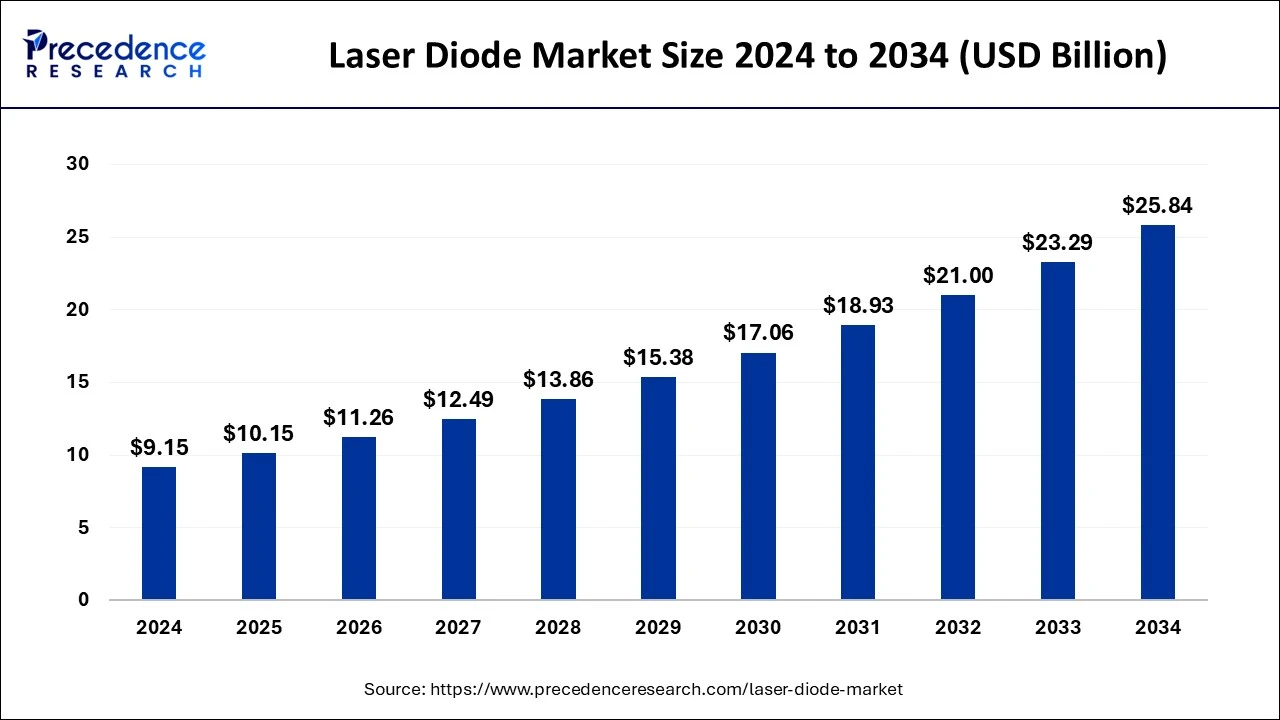

The laser diode market is set to grow from USD 9.15 billion in 2024 to an estimated USD 25.84 billion by 2034, With a CAGR of 10.94% from 2024 to 2034

Laser Diode Market Key Takeaways

-

Asia Pacific emerged as the leading region in 2024, holding 46% of the global market share.

-

North America is forecasted to experience the most rapid growth in the coming years.

-

The largest share in the mode of operation category was taken by multi-mode laser diodes in 2024.

-

In terms of wavelength, the blue laser diode segment led the market in 2024.

-

Gallium Arsenide remained the top doping material, capturing the largest share in 2024.

-

Quantum well laser diodes represented the leading technology segment in 2024.

-

The automotive industry was the top application segment, dominating the market share in 2024.

Laser Diode Market Overview

The laser diode market has gained remarkable traction, reflecting its critical role in modern-day technologies. From telecommunications to automotive and medical devices, laser diodes are an indispensable element. The laser diode is a compact semiconductor device that releases light through amplification by stimulated emission. It consists of a p-n junction typically of the alloy gallium arsenide (GaAs) or other semiconductor material.

Laser diodes are used broadly in many areas such as in telecommunication, laser printing, barcode reader, optical storage, and laser pointers, etc. Laser diodes have transformed industries and technologies by offering reliable cheap and versatile sources of coherent light for purposes.

Laser Diode Market Drivers

The growth of fiber optic communication and demand for precise laser-based processes in industries are major growth drivers. Laser diodes are also essential for barcode scanning, printing, and lidar technology. The rising emphasis on miniaturized, power-efficient electronics and increasing adoption of laser projection systems are further accelerating market demand.

Laser Diode Market Opportunities

Emerging applications in AR/VR and wearable devices offer promising growth opportunities. The push for autonomous driving and smart cities is increasing the demand for advanced laser sensing technologies. Laser diodes’ integration with AI-driven systems for data analysis and real-time monitoring is poised to revolutionize automation and smart manufacturing sectors.

Laser Diode Market Challenges

Technical limitations such as short lifespan under high-power operations and sensitivity to environmental changes are significant hurdles. Moreover, a shortage of skilled technicians for system integration and maintenance can hinder implementation, particularly in developing economies. Regulatory constraints on laser usage in certain applications may also slow market expansion.

Laser Diode Market Regional Insights

Asia Pacific commands the largest market share due to extensive semiconductor production and rising demand from consumer electronics. North America is seeing accelerated growth fueled by automotive innovation and robust defense spending. Europe remains a significant player, especially in laser-based material processing and medical imaging technologies.

Laser Diode Market Recent Developments

Innovations in semiconductor laser structures and hybrid integration techniques have enhanced laser diode performance. Notable investments are being made to develop compact and high-efficiency laser modules.

Strategic mergers and acquisitions are also reshaping the competitive landscape, with companies aiming to broaden their product portfolios and global reach.

- In May 2024, Lumispot announced the release of a brand-new multi-peak laser diode array with fast-axis collimation for improving the performance of applications in laser processing, medical treatment, and LiDAR industries.

- In April 2024, IPG Photonics launched six new highly efficient Diode Laser Solutions (DLS-ECO) for substituting infrared bulbs and gas-fired furnaces in industrial heating and drying processes. These solutions help portray IPG’s goal of sustainable energy consumption through lower energy utilization as well as CO2 emissions, and the systems are perfect for battery slurry drying, semiconductor wafer heating, and a lot more.

- In January 2023, IPG Photonics Corporation released six new high-efficiency diode laser solutions with several advantages to thermal ovens in industrial heating and drying processes.

Laser Diode Market Companies

- Arima Lasers Corp

- BluGlass Limited

- Coherent Corp.

- Frankfurt Laser Company

- Hamamatsu Photonics K.K.

- IPG Photonics Inc.

- Jenoptik AG

- Lumentum Holding Inc.

- Lumics GmbH

- MKS Instruments

- Nichia Corporation

- Panasonic Industry Co., Ltd.

- Power Technology Inc

- ROHM Co., Ltd.

- RPMC Lasers, Inc.

- Sharp Corp.

- Sheaumann Laser, Inc.

- Thorlabs, Inc.

- TOPTICA Photonics AG

- TRUMPF SE + Co. KG

- Ushio, Inc.

Segments Covered in the Report

By Mode of Operation

- Single-Mode Laser Diode

- Multi-Mode Laser Diode

By Wavelength

- Infrared Laser Diode

- Red Laser Diode

- Blue Laser Diode

- Green Laser Diode

- UV Laser Diode

- Others

By Doping Material

- Gallium Aluminum Arsenide

- Gallium Arsenide

- Aluminum Gallium Indium Phosphide

- Indium Gallium Nitride

- Gallium Nitride

- Others

By Technology

- Distributed Feedback Laser Diode

- Double Heterostructure Laser Diode

- Quantum Cascade Laser Diode

- Quantum Well Laser Diode

- Vertical Cavity Surface Emitting Laser Diode

- Others

By Application

- Automotive

- Consumer Electronics

- Healthcare

- Industrial

- Military and Defense

- Telecommunication

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!