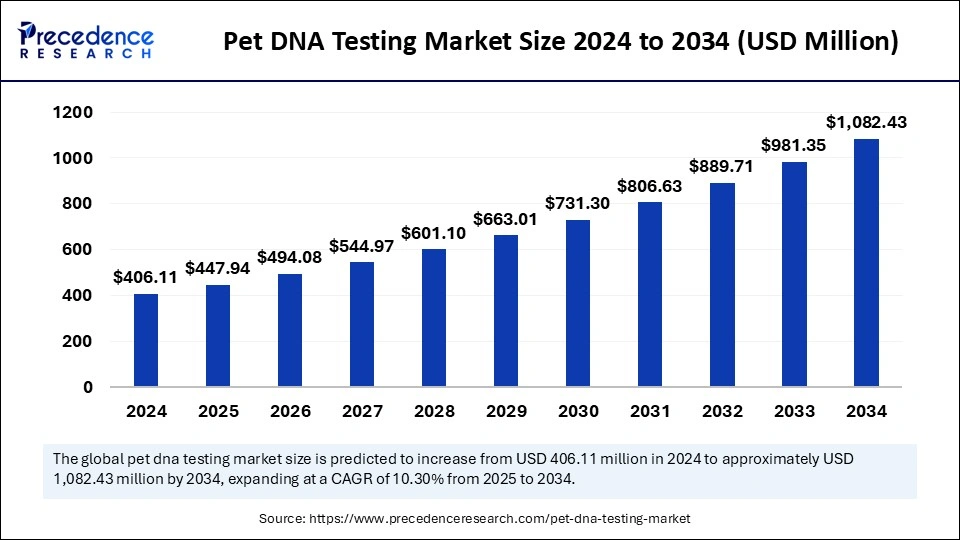

Pet DNA testing market size is forecasted to increase from USD 406.11 million in 2024 to USD 1,082.43 million by 2034, with a CAGR of 10.30% over the forecast period.

Pet DNA Testing Market Key Takeaways

-

In 2024, North America dominated the pet DNA testing market with a 42% share.

-

Asia Pacific is expected to witness the fastest CAGR of 12.2% over the forecast period.

-

By animal type, dogs held the leading market share at 53% in 2024.

-

The cat segment is projected to expand at a CAGR of 10.9% during the forecast period.

-

Saliva was the top sample type, contributing 55% of the market share in 2024.

-

Blood samples are seeing impressive growth with a CAGR of 10.72% through the forecast years.

-

In 2024, breed profile tests accounted for the largest share at 39% by test type.

-

Health and wellness tests are expected to grow at a CAGR of 10.52% in 2024.

-

The breeder’s segment led the market in 2024, holding a 42% share by end use.

-

Pet owners are contributing to market growth with a notable CAGR of 10.6% during the forecast timeline.

Pet DNA Testing Market Overview

The pet DNA testing market is evolving rapidly, driven by the increasing demand for personalized pet care and advancements in genetic technologies. Pet owners are becoming more invested in understanding their animals’ backgrounds, breed compositions, and potential health risks. This shift has led to a surge in demand for home-based DNA test kits that offer quick results and in-depth analysis. The market is benefiting from innovations in genomics, decreasing costs of testing, and a rising trend of pet humanization across the globe.

Drivers

One of the key factors propelling market growth is the rising awareness of breed-specific health conditions and the benefits of early disease detection. Pet owners are also showing greater interest in behavioral genetics to manage training and compatibility with household environments.

The availability of convenient, mail-in kits and intuitive digital interfaces enhances the overall user experience, making DNA testing more appealing. Additionally, social media has played a role in promoting DNA testing through shared results and success stories, further driving consumer interest.

Opportunities

There is significant room for innovation in the pet DNA testing industry. The integration of genetic testing with mobile wellness apps that track diet, vaccinations, and activity could redefine holistic pet care. Expanding into multi-species testing, including birds, reptiles, and small mammals, can broaden market demographics.

Companies that invest in multilingual support and local partnerships in emerging markets will gain a competitive edge. Furthermore, the pet insurance industry is beginning to explore DNA-based underwriting models, offering another avenue for market growth.

Challenges

A notable challenge in the pet DNA testing market is consumer skepticism regarding the scientific validity of results. Some companies have been criticized for a lack of transparency in their methodologies or limited breed databases, leading to inaccurate reports. Regulatory oversight is still minimal, which contributes to inconsistency in testing quality. Additionally, the cost of premium tests can be a barrier for budget-conscious consumers, limiting adoption in certain segments.

Regional Insights

In North America, the pet DNA testing market is flourishing thanks to widespread access to digital services and a culture of premium pet care. Europe has seen growing adoption in countries like the UK, Germany, and France, where consumers are increasingly interested in pet wellness trends. In Asia-Pacific, awareness is growing rapidly, supported by rising pet adoption rates and urbanization. Regions like the Middle East and Latin America are expected to show strong potential in the coming years as market players increase outreach and affordability.

Recent Developments

The pet DNA testing market has seen exciting innovations in recent times, including the use of cloud-based platforms to manage pet health records. Companies are enhancing their breed recognition capabilities and adding more actionable insights, such as nutrition plans based on genetic profiles.

Some providers are now offering lifetime data updates as genomic science evolves. Investment activity is also high, with venture capital firms funding startups that specialize in personalized pet health solutions and cross-species genetic research.

Pet DNA Testing Market Companies

- Zoetis Inc. (Basepaws Inc.)

- Mars Petcare (Wisdom Panel)

- Orivet Genetic Pet Care Limited

- Embark Veterinary, Inc.

- Dognomics (public: Clinomics)

- DNA MY DOG (Canadian Dog Group Ltd.)

- Neogen Corporation

- EasyDNA (Genetic Technologies)

- CirclePaw (Prenetics Global Limited)

- Macrogen, Inc.

Segments Covered in the Report

By Animal Type

- Dogs

- Cats

- Other Animals

By Sample Type

- Blood

- Saliva

- Fecal

- Others

By Test Type

- Breed Profile

- Genetic Diseases

- Health and Wellness

By End-use

- Pet Owners

- Breeders

- Veterinarians

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!