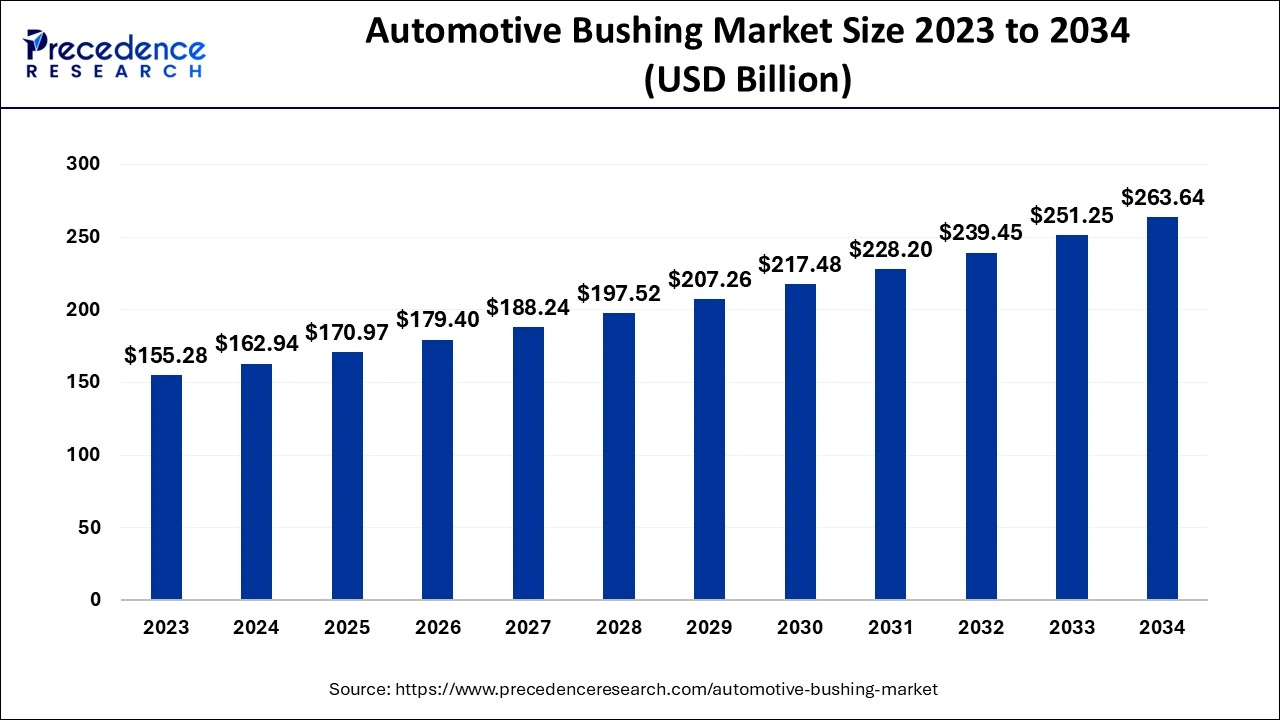

Automotive bushing market size is expected to grow from USD 162.94 billion in 2024 to approximately USD 263.64 billion by 2034, registering a CAGR of 4.93% due to increasing vehicle production and demand for smoother ride quality.

Automotive Bushing Market Key Takeaways

-

Asia Pacific captured the largest market share of 61% in the global automotive bushing market in 2023.

-

North America is anticipated to experience steady and solid growth during the forecast timeframe.

-

Among vehicle types, the passenger segment dominated the market in 2023.

-

The light commercial vehicle segment is expected to grow at a remarkable CAGR in the upcoming years.

-

In 2023, suspension bushings accounted for the largest portion of the market by application.

-

Automotive transmission bushings are set to grow substantially over the forecast period.

Automotive Bushing Market Overview

The automotive bushing market is proliferating because they are ideal for absorbing vibration and reducing noise, but they tend to wear out more quickly than other bushings. Automotive bushings are small, flexible, cylindrical components designed to provide a cushioning effect on the various metals in a vehicle’s suspension system. Typically made of rubber, polyurethane, or a combination of both, these products help absorb vibrations and reduce noise as the vehicle is in motion.

Automotive bushings are available in many different types and sizes depending on the specific application and are often used in areas where metals come into contact with each other, such as suspension systems. Automotive bushings are used to reduce direct metal-to-metal contact in areas such as engines, gearboxes, and suspension systems, thereby reducing noise and vibration. Bushings are vital in isolating vibrations and enhancing suspension efficiency, and as vehicle technology evolves, so does the demand for innovative bushing components.

Drivers

Market growth is fueled by increasing vehicle production worldwide, particularly in developing economies. The demand for vehicles that offer reduced vibration and noise, coupled with growing awareness about driver and passenger comfort, is pushing OEMs to focus on better suspension systems.

Government regulations emphasizing vehicle safety are also motivating manufacturers to integrate improved bushing designs to ensure better handling and control.

Opportunities

The transition toward electric and hybrid vehicles presents new opportunities for bushing manufacturers. These vehicles require customized suspension and powertrain bushings to accommodate different weight distributions and power configurations. The rise of connected and autonomous vehicles further broadens the potential for smart bushing systems that respond dynamically to road conditions, offering a new frontier for innovation.

Challenges

One of the key challenges facing the automotive bushing market is the volatility in raw material prices, particularly for rubber and metal components. Additionally, intense competition and pressure to reduce costs can compromise the quality of bushings, affecting overall vehicle performance. There is also a need for higher standardization in manufacturing processes to ensure consistent quality across regions and vehicle models.

Regional Insights

Asia Pacific led the market in 2023, capturing 61% of the global share due to its high vehicle production capacity and cost-effective manufacturing infrastructure. Countries like China, Japan, and South Korea are central to this growth. Meanwhile, North America is set to grow at a healthy rate, propelled by technological advancements and an uptick in demand for luxury and electric vehicles. Regional automotive policies and investment in EV infrastructure are reinforcing this trend.

Recent Developments

Recent industry developments highlight a move toward eco-friendly and recyclable bushing materials. Several manufacturers are launching product lines designed for electric and hybrid vehicles, emphasizing noise reduction and energy efficiency. Partnerships between global OEMs and specialized component suppliers are fostering innovations in bushing design, aiming to enhance overall vehicle dynamics.

Automotive Bushing Market Companies

- Powerflex USA

- GYCX Factory

- MEYLE AG

- ContiTech Deutschland GmbH

- Vogelsang Fastener Solutions

- Schaeffler AG

- Teknorot

- Barberi Rubinetterie Industriali S.r.l.

- Xiamen

- Kesaria Rubber Industries Pvt. Ltd.

Segments Covered in the Report

By Vehicle Type

- Passenger

- LCV

- HCV

By Application

- Suspension

- Engine

- Chassis

- Interior

- Exhaust

- Transmission

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!