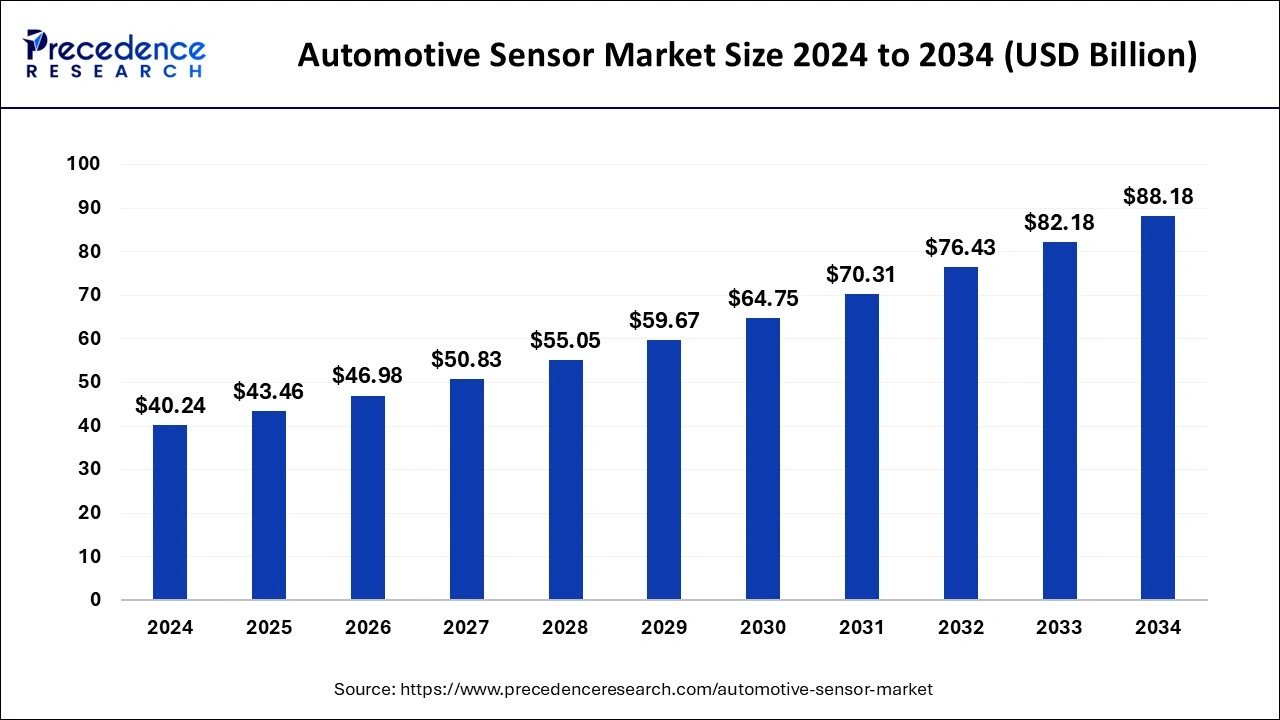

The global automotive sensor market is projected to grow from USD 40.24 billion in 2024 to USD 88.18 billion by 2034, at a CAGR of 8.16%.

Automotive Sensor Market Key Takeaway

- Asia Pacific dominated the automotive sensor market in 2024, capturing 56.11% of the total revenue share, driven by increasing vehicle production and the rapid adoption of advanced driver assistance systems (ADAS).

- The ADAS & safety system segment led the market by application, holding 42% of the total revenue share in 2024, as demand for enhanced vehicle safety and regulatory mandates continue to rise.

- Passenger vehicles accounted for the largest share by vehicle type, generating 86% of the total revenue in 2024, due to growing consumer demand for smart and connected vehicles.

- Image sensors played a crucial role in the automotive sensor market, contributing 17% of the revenue share in 2024, with increasing integration in cameras for autonomous and semi-autonomous vehicles.

Automotive Sensor Market Overview

The automotive sensor market is experiencing rapid growth due to the increasing adoption of advanced driver assistance systems (ADAS), connected vehicles, and electric vehicles (EVs). Sensors play a crucial role in monitoring various parameters such as temperature, pressure, speed, and proximity, ensuring vehicle safety, efficiency, and performance. As the automotive industry shifts towards automation and electrification, the demand for sophisticated sensors continues to rise. Government regulations mandating safety features, such as collision avoidance systems and lane departure warnings, are further accelerating the adoption of automotive sensors.

Market Drivers

One of the key drivers of the automotive sensor market is the rising demand for safety and comfort features in vehicles. With stringent government regulations promoting vehicle safety, automakers are integrating advanced sensors for collision detection, blind-spot monitoring, and automated braking. The increasing adoption of electric and hybrid vehicles is also fueling demand, as these vehicles require specialized sensors for battery management, temperature control, and powertrain efficiency. Additionally, the rapid advancements in autonomous vehicle technology and artificial intelligence (AI) are contributing to the expansion of the automotive sensor market.

Opportunities

The emergence of smart and connected vehicles presents significant opportunities for the automotive sensor market. With the rise of the Internet of Things (IoT), vehicles are becoming more interconnected, requiring a vast network of sensors to collect and transmit real-time data. The development of solid-state LiDAR sensors for autonomous vehicles is another promising opportunity, offering more compact, efficient, and cost-effective sensing solutions. Moreover, the increasing use of biometric sensors for driver monitoring, such as fatigue detection and heart rate monitoring, is opening new growth avenues.

Challenges

Despite the market’s growth potential, several challenges exist. High costs associated with advanced automotive sensors can limit their adoption, particularly in budget and mid-range vehicle segments. The complexity of sensor integration and calibration poses a technical challenge for manufacturers. Additionally, data privacy and cybersecurity concerns in connected and autonomous vehicles require robust security measures to prevent cyber threats and unauthorized access. Fluctuating raw material prices and supply chain disruptions also pose risks to market growth.

Regional Insights

North America leads the automotive sensor market, driven by strong investments in autonomous vehicle development and advanced safety regulations. Europe is another major market, with a strong presence of luxury and high-end vehicle manufacturers that integrate sophisticated sensor technologies. The Asia-Pacific region is expected to witness the fastest growth, fueled by rising automotive production, increasing consumer demand for safety features, and government initiatives promoting electric vehicles in countries such as China, Japan, and India. Meanwhile, Latin America and the Middle East are emerging markets with growing automotive industries and increasing adoption of smart vehicle technologies.

Recent News

Recent developments in the automotive sensor market include advancements in LiDAR and radar sensor technologies for self-driving cars. Automakers and technology firms are partnering to develop high-performance sensors that enhance vehicle perception and navigation. The market is also witnessing innovations in AI-driven sensor fusion, which combines data from multiple sensors to improve accuracy and vehicle decision-making. Additionally, governments worldwide are enforcing stricter emission regulations, leading to increased demand for sensors that monitor and optimize vehicle emissions.

Automotive Sensor Market Companies

- Robert Bosch

- AUTOLIV INC

- DENSO Corporation

- Valeo

- Continental AG

- Sensata Technologies

- Delphi Automotive Company

Segments Covered in the Report

By Type

- Position Sensors

- Clutch Position Sensors

- Gear Position Sensors

- Throttle Position Sensors

- Crankshaft Position Sensors

- Steering Angle Position Sensors

- Camshaft Position Sensors

- Safety Sensors

- Seat Belt Sensors

- Brake Switch Sensors

- Door Switch Sensors

- ADAS Sensors

- Blind Spot Detection

- Night Vision Sensors

- Light Sensors

- Parking Sensors

- Cruise Control

- Impact Sensors

- Anti-theft Sensors

- Knock Detection Sensors

- Level Sensors

- Fuel Level Sensors

- Coolant Level Sensors

- Oil Level Sensors

- Oxygen Sensors

- Pressure Sensors

- Tire Pressure Sensors

- EGR Pressure Sensors

- Airflow Rate Sensors

- Temperature Sensors

- Engine Coolant Temperature Sensors

- Rain/humidity Sensors

- Oil/Fuel Temperature Sensors

- Battery Temperature Sensors

- Air Temperature Sensors

- Speed Sensors

- Wheel Speed Sensors

- Speedometer

By Application

- Powertrain

- Safety & Security

- Body Electronics

- Steering system

- Chassis system

- Others

- ADAS & safety system

- Health, wellness, wellbeing (HWW)

- Telematics

By Vehicle

- Passenger Cars

- Compact

- Midsize

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Engine Type

- Gasoline

- Diesel

- Hybrid

- Battery electric vehicles

- Fuel cell

By Sales Channel

- Original Equipment Manufacturers

- Original Equipment Supplier Spare Parts

- Independent Aftermarket

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa