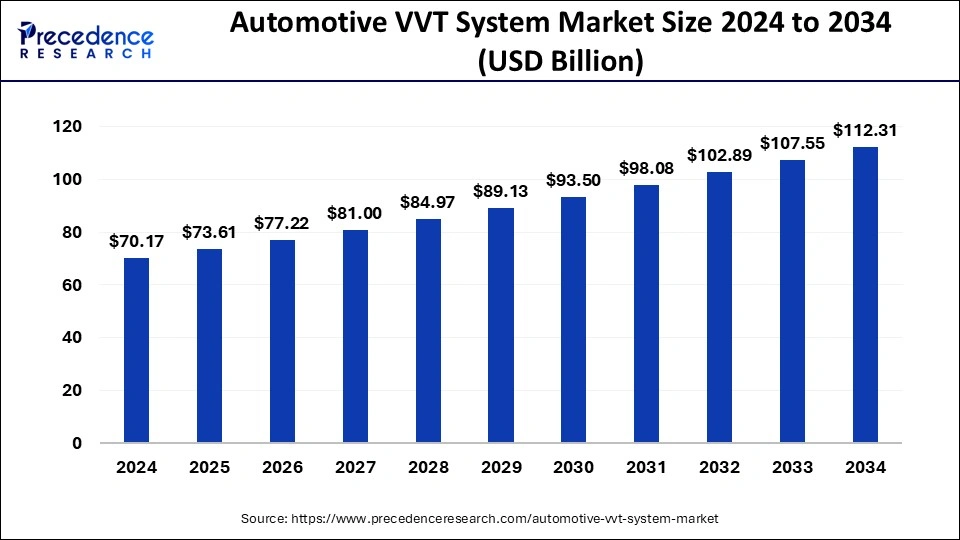

The global automotive VVT system market is valued at USD 70.17 billion in 2024 and is expected to reach USD 112.31 billion by 2034, growing at a CAGR of 4.82%

Automotive VVT System Market Key Takeaways

- Asia Pacific dominated the automotive VVT system market in 2023 with the largest market share.

- The Double Overhead Cam (DOHC) segment led the market by valve train in 2023.

- Passenger vehicles accounted for over 65% of the total revenue share in 2023.

Market Overview

The automotive VVT system market is experiencing steady growth due to the rising demand for fuel-efficient and high-performance vehicles. Variable Valve Timing (VVT) technology enhances engine efficiency by optimizing valve operation, improving power output, and reducing emissions. Automakers are increasingly incorporating VVT systems to comply with stringent emission regulations and improve vehicle mileage. The adoption of advanced VVT technologies, such as cam-phasing and cam-changing mechanisms, is further driving innovation in the market. With the increasing electrification of vehicles, hybrid models integrating VVT systems are gaining traction, ensuring sustainability without compromising performance.

Drivers

One of the primary drivers of the automotive VVT system market is the growing emphasis on fuel economy and emission control. Stringent government regulations aimed at reducing carbon footprints are pushing automakers to implement advanced engine management systems like VVT. The rise in consumer preference for high-performance vehicles with better acceleration and efficiency is also fueling demand. Additionally, advancements in engine technology, including the integration of electronic and hydraulic VVT systems, are enhancing engine responsiveness, making vehicles more desirable for consumers.

Opportunities

The shift towards hybrid and electric vehicles presents new growth opportunities for the automotive VVT system market. Hybrid powertrains, which rely on internal combustion engines alongside electric motors, benefit significantly from VVT systems that optimize fuel consumption. Emerging markets in Asia-Pacific and Latin America, where vehicle ownership is rapidly increasing, provide significant expansion potential. Furthermore, continuous research and development in VVT technology to improve engine durability and efficiency is expected to open new avenues for market players.

Challenges

Despite its advantages, the automotive VVT system market faces several challenges, including the high cost of advanced VVT technology. The complexity of integrating VVT systems into existing engine architectures can lead to increased manufacturing costs, limiting adoption in budget vehicle segments. Additionally, the growing push toward full electrification of vehicles poses a long-term challenge, as purely electric vehicles do not require VVT systems. Supply chain disruptions and fluctuating raw material prices also impact the production and affordability of VVT components.

Regional Insights

The Asia-Pacific region dominates the automotive VVT system market due to the presence of major automobile manufacturers in countries like China, Japan, and India. Rising vehicle production, coupled with government initiatives to improve fuel efficiency, is driving demand. North America and Europe are also key markets, supported by stringent emission regulations and strong consumer preference for high-performance vehicles. Meanwhile, Latin America and the Middle East are emerging markets with growing automotive production, providing further opportunities for market expansion.

Recent News

Recent developments in the automotive VVT system market include the launch of innovative VVT technologies aimed at enhancing engine efficiency and reducing emissions. Major automotive manufacturers are investing in hybrid engine development, incorporating advanced VVT solutions for better fuel economy. Additionally, regulatory changes across various regions are influencing VVT adoption, with governments incentivizing fuel-saving technologies. The ongoing research into electric and hybrid vehicle optimization is expected to shape the future landscape of the VVT market.

Automotive VVT System Market Companies

- Mikuni American Corporation

- Johnson Controls, Inc.

- Federal-Mogul LLC

- Camcraft, Inc.

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Eaton Corporation

- Mitsubishi Electric Corporation

- DENSO Corporation

- Robert Bosch GmbH

Segments Covered in the Report

By Fuel Type

- Diesel

- Gasoline

By Methods

- Cam Changing

- Cam Phasing

- Variable Valve

- Cam Phasing & Changing

By System

- Continuous

- Discrete

By Number of Valves

- More than 24

- Between 17 to 23

- 16

- Less Than 12

By Valve Train

- Over Head Valve(OHV)

- Double Overhead Cam(DOHC)

- Single Overhead Cam (SOHC)

By Technology

- Dual VVT-I

- VVT-I

- VVT-iW

- VVT-iE

By Vehicle Type

- Passenger Vehicles

- Electrical Vehicles

- Commercial Vehicles

By Actuation Type

- Type V

- Type IV

- Type III

- Type II

- Type I

By End-use

- Aftermarket

- OEMs

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World