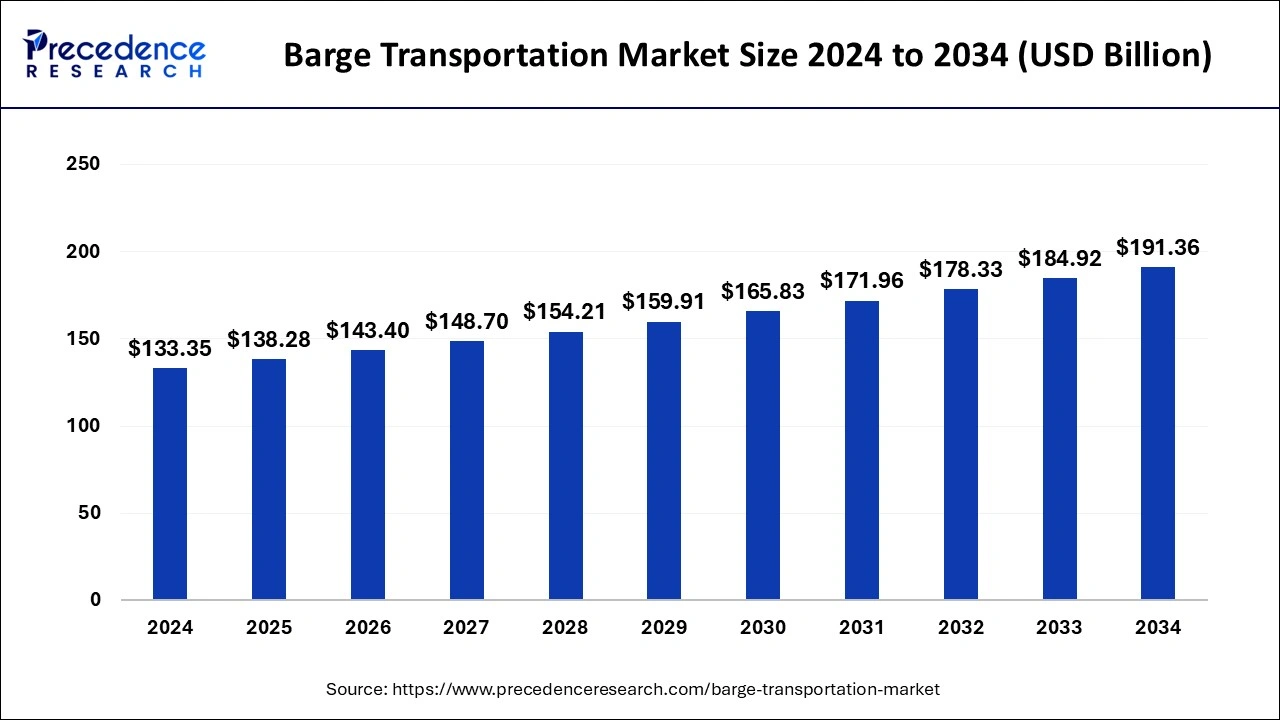

The global barge transportation market is set to grow from USD 133.35 billion in 2024 to USD 191.36 billion by 2034, at a CAGR of 3.68%.

Barge Transportation Market Key Takeaways

- Europe dominated the global barge transportation market with a 72% share in 2024.

- The tank barge fleet segment accounted for over 25% of revenue in 2024.

- The dry cargo product segment held the largest market share in 2024.

Barge Transportation Market Overview

The barge transportation market is witnessing steady growth, driven by increasing demand for cost-effective and fuel-efficient freight transport. Barges are widely used for transporting bulk commodities such as petroleum, coal, agricultural products, chemicals, and construction materials. Their ability to carry large volumes of cargo with lower fuel consumption compared to trucks and trains makes them an attractive option for industries seeking economical and environmentally friendly logistics solutions. Additionally, advancements in barge design, navigation systems, and automation are further enhancing operational efficiency and safety. As global trade and infrastructure development continue to expand, the demand for barge transportation is expected to rise.

Drivers

A key driver of the barge transportation market is the cost-effectiveness of inland and coastal waterway transport compared to other freight modes. Barges offer a higher carrying capacity, reduced fuel consumption, and lower carbon emissions, making them a preferred choice for industries focused on sustainability. The rising demand for bulk cargo transportation, particularly in the agricultural, energy, and mining sectors, is fueling market growth. Additionally, government investments in inland waterway infrastructure and port modernization are improving navigation efficiency, further boosting the market. Increasing congestion on road and rail networks is also pushing industries toward waterborne transportation as a viable alternative.

Opportunities

The market presents significant opportunities with the growing emphasis on green transportation and sustainability. The development of hybrid and electric-powered barges is gaining traction as companies look for ways to reduce emissions and comply with environmental regulations. Additionally, the expansion of international trade routes and investment in inland waterway connectivity in developing economies create growth prospects for barge operators. The rise of digitalization and smart tracking systems in maritime logistics is also providing new opportunities for enhanced fleet management and route optimization. Emerging markets in Asia Pacific, Latin America, and Africa, where inland waterways are being increasingly utilized, offer untapped potential for market expansion.

Challenges

Despite its advantages, the barge transportation market faces several challenges. Infrastructure limitations, such as aging locks and outdated waterways, can hinder smooth operations and increase transit times. Weather-related disruptions, including floods and droughts, impact water levels and barge navigation, affecting delivery schedules. Additionally, competition from other freight transportation modes, such as rail and trucking, poses a challenge, especially in regions with well-developed land-based logistics networks. Regulatory requirements, including emission standards and safety regulations, add complexity to barge operations and increase compliance costs. Fluctuations in fuel prices and geopolitical uncertainties affecting global trade can also impact market stability.

Regional Insights

North America leads the barge transportation market, with extensive inland waterway networks, particularly along the Mississippi River and the Great Lakes. The region benefits from strong agricultural exports and the presence of well-established barge operators. Europe follows closely, with significant barge transportation activities along the Rhine, Danube, and other major rivers. The Asia Pacific region is experiencing rapid growth, driven by increasing industrial production, rising trade volumes, and investments in waterway infrastructure, particularly in China and India. Meanwhile, Latin America and the Middle East & Africa are emerging markets, with growing interest in utilizing river systems for efficient cargo movement and reducing road congestion.

Recent Developments

The barge transportation market has seen advancements in vessel design, with companies developing fuel-efficient and environmentally friendly barges to comply with stricter emission regulations. Several industry players are investing in hybrid propulsion systems to reduce dependence on conventional fuels. Governments worldwide are increasing funding for inland waterway infrastructure projects to enhance navigability and efficiency. Additionally, digitalization and automation in barge operations are gaining traction, with the introduction of smart tracking, fleet management, and predictive maintenance technologies. The rising focus on sustainable logistics solutions has also led to initiatives promoting intermodal transport, integrating barge transportation with rail and road networks for seamless cargo movement.

Barge Transportation Market Companies

- SEACOR Holdings

- American Commercial Barge Line (ACBL)

- Ingram Marine Group

- Campbell Transportation Company

- Kirby Corporation

- APL Logistics

- Crowley Maritime Corporation

Segments Covered in the Report

By Barge Fleet

- Covered

- Open

- Tank

By Product

- Liquid Cargo

- Dry Cargo

- Gaseous Cargo

By Application

- Agricultural Products

- Coal & Crude Petroleum

- Metal Ores

- Coke & Refined Petroleum Products

- Food Products

- Secondary Raw Materials & Wastes

- Beverages & Tobacco

- Rubber & Plastic

- Chemicals

- Nuclear Fuel

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World