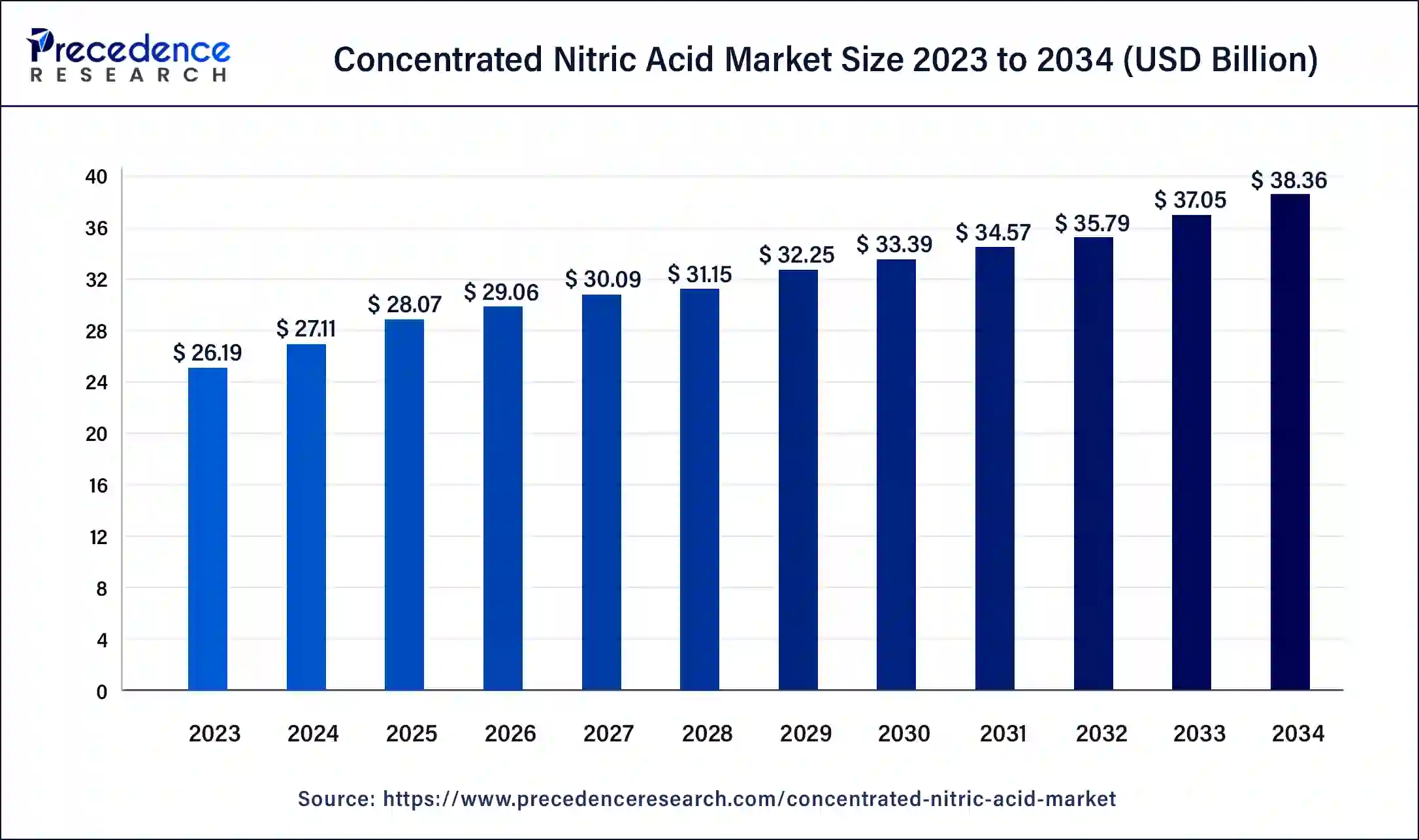

The global concentrated nitric acid market size was evaluated at USD 26.19 billion by 2023 and is projected to gain around USD 38.36 billion by 2034 with a CAGR of 3.53% between 2024 and 2034.

Key Insights

- Asia Pacific dominated the concentrated nitric acid market with the largest market share of 37% in 2023.

- North America is estimated to be significantly growing during the forecast period of 2024-2034.

- By type, the strong nitric acid segment dominated the market in 2023.

- By type, the fuming nitric acid segment is expected to grow at a significant rate during the forecast period.

- By application, the fertilizers segment dominated the market in 2023.

- By application, the explosives segment is expected to grow significantly during the forecast period.

- By end-use, the agriculture segment dominated the concentrated nitric acid market in 2023.

- By end-use, the chemical segment is expected to grow at a significant rate during the forecast period.

Get Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5085

Market Overview

The Concentrated Nitric Acid Market revolves around the production, distribution, and application of nitric acid with concentrations above 68%. This compound is a critical input in various industrial processes, including the manufacturing of fertilizers, explosives, and chemicals for various applications. Its strong oxidizing properties make it essential in the production of ammonium nitrate, which is used extensively in fertilizers and explosives. The market also includes applications in the automotive, electronics, and aerospace sectors, where concentrated nitric acid is used for processes such as metal etching, purification, and the production of specialty chemicals.

Growth Factors

The market is primarily driven by the rising demand for fertilizers and explosives, especially in developing regions where agricultural activities and construction projects are booming. Additionally, increasing industrialization and the expansion of the automotive and aerospace sectors contribute to the growth of the concentrated nitric acid market. The chemical’s versatility and its usage in diverse applications have further bolstered its demand across different sectors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 38.36 Billion |

| Market Size in 2024 | USD 27.11 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.53% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Key drivers of the concentrated nitric acid market include the growing agricultural sector, which relies heavily on ammonium nitrate-based fertilizers to improve crop yields. Another major driver is the expanding mining and construction industry, which utilizes explosives derived from nitric acid. The rise in demand for specialty chemicals, particularly in electronics and pharmaceuticals, also supports market growth. Furthermore, nitric acid’s role in the production of polyurethanes and adipic acid, used in synthetic fibers and plastics, is a significant driver in various industrial segments.

Opportunities

The concentrated nitric acid market offers substantial growth opportunities in regions undergoing rapid industrialization, such as Asia-Pacific and Latin America. The demand for eco-friendly and sustainable agricultural solutions is expected to create opportunities for innovations in nitric acid applications within fertilizers. Additionally, the aerospace and defense industries’ focus on advanced materials opens avenues for nitric acid applications in precision cleaning and material etching processes. The rising trend towards renewable energy and cleaner manufacturing processes also provides opportunities for nitric acid’s use in developing cleaner and more efficient chemical processes.

Challenges

One of the primary challenges faced by the concentrated nitric acid market is environmental regulation. Nitric acid production is associated with greenhouse gas emissions, particularly nitrogen oxides, which contribute to air pollution and climate change. As such, strict environmental regulations in regions like North America and Europe could impact market growth by increasing operational costs. Furthermore, the handling and transportation of concentrated nitric acid pose significant safety risks due to its highly corrosive and reactive nature, which may limit market expansion.

Region Insights

The Asia-Pacific region holds a dominant share of the concentrated nitric acid market, driven by significant growth in the agriculture, construction, and electronics industries in countries like China and India. North America and Europe also represent significant markets, with a focus on specialty applications and compliance with stringent environmental standards. While Europe is a major consumer of nitric acid for industrial applications, it faces challenges due to regulatory constraints. Meanwhile, Latin America and the Middle East are emerging markets with growing demand driven by the agriculture and mining sectors, offering substantial growth prospects as industrial activities in these regions continue to expand.

Read Also: Smart Warehouse Market Size is Expanding USD 98.64 Billion by 2034

Recent Developments

- In June 2022, Gujrat Narmada Valley Fertilizers and Chemicals (GNFC), a joint-sector company promoted by the Gujrat State Fertilizer and Chemicals (GSFC) and the Government of Gujrat, was all set to become the largest producer of CNA (concentrated nitric acid) by the end 2022 calendar year.

- In January 2023, a new facility for the production of CNA (concentrated nitric acid) with a design output of 40,000 tonnes per year, doubling its capacity, was launched by Grupa Azoty S.A. This is the 2nd production line for the above 98% CAN (concentrated nitric acid) now operating in Tarnow.

Concentrated Nitric Acid Market Companies

- GNFC Limited

- Koch Fertilizer, LLC

- DFPCL

- Rashtriya Chemicals and Fertilizers Limited.

- The Chemours Company

- INEOS Capitals, Limited.

- The Dow Chemical Company

- Sasol Limited

- LSB Industries

- UBE INDUSTRIES, LTD.

- Linde

- Hanwha Corporation

- BASF SE

- CF Industries Holdings, Inc.

- Yara

Segments Covered in the Report

By Type

- Strong Nitric Acid

- Fuming Nitric Acid

By Application

- Fertilizers

- Dye Intermediates

- Rocket Propulsion

- Woodworking

- Explosives

- Others

By End-use

- Aerospace & Defense

- Chemical

- Agriculture

- Electrical and Electronics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5085

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/