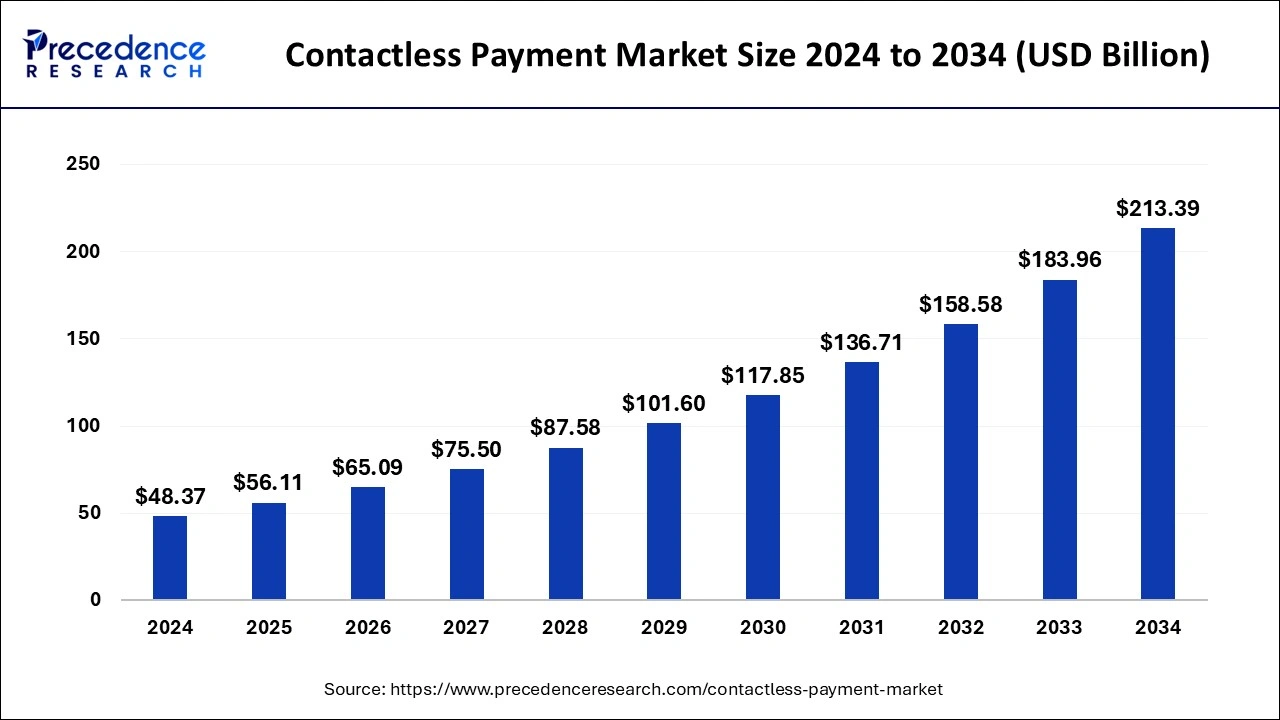

Contactless Payment Market Overview

The contactless payment market is witnessing rapid growth, driven by the increasing demand for fast, secure, and convenient payment solutions. Contactless payment technology allows consumers to complete transactions by simply tapping their cards, smartphones, or wearable devices on a point-of-sale terminal, reducing the need for physical cash or PIN entry. The adoption of near-field communication (NFC), radio-frequency identification (RFID), and tokenization technologies has enhanced the security and efficiency of contactless payments. The shift toward digital transactions, rising smartphone penetration, and growing e-commerce activities are further fueling market expansion. Additionally, the COVID-19 pandemic significantly accelerated the use of contactless payments, as businesses and consumers sought safer and more hygienic transaction methods.

Drivers

The primary driver of the contactless payment market is the increasing preference for seamless and hassle-free transactions. Consumers and businesses alike are prioritizing speed and convenience, making contactless payments an attractive option. The widespread adoption of NFC-enabled smartphones and wearables has further boosted market growth, allowing users to make secure payments through mobile wallets and digital banking applications. Financial institutions and payment service providers are actively promoting contactless payments through incentives and expanded acceptance infrastructure. Additionally, regulatory support for cashless economies and government initiatives to promote digital payments are driving adoption worldwide. The integration of advanced security measures, including biometric authentication and encryption, is further enhancing consumer trust in contactless transactions.

Opportunities

The market presents numerous opportunities, particularly with the continuous evolution of financial technology. The integration of artificial intelligence (AI) and machine learning in fraud detection and payment security is creating new growth avenues. The rise of smart cities and digital banking initiatives is increasing the adoption of contactless payments in public transport, retail, and other sectors. Emerging economies, particularly in Asia Pacific, Latin America, and Africa, are witnessing a surge in digital financial services, offering significant expansion potential for contactless payment providers. The increasing popularity of cryptocurrency and blockchain-based payment solutions is also opening new possibilities for innovation in the contactless payment space. Furthermore, collaborations between fintech companies, banks, and merchants are driving the development of new contactless payment methods and expanding their accessibility.

Challenges

Despite its advantages, the contactless payment market faces several challenges. Security concerns remain a major issue, as contactless transactions, though encrypted, can be vulnerable to fraud, unauthorized access, and data breaches. Consumers who are not yet familiar with the technology may be hesitant to adopt contactless payments due to concerns about transaction security. Additionally, the cost of upgrading point-of-sale systems and payment infrastructure to support contactless transactions can be a barrier for small businesses. Limited network connectivity in certain regions and interoperability issues among different payment providers also pose challenges to widespread adoption. Furthermore, regulatory complexities and compliance requirements vary across different markets, making it necessary for payment service providers to navigate evolving legal frameworks.

Regional Insights

North America leads the contactless payment market, driven by high smartphone penetration, strong digital banking infrastructure, and widespread adoption of mobile wallets. The region has seen significant investments in fintech innovations, making contactless payments more accessible to consumers and businesses. Europe is another major market, with countries such as the UK, Germany, and France driving adoption through cashless payment initiatives and advanced financial regulations. The Asia Pacific region is experiencing the fastest growth, with rapid digitalization in countries like China, India, and Japan. The expansion of e-commerce, government-led financial inclusion programs, and increasing consumer preference for mobile payments are key factors fueling regional growth. Meanwhile, Latin America and the Middle East & Africa are emerging markets, with increasing efforts to develop digital payment ecosystems and improve financial accessibility.

Recent Developments

The contactless payment market has seen continuous innovation, with companies launching new solutions to enhance transaction speed, security, and user experience. Payment service providers are integrating biometric authentication, such as fingerprint and facial recognition, to increase security and reduce fraud risks. The rise of wearable payment devices, including smartwatches and rings, is further expanding consumer choices for contactless transactions. Additionally, several financial institutions and fintech companies are collaborating to enhance cross-border payment capabilities and promote interoperability between different contactless payment networks. Governments and central banks worldwide are also exploring the introduction of central bank digital currencies (CBDCs), which could further influence the adoption of contactless payments. As digital financial services continue to evolve, the contactless payment market is expected to experience sustained growth and technological advancements.