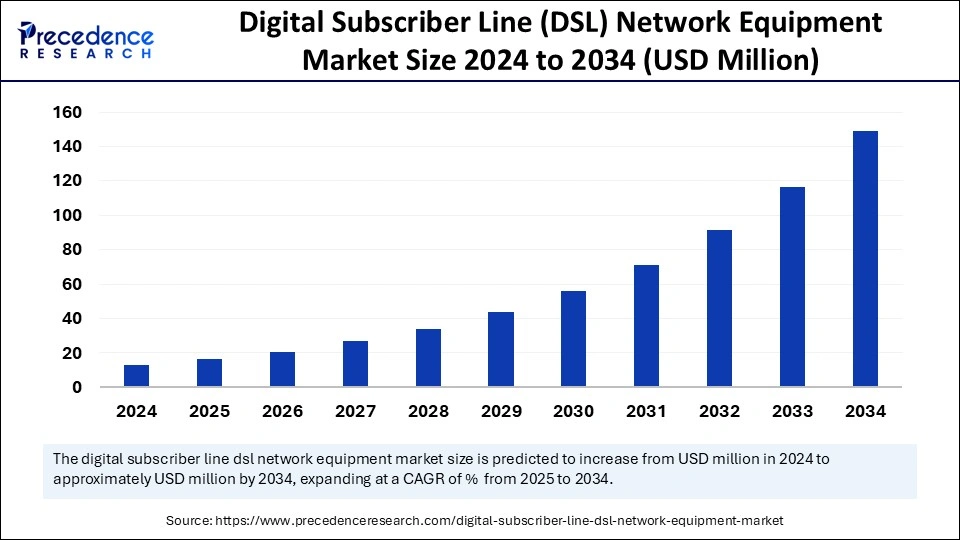

The digital subscriber line network equipment market is set to grow by 2034, fueled by cost-effective broadband demand, VDSL2 and G.fast advancements, and expanding access in emerging economies.

Digital Subscriber Line Network Equipment Market Key Takeaways

- North America dominated the digital subscriber line network equipment market in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By product type, the asymmetric digital subscriber line (ADSL) segment dominated the market with the largest share in 2024.

- By product type, the very high bit-rate digital subscriber line (VDSL) segment is predicted to grow at the fastest CAGR in the upcoming years.

- By application, the residential segment held a significant share of the market in 2024.

- By application, the large enterprises segment is expected to witness the fastest growth during the predicted timeframe.

Digital Subscriber Line Network Equipment Market Overview

The digital subscriber line network equipment market maintains a significant presence in the global broadband landscape, despite technological shifts toward fiber optics and wireless communication. DSL technology leverages existing copper telephone infrastructure, offering broadband access to millions, particularly in areas lacking modern fiber networks.

Its relevance is sustained by low-cost deployment, improved performance standards, and continued investment by telecom operators. While new markets gravitate toward cutting-edge connectivity, DSL serves as a practical bridge, especially for underserved populations. With advancements in signal enhancement and compatibility, the digital subscriber line network equipment market remains a critical segment in delivering reliable internet access across varying geographies.

Digital Subscriber Line Network Equipment Market Drivers

The demand for affordable broadband access remains a strong driver for the digital subscriber line network equipment market. Regions with older infrastructure continue to depend on DSL for basic and mid-tier internet services. The emergence of technologies such as G.fast and VDSL2 vectoring has dramatically improved data rates, reducing the performance gap with fiber. These solutions have made DSL more competitive and suitable for modern applications including video streaming, remote education, and telemedicine.

Moreover, telecom providers are seeking cost-effective ways to extend broadband reach without the expense of laying new cables, further fueling reliance on DSL. This cost-performance balance underpins the consistent demand in the digital subscriber line network equipment market.

Digital Subscriber Line Network Equipment Market Opportunities

Emerging economies present the largest untapped opportunities in the digital subscriber line network equipment market. In countries where fiber and wireless infrastructure are still evolving, DSL offers an immediate solution to enable mass digital participation. Governments and non-profits supporting rural digitalization are funding DSL expansion projects to achieve connectivity goals within limited budgets.

Additionally, the market is seeing innovation in integrated DSL solutions with smart routing, remote diagnostics, and energy-efficient chipsets. This opens up commercial opportunities for vendors to deliver scalable, environmentally conscious products. There is also potential in upgrading legacy DSL services for existing users in urban zones, converting them to hybrid DSL-fiber services. These strategic upgrades will continue to shape growth in the digital subscriber line network equipment market.

Digital Subscriber Line Network Equipment Market Challenges

The digital subscriber line network equipment market must contend with several headwinds. Chief among them is the global transition to fiber and 5G, which gradually reduces DSL’s market share. Consumers now expect gigabit speeds and low latency, challenging DSL’s technical limits. Additionally, maintaining aging copper networks is both logistically and financially burdensome. In some countries, copper lines are being decommissioned, further compressing the addressable market for DSL equipment.

The perception of DSL as a legacy solution also complicates marketing efforts, requiring service providers to demonstrate the viability of modern DSL through enhanced service delivery. These dynamics place pressure on stakeholders in the digital subscriber line network equipment market to evolve or risk obsolescence.

Digital Subscriber Line Network Equipment Market Regional Insights

Regional dynamics in the digital subscriber line network equipment market reveal nuanced opportunities and threats. In the U.S. and Canada, DSL infrastructure remains active in suburban and rural areas, although large carriers are phasing out expansion plans. Europe’s regulatory stance has slowed fiber adoption in some regions, making DSL upgrades a pragmatic alternative.

Markets in Asia-Pacific show the highest growth rate, particularly where rapid urbanization is not yet matched by infrastructure investment. Southeast Asia and South Asia use DSL to bridge access gaps, often in conjunction with mobile broadband. In Latin America and parts of Africa, economic constraints and population distribution make DSL a key enabler of nationwide digital access. These geographic distinctions guide strategic deployment within the digital subscriber line network equipment market.

Digital Subscriber Line Network Equipment Market Recent Developments

Recent trends in the digital subscriber line network equipment market point to innovation amidst industry maturity. Vendors are focusing on enhancing signal stability, reducing latency, and integrating AI-driven traffic management into DSL hardware. Telecom companies are piloting projects that combine DSL with next-gen wireless networks for redundancy and speed balancing. There’s a noticeable uptick in public funding for last-mile connectivity using DSL, especially in territories that lack digital infrastructure.

Equipment suppliers are also aligning their product roadmaps with green tech initiatives, reducing energy consumption and material waste in DSL modems and DSLAM units. These developments indicate that while the digital subscriber line network equipment market may not be in its peak growth phase, it continues to evolve to serve a dynamic global demand.

Digital Subscriber Line Network Equipment Market Companies

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Nokia Networks

- Telefonaktiebolaget LM Ericsson

- Cisco Systems, Inc.

- Alcatel-Lucent S.A.

- ADC Telecommunications

- Westell Technologies, Inc.

Segments Covered in the Report

By Product Type

- Digital Subscriber Line (IDSL)

- Asymmetric Digital Subscriber Line (ADSL)

- Rate-Adaptive Digital Subscriber Line (RADSL)

- Symmetric Digital Subscriber Line (SDSL)

- High Bit-Rate Digital Subscriber Line (HDSL)

- ISDN Digital Subscriber Line (IDSL)

- Symmetric Digital Subscriber Line (SDSL)

- Very High Bit-rate Digital Subscriber Line (VDSL)

By Application

- Large Enterprises

- Residential

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!