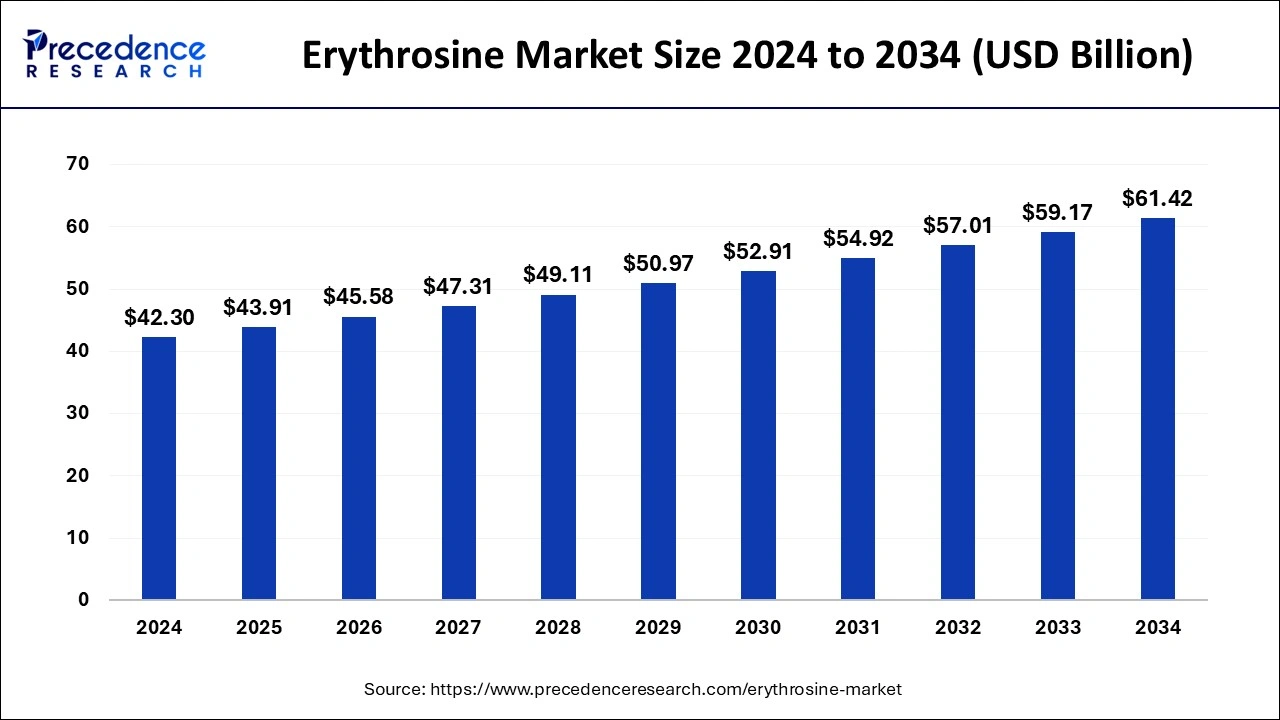

Erythrosine market size is forecasted to increase from USD 42.30 billion in 2024 to USD 61.42 billion by 2034, driven by a consistent CAGR of 3.80% over the next decade.

Erythrosine Market Key Takeaways

- North America accounted for the largest share of the erythrosine market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the liquid segment noted the largest market share in 2024.

- By type, the powder segment is projected to witness the fastest growth during the forecast period.

- By end-use, the food and beverages segment contributed the largest share market in 2024.

- By end-use, the pharmaceutical segment is projected to witness the fastest growth during the forecast period.

Market Overview

The global erythrosine market is growing due to growth, supported by technological advancements in production processes and increasing consumer awareness of food safety and quality. Moreover, there is a growing trend for bright-colored food products in markets, and thus, food producers are using erythrosine in product formulations to meet consumer tastes and preferences. This growth is mainly attributed to the rising use of food color in confectioneries, dairy products, and in the preparation of several beverages.

Erythrosine is a commonly used synthetic red dye that finds applications in diverse industries such as food & beverages, pharmaceuticals, and cosmetics. Known for its high tinting strength and stability under heat and light, it remains a favored choice among manufacturers aiming for visually striking product presentations.

Drivers

The growth of the erythrosine market is underpinned by rising consumer preferences for packaged foods, especially in urban regions. With global populations leaning toward convenience and processed goods, the need for food-grade coloring agents is rising. The pharmaceutical industry’s reliance on erythrosine for product coating and identification also supports market expansion. Moreover, its cost-effectiveness and performance advantages over some natural dyes keep it in demand among budget-conscious manufacturers.

Opportunities

The future of the erythrosine market holds promising opportunities in the personalization of color applications. Custom color blends and specialized solutions for bakery and beverage products offer manufacturers avenues to differentiate. In addition, expansion into emerging markets where demand for visually attractive products is on the rise offers long-term potential. As digital and e-commerce platforms continue to grow, the visibility of colorful food and cosmetic products further fuels demand for consistent and vibrant dyes like erythrosine.

Challenges

The market is not without its hurdles. One of the major concerns is the negative perception surrounding synthetic dyes, which has prompted some regions to restrict their use or require strict labeling. Increasing consumer demand for clean-label and organic products puts erythrosine at a disadvantage against natural alternatives. Additionally, compliance with regulatory standards varies by country, making it challenging for global companies to streamline production and distribution strategies.

Regional Insights

Asia Pacific leads the erythrosine market due to its large-scale food manufacturing industry and growing cosmetic consumption. Demand is particularly high in countries like India, Japan, and South Korea, where vibrant color usage is both cultural and commercial. In North America, awareness about artificial colorings has resulted in a relatively cautious but steady use, especially in pharmaceuticals. Europe maintains a controlled market environment, with clear regulations shaping erythrosine’s applications in both food and personal care segments.

Recent Developments

Recent innovations include formulation upgrades to make erythrosine more photostable and compatible with broader pH ranges. Some manufacturers are exploring biotechnological methods to reduce environmental impact during production. The industry has also seen increased investment in consumer education to improve public understanding of synthetic dye safety. Collaborative initiatives among regulatory bodies and manufacturers are helping to standardize safety assessments and global trade practices for erythrosine products.

Erythrosine Market Companies

- Cargill, Incorporated

- CJ CheilJedang Corp.

- Ingredion Incorporated

- Mitsubishi Chemical Corporation

- Jungbunzlauer Suisse AG

- Shandong Sanyuan Biotechnology Co., Ltd.

Segments Covered in the Report

By Type

- Liquid

- Powder

- Granules

By End-Use

- Food and Beverages

- Cosmetics

- Pharmaceutical

- Chemical

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!