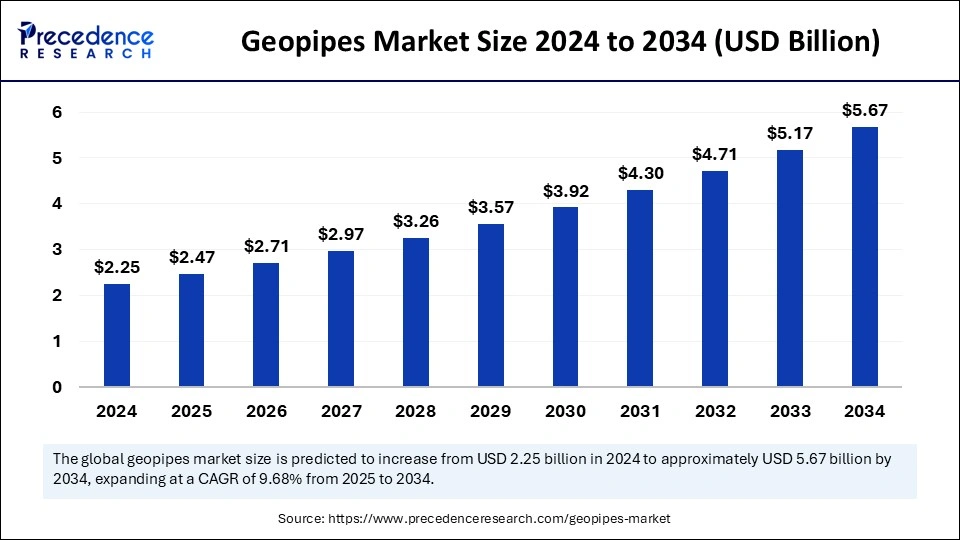

Geopipes market is set to expand from USD 2.25 billion in 2024 to USD 5.67 billion by 2034, With a 9.68% CAGR.

Table of Contents

ToggleGeopipes Market Key Takeaways

-

Asia Pacific was the top-performing region in 2024, capturing 44% of the global geopipes market.

-

North America is predicted to register the fastest growth, with a CAGR of 9.2% in the coming years.

-

The HDPE segment emerged as the market leader, holding 61% of the total share in 2024.

-

The PP segment is set to witness the fastest expansion, with a CAGR of 10.23% during the forecast period.

-

Drainage and sewer systems remained the dominant application, accounting for 39% of the market in 2024.

-

The irrigation and agriculture segment is projected to achieve the highest CAGR of 10.13% in the studied period.

Geopipes Market Overview

The worldwide geopipes market continues to expand at a rapid pace since businesses are seeking sustainable alternatives for infrastructure development. The corrosion-resistant and economical geopipes, made from high-density polyethylene (HDPE) and polyvinyl chloride (PVC) polymers, serve drainage system applications, sewage network installations, and industrial fluid transfer applications with their flexible design.

Advancements in polymer sciences have greatly boosted geopipe performance attributes, thus expanding applications in mining, agriculture, and oil & gas industries. The manufacturing sector now selects eco-friendly alternatives for aged infrastructure systems due to increasing environmental regulations alongside their commitment to reusable materials. The rising infrastructure development activities across the world are expected to boost the demand for geopipes in the coming years.

Geopipes Market Drivers

The rising focus on water conservation and efficient drainage solutions is a major driver of the geopipes market. Governments worldwide are investing in modern sewer and stormwater management systems, increasing demand for corrosion-resistant and flexible piping solutions. Additionally, advancements in HDPE and PP materials, making geopipes more durable and eco-friendly, are contributing to market expansion.

Increasing Infrastructure Development

Increasing infrastructure development around the world is one of the key factors driving the growth of the geopipes market. Geopipes find applications across various sectors, including water management, transportation, and oil & gas. Worldwide governments are focusing on establishing robust pipeline systems to enhance water delivery and sewage disposal and gas transportation infrastructure. Geopipes made from high-density polyethylene (HDPE) are suitable for infrastructure projects due to their high strength and corrosion-resistant properties. There is a strong emphasis on sustainable construction projects. Geopipes are environmentally friendly, making them suitable for sustainable construction. Stringent regulations regarding sustainability and energy efficiency further drive market growth.

Geopipes Market Opportunities

The adoption of smart piping systems and the integration of IoT technology in water management offer exciting opportunities for the geopipes market. Furthermore, increasing awareness of eco-friendly plastic alternatives and the development of biodegradable geopipes can provide a sustainable growth path. Emerging markets in Africa and South America also present untapped opportunities for infrastructure expansion.

Geopipes Market Challenges

Challenges include high costs associated with premium-grade geopipes and regulatory hurdles regarding plastic waste management. However, ongoing research into sustainable materials is expected to alleviate these concerns.

Regional Insights

Asia Pacific holds the largest market share (44% in 2024), while North America is expected to grow at the fastest CAGR of 9.2%. Europe remains a key player due to its stringent environmental policies and advancements in water treatment infrastructure.

Recent Developments

Major companies are investing in new production facilities and R&D to improve product efficiency. Technological advancements, such as sensor-based monitoring in geopipes, are expected to revolutionize the industry in the coming years.

- In March 2025, Nippon Steel obtained five “SuMPO EPD” certifications for its pipes and tubes used in the chemical industry and for boilers. To support its customers’ efforts to promote carbon neutrality, Nippon Steel Corporation has achieved these certifications under the SuMPO Environmental Labeling Program by the Sustainable Management Promotion Organization (SuMPO), a general incorporated association.

- In July 2024, the Van Leeuwen Pipe and Tube Group unveiled its own brand of CO2-reduced steel pipe and tube products, named Van Leeuwen Impact. This new line supports the sustainability goals of its partners and customers in the steel pipe and tube industry. As customers increasingly seek sustainable solutions, Van Leeuwen Impact offers a way for businesses to reduce their carbon footprint without compromising product quality or performance.

- In November 2023, Baker Hughes, an energy technology company, announced the launch of its new PythonPipe portfolio. This latest development in reinforced thermoplastic pipe (RTP) technology facilitates faster installations, reduces the time to first production, and lowers lifecycle emissions.

Geopipes Market Companies

- Geosynthetics Limited

- GSE Environmental

- TenCate Geosynthetics

- SKAPS Industries

- HUESKER

- Officine Maccaferri

- ABG Ltd.

- Terram

- Thrace Group

- Ocean Global

Segments covered in the report

By Product

- High-density Polyethylene (HDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Other

By Application

- Drainage & Sewer Systems

- Irrigation & Agriculture

- Mining & Industrial

- Oil & Gas Pipelines

- Road & Highway Construction

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa