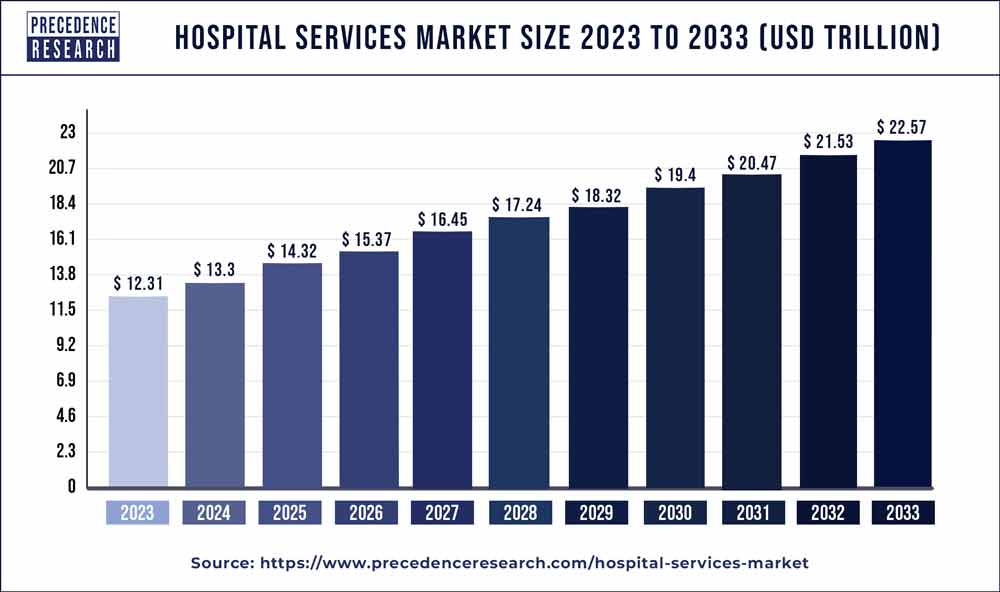

hospital services market is projected to grow from USD 12.31 trillion in 2023 to USD 22.57 trillion by 2033, with a CAGR of 6.05%.

Key Takeaways

- North America accounted for the highest market share of 37.82% in 2023.

- The public/community hospitals segment held 36.71% of the market share by hospital type in 2023.

- Inpatient services dominated the service type category, capturing 58.46% of the revenue share in 2023.

- The cardiovascular segment generated over 21.63% of the total revenue in 2023 by service areas.

Hospital Services Market Overview

Drivers

-

Rising Prevalence of Chronic Diseases:

The increasing incidence of chronic conditions such as diabetes, cancer, and cardiovascular diseases is driving the demand for hospital services. As the global population ages, the need for continuous monitoring and treatment in hospital settings is expected to rise. -

Advancements in Medical Technology:

Innovations in healthcare technology, including minimally invasive surgeries, robotic-assisted procedures, and advanced diagnostic tools, are enhancing the quality and efficiency of hospital services. -

Government Initiatives to Improve Healthcare Infrastructure:

Governments across the globe are investing heavily in strengthening healthcare systems by building new hospitals, upgrading existing facilities, and promoting public-private partnerships. -

Growing Demand for Specialized Services:

The rising need for specialized treatments, such as oncology, cardiology, and orthopedics, is increasing the demand for advanced hospital services that offer high-quality patient care. -

Expansion of Health Insurance Coverage:

Expanding health insurance coverage in both developed and developing economies is making hospital services more accessible to a larger population, thereby driving market growth.

Opportunities

-

Integration of Telemedicine and Remote Patient Monitoring:

The adoption of telemedicine and remote patient monitoring technologies enables hospitals to provide care beyond traditional settings, offering new revenue streams and expanding their patient base. -

Rising Demand for Ambulatory Care Services:

The shift toward outpatient care and ambulatory services, driven by cost efficiency and improved patient convenience, is opening new growth avenues for hospitals. -

Implementation of Artificial Intelligence in Hospital Operations:

AI-powered tools are being deployed to improve operational efficiency, predict patient outcomes, and enhance diagnostic accuracy, creating opportunities for market expansion. -

Growing Adoption of Value-Based Healthcare Models:

The transition from fee-for-service to value-based care models is encouraging hospitals to focus on improving patient outcomes and reducing costs, driving the need for efficient and high-quality services.

Challenges

-

Rising Operational Costs:

Hospitals face increasing operational costs due to the need for advanced technologies, skilled personnel, and regulatory compliance. Managing these costs while maintaining profitability remains a challenge. -

Shortage of Skilled Healthcare Professionals:

A shortage of trained medical personnel, including doctors, nurses, and allied healthcare workers, poses a significant challenge for hospitals in maintaining high standards of care. -

Stringent Regulatory Compliance Requirements:

Compliance with regulatory standards and accreditation requirements can be resource-intensive and time-consuming, adding to the operational burden on hospitals. -

Increased Competition from Alternative Care Settings:

The rise of outpatient clinics, ambulatory surgical centers, and home healthcare services is intensifying competition, impacting the revenue potential of traditional hospital services.

Regional Insights

-

North America:

North America holds the largest market share due to advanced healthcare infrastructure, high healthcare spending, and the presence of leading healthcare providers. The region is witnessing a surge in demand for specialized healthcare services and outpatient care. -

Europe:

Europe is experiencing growth driven by government initiatives to improve healthcare access and quality. Increasing investments in digital health technologies and the expansion of healthcare facilities are fueling market growth. -

Asia Pacific:

The Asia Pacific region is expected to witness the fastest growth due to rising healthcare expenditure, a growing aging population, and the increasing adoption of advanced healthcare technologies. Government initiatives aimed at expanding healthcare access in rural areas are also contributing to market growth. -

Latin America and the Middle East & Africa:

These regions are gradually adopting advanced hospital services driven by improving healthcare infrastructure, increasing medical tourism, and growing awareness about preventive healthcare.

Recent News

-

Mayo Clinic Partners with Google Cloud to Enhance AI Capabilities:

Mayo Clinic announced a collaboration with Google Cloud to integrate AI-driven solutions that improve diagnostic accuracy and operational efficiency in hospital settings. -

Apollo Hospitals Launches AI-Enabled Healthcare Platform:

Apollo Hospitals introduced an AI-powered platform to enhance patient engagement and streamline hospital operations, leveraging big data and predictive analytics.

Segments Covered in the Report

By Hospital Type

- State-owned Hospital

- Private Hospital

- Public/ Community Hospital

By Service Type

- Outpatient Services

- Inpatient Service

By Service Areas

- Cardiovascular

- Acute Care

- Cancer Care

- Diagnostics, and Imaging

- Neurorehabilitation & Psychiatry Services

- Gynecology

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World