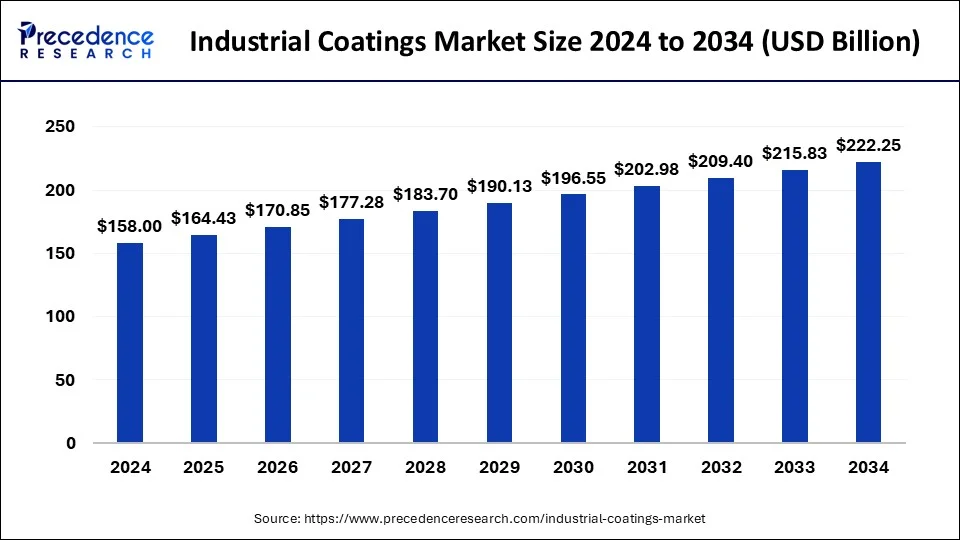

The global industrial coatings market is projected to reach USD 215.83 billion by 2033, growing from USD 151.58 billion in 2023 at a CAGR of 3.53%

Industrial Coatings Market Key Takeaways

In 2023, Asia Pacific held the largest share of the global market at 44.73%.

The solvent-borne technology segment contributed over 36.30% of total revenue.

The water-based industrial coatings segment is expected to grow at the highest CAGR during the forecast period.

Acrylic coatings dominated the product category with a 34.27% revenue share.

The general industrial sector was the leading end-user, accounting for more than 40.69% of total market revenue.

Market Overview

The industrial coatings market is experiencing significant growth due to increasing demand from various end-use industries, including automotive, construction, aerospace, and general manufacturing. These coatings serve as protective layers that enhance durability, corrosion resistance, and aesthetics. The market is driven by technological advancements, including the shift toward eco-friendly and high-performance coatings. Water-based coatings are gaining traction as industries seek sustainable solutions to reduce environmental impact. Additionally, the rapid expansion of the manufacturing sector in emerging economies is fueling the demand for industrial coatings across multiple applications.

Drivers

One of the key drivers of the industrial coatings market is the growing industrialization and infrastructure development worldwide. The rising need for corrosion-resistant coatings in construction and automotive sectors is propelling market expansion. Additionally, stringent environmental regulations are pushing manufacturers toward water-based and powder coatings, reducing the dependency on solvent-borne coatings. The increasing adoption of automation in manufacturing has also contributed to market growth by ensuring better application efficiency and reduced wastage. Furthermore, advancements in nanotechnology have led to the development of high-performance coatings with enhanced durability and chemical resistance.

Opportunities

The industrial coatings market presents several opportunities for growth, particularly in the development of bio-based and sustainable coatings. As environmental concerns continue to rise, companies are investing in green technologies to comply with regulations and meet consumer demand for eco-friendly solutions. The expansion of smart coatings, which offer self-healing and anti-corrosion properties, is expected to create new avenues in various industries. Emerging markets in Asia-Pacific, Latin America, and the Middle East provide untapped potential due to increasing industrialization, urbanization, and infrastructure projects. Additionally, the adoption of digital printing and advanced application techniques is expected to enhance production efficiency and open new revenue streams for manufacturers.

Challenges

Despite its promising growth, the industrial coatings market faces several challenges. Stringent environmental regulations regarding volatile organic compound (VOC) emissions pose a significant hurdle for solvent-based coatings. The high cost of raw materials, including resins and pigments, affects the overall profitability of manufacturers. Additionally, fluctuating crude oil prices impact the production costs of synthetic coatings. Supply chain disruptions and geopolitical tensions also pose risks to the availability of essential raw materials. Furthermore, the competition from unorganized local players offering low-cost alternatives can affect the market share of established global manufacturers.

Regional Insights

The Asia-Pacific region dominates the industrial coatings market, accounting for the largest share due to rapid industrialization and economic growth in countries like China, India, and Japan. The demand for coatings in automotive, construction, and machinery industries continues to rise, making it a lucrative market for global players. North America and Europe are also witnessing steady growth, driven by the adoption of sustainable coatings and stringent environmental regulations. The Middle East and Africa are emerging markets with increasing infrastructure development and investments in oil and gas projects. Latin America, particularly Brazil and Mexico, is experiencing a rise in demand due to the expansion of the automotive and manufacturing sectors.

Recent News

The industrial coatings market is witnessing several developments, including mergers, acquisitions, and product innovations. Leading manufacturers are investing in research and development to introduce eco-friendly coatings with low VOC emissions. Companies are also expanding their production capacities to meet the growing demand from key industries. Strategic collaborations between manufacturers and end-users are driving innovation and enhancing product offerings. Additionally, advancements in smart coatings, nanotechnology, and UV-curable coatings are reshaping the industry landscape, providing high-performance solutions to various sectors. The ongoing shift toward digitalization and automation in the coatings industry is expected to streamline production processes and improve overall efficiency.

Industrial Coatings Market Companies

- BECKERS GROUP

- NIPPON PAINT HOLDINGS CO., LTD.

- HENKEL AG & CO. KGAA

- BASF SE

- JOTUN

- AXALTA COATING SYSTEMS, LLC

- THE SHERWIN-WILLIAMS COMPANY

- AKZO NOBEL N.V.

Segments Covered in the Report

By Technology

- Powder Based

- Solvent Borne

- Water-Borne

- Others

By Product

- Epoxy

- Acrylic

- Alkyd

- Polyurethane

- Polyester

- Others

By End-user

- Electronics

- Aerospace

- General Industrial

- Marine

- Mining

- Power Generation

- Automotive & Vehicle Refinish

- Oil & Gas

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America