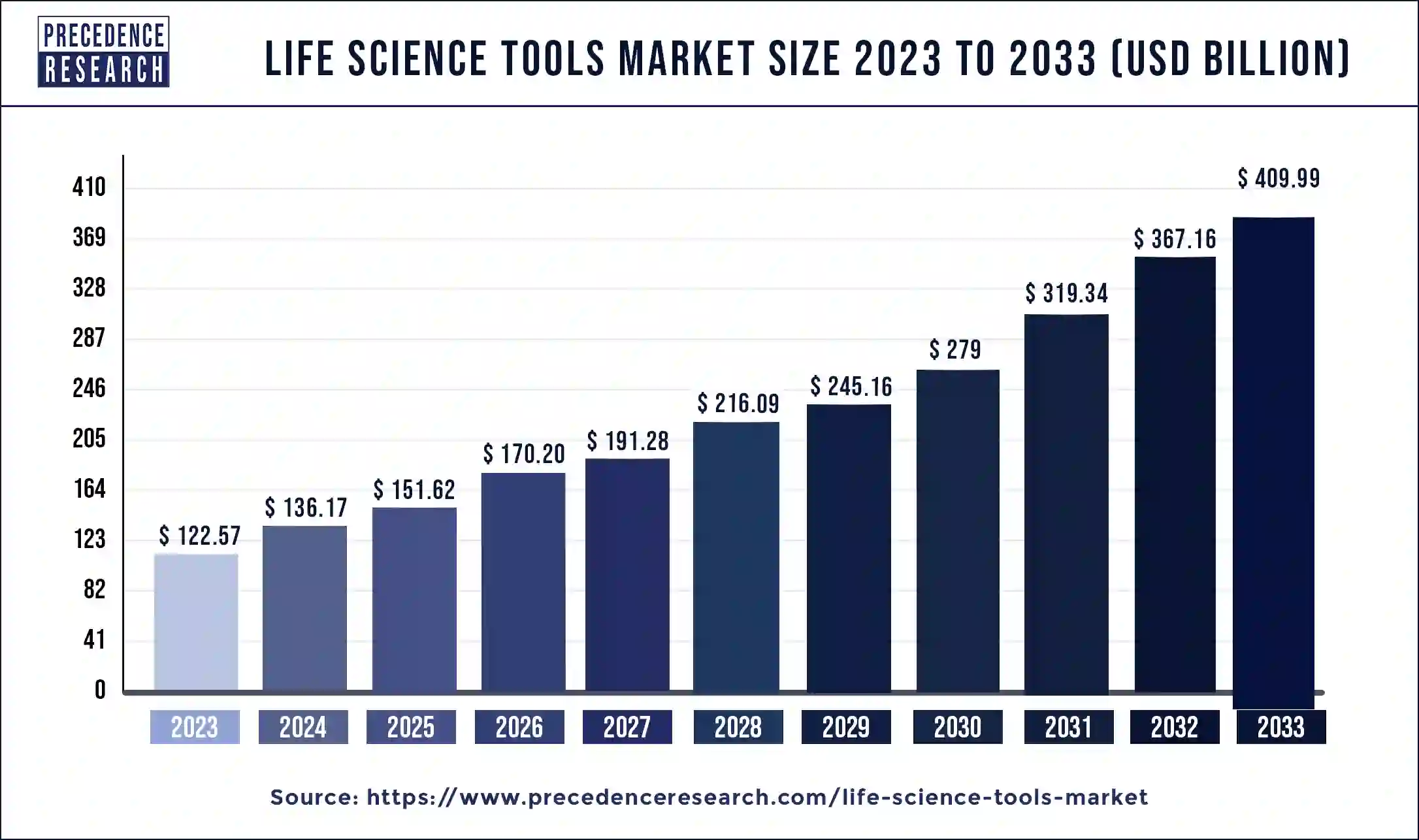

The global life science tools market, valued at USD 122.57 billion in 2023, is projected to reach USD 409.99 billion by 2033, growing at a CAGR of 13% from 2024 to 2034.

Life Science Tools Market Key Takeaways

- North America accounted for 43.28% of the market share in 2023.

- Europe held a market share of 25.62% in 2023.

- The Asia Pacific region is projected to grow at the highest CAGR of 15% during the forecast period.

- In 2023, cell biology technology captured a revenue share of 43.34% by technology.

- The consumable segment accounted for 47.59% of the revenue share by product in 2023.

- Biotechnology and pharmaceutical companies generated a revenue share of 34.35% by end-use in 2023.

- The drug discovery and development segment held the highest revenue share of 31.69% by application in 2023.

Market Overview

The life science tools market is expanding rapidly due to the increasing demand for advanced technologies in biotechnology, pharmaceuticals, and academic research. Life science tools include a wide range of instruments, reagents, and software used in genomics, proteomics, cell biology, and drug discovery. These tools play a crucial role in enhancing the efficiency and accuracy of research processes, enabling scientists to explore complex biological systems and develop innovative therapies. The rising prevalence of chronic diseases, growing investments in life science research, and technological advancements such as next-generation sequencing and CRISPR technologies are driving the growth of the life science tools market.

Drivers

Several factors are propelling the growth of the life science tools market. The increasing focus on precision medicine and personalized therapies has led to a surge in demand for advanced life science tools. Rising government and private sector investments in research and development (R&D) aimed at understanding disease mechanisms and developing targeted therapies are further fueling market growth. The rapid adoption of next-generation sequencing (NGS) technologies and advances in cell-based assays and protein analysis tools are enhancing research capabilities, contributing to market expansion. Moreover, the growing use of automation and artificial intelligence in life science research is increasing the efficiency of data analysis and decision-making processes.

Opportunities

The life science tools market offers significant opportunities, particularly in the areas of genomic and proteomic research. The growing demand for high-throughput technologies in drug discovery and development creates opportunities for market players to introduce innovative solutions. Emerging markets, especially in Asia Pacific and Latin America, offer untapped potential due to increasing investments in healthcare infrastructure and rising awareness of advanced research technologies. The integration of artificial intelligence and machine learning with life science tools is another promising opportunity, allowing researchers to accelerate data analysis and gain deeper insights into complex biological processes. Additionally, the expanding application of life science tools in fields such as agriculture, environmental science, and food safety presents new growth avenues.

Challenges

Despite its promising growth, the life science tools market faces several challenges. High costs associated with advanced technologies and the need for continuous upgrades to maintain competitiveness can be a barrier, particularly for small and mid-sized research institutions. Additionally, the complexity of integrating advanced tools with existing research workflows poses challenges for end users. Regulatory compliance and stringent quality standards further add to the complexity of product development and commercialization. Moreover, data privacy concerns related to genomic and clinical research remain a significant challenge, as the increasing use of big data in life science research raises concerns about data security and ethical considerations.

Regional Insights

North America dominates the life science tools market, driven by strong investments in biotechnology and pharmaceutical research, a well-established research infrastructure, and favorable government policies supporting innovation. The United States is a major contributor to the region’s growth, with numerous research institutions and pharmaceutical companies adopting advanced life science tools. Europe follows closely, with significant investments in life science research and development, particularly in countries like Germany, the United Kingdom, and France.

The Asia Pacific region is expected to witness the fastest growth during the forecast period due to rising healthcare expenditures, increasing government support for scientific research, and growing adoption of advanced technologies in countries like China, Japan, and India. Latin America and the Middle East & Africa are also gradually emerging as potential markets, driven by improving research infrastructure and increasing focus on healthcare innovation.

Recent News

The life science tools market has witnessed several notable developments in recent years. Leading companies are focusing on expanding their product portfolios through mergers, acquisitions, and collaborations to enhance their research capabilities. Advancements in gene editing technologies, such as CRISPR, and innovations in single-cell analysis are driving the development of next-generation life science tools. Additionally, the increasing use of artificial intelligence and machine learning in life science research is enhancing data analysis capabilities and accelerating the pace of discovery. Government initiatives aimed at promoting life science research and innovation are also creating a favorable environment for market growth.

Life Science Tools Market Companies

- Agilent Technologies

- Becton, Dickinson and Company

- Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- GE Healthcare

- Hitachi, Ltd.

Segments Covered in the Report

By Technology

- Genomics

- Cell Biology

- Proteomics

- Stem Cell Research

- Immunology

By Product

- Consumables

- Instruments

- Services

By Application

- Drug Discovery and Development

- Clinical Diagnostics

- Genomic and Proteomic Research

- Cell Biology Research

- Others

By End-User

- Academic and Research Institutions

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Government and Regulatory Agencies

By Regional Outlook

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa