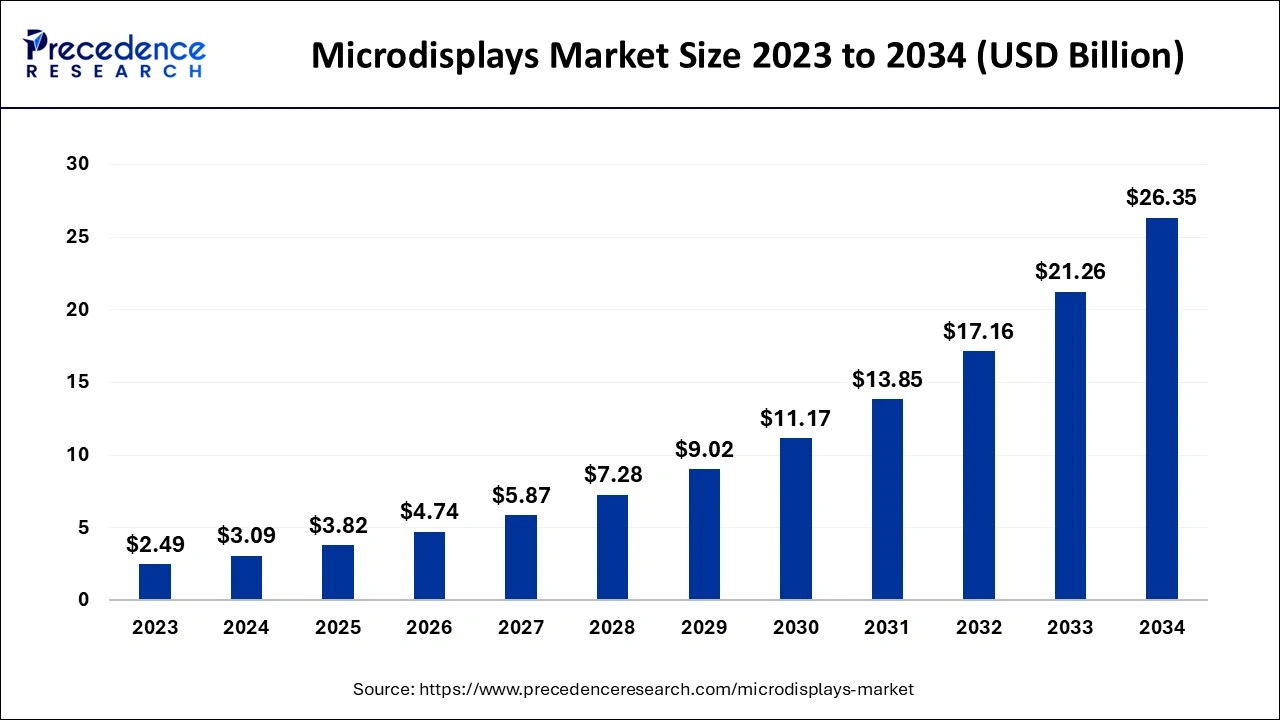

Microdisplays market size is estimated at USD 3.09 billion in 2024 and expected to reach around USD 26.35 billion by 2034, expanding at a strong CAGR of 23.92%.

Microdisplays Market Key Takeaways

-

Asia Pacific secured the largest share of the global microdisplays market at 36% in 2023.

-

The North American market is expected to expand at the fastest pace over the forecast period.

-

In 2023, the U.S. accounted for more than 73% of North America’s microdisplays market.

-

Among products, near-to-eye displays dominated the global landscape in 2023.

-

Projection displays are projected to record the highest growth rate in the coming years.

-

LCD technology led the market by share in 2023.

-

LCoS technology is anticipated to grow considerably during the forecast timeline.

-

Consumer electronics was the leading application for microdisplays in 2023.

-

The automotive segment is projected to achieve the highest CAGR through the forecast period.

Market Overview

The global microdisplays market is undergoing significant transformation, growing from a valuation of USD 3.09 billion in 2024 to a projected USD 26.35 billion by 2034. The substantial CAGR of 23.92% is reflective of growing adoption across multiple verticals, including consumer electronics, automotive, defense, and healthcare. This surge is largely driven by demand for smaller, smarter, and sharper visual technologies.

Drivers

Technological evolution is a core driver, with OLED and LCoS technologies enabling clearer, brighter, and more efficient displays. The rapid growth of virtual and augmented reality, gaming, and digital eyewear has further accelerated demand. Moreover, the defense sector continues to be a major end user, especially in night vision systems and helmet-mounted displays.

Opportunities

Emerging opportunities lie in medical imaging and industrial applications where precision and compactness are crucial. The rise of autonomous vehicles and smart dashboards also presents new use cases for microdisplays. Market players investing in cost-effective and scalable manufacturing processes stand to gain significant competitive advantage in the coming years.

Challenges

Barriers to adoption include cost constraints, limited durability in some microdisplay types, and difficulties in large-scale production. Compatibility issues with existing display interfaces and thermal management in compact spaces are technical concerns that require continuous innovation and engineering.

Regional Insights

Asia Pacific leads the market owing to its manufacturing dominance and growing use of consumer electronics, especially in China and South Korea. North America, on the other hand, is poised for the fastest growth, backed by heavy investments in wearable tech, military-grade equipment, and AR/VR platforms. The U.S. plays a dominant role in this regional growth, holding a major market share.

Recent Developments

Several display manufacturers have recently launched prototypes featuring higher resolution, faster response times, and greater energy efficiency. Collaborations between automotive companies and display tech firms have also increased. Additionally, government-backed research initiatives in countries like the U.S. and Japan are accelerating the innovation pace within this sector.

Microdisplays Market Companies

- LG DISPLAY CO., LTD.

- eMagin. (SAMSUNG DISPLAY)

- Sony Corporation

- KOPIN

- AUO Corporation

- Micron Technology, Inc.

- Himax Technologies, Inc.

- Syndicate

- UNIVERSAL DISPLAY

- MicroVision

Segments Covered in the Report

By Product

- Near-To-Eye

- Projection

- Others

By Technology

- Liquid Crystal Display (LCD)

- Organic Light-Emitting Diode (OLED)

- Digital Light Processing (DLP)

- Liquid Crystal On Silicon (Lcos)

By Application

- Consumer Electronics

- Military and Defense

- Medical Applications

- Industrial Systems

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!