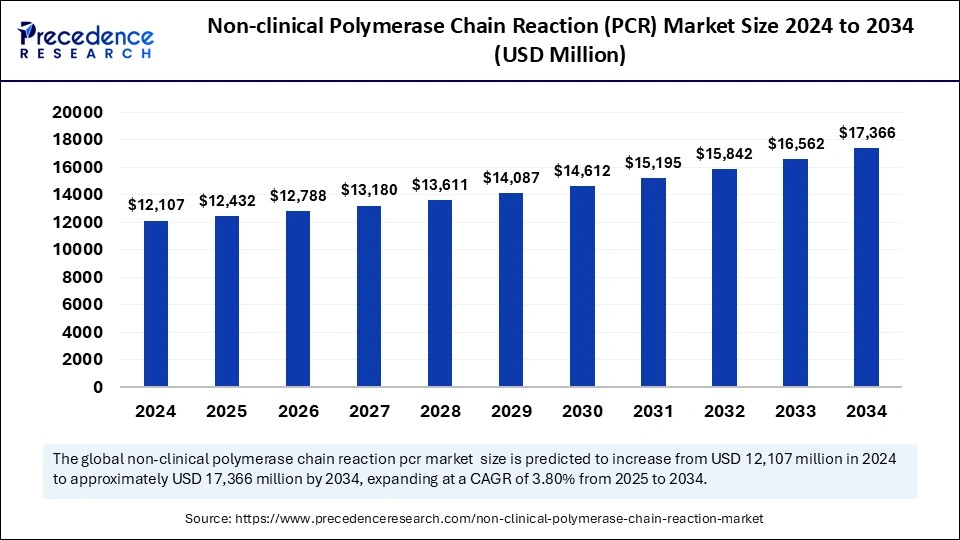

The non-clinical PCR market is projected to grow from USD 12,106.50 million in 2024 to USD 17,366 million by 2034, with a CAGR of 3.80% during the forecast period.

Non-clinical PCR Market Key Takeaways

-

North America held 39.23% of the non-clinical PCR market in 2024.

-

Asia Pacific is expected to grow at a 4.7% CAGR from 2025 to 2034.

-

The basic research segment accounted for 35.94% of the market share in 2024.

-

The pharmaceutical research segment is projected to grow at a 4.4% CAGR.

-

The reagents and consumables segment captured 56.25% of the market in 2024.

-

The instrumentation segment is anticipated to grow at a 3.7% CAGR.

-

Pharmaceutical and biotechnology companies led with 33.82% market share in 2024.

-

The academic and research institutes segment is growing at a 3.3% CAGR.

Non-clinical PCR Market Overview

The non-clinical polymerase chain reaction (PCR) market is gaining prominence due to its increasing applications in forensic science, environmental monitoring, agriculture, and food safety. PCR is a widely used molecular biology technique that amplifies DNA sequences, enabling the identification and analysis of genetic material. While PCR is primarily associated with clinical diagnostics, its non-clinical applications have witnessed significant growth in recent years.

In forensic science, PCR is used to analyze DNA samples collected from crime scenes, providing valuable evidence for criminal investigations. Environmental monitoring benefits from PCR technology in detecting microbial contamination in water, soil, and air. In agriculture, PCR plays a pivotal role in identifying genetically modified organisms (GMOs) and monitoring plant pathogens. Similarly, the food safety industry leverages PCR to detect foodborne pathogens and ensure compliance with regulatory standards.

The increasing adoption of PCR in these sectors is driven by advancements in PCR technologies, including real-time PCR (qPCR) and digital PCR (dPCR), which offer higher sensitivity, specificity, and accuracy. The growing awareness of the importance of DNA-based analysis in various non-clinical applications is expected to drive market growth in the coming years.

Non-clinical PCR Market Drivers

-

Growing Demand for Forensic DNA Analysis: PCR technology is widely used in forensic science to analyze biological evidence from crime scenes, aiding in criminal investigations and legal proceedings. The rising incidence of criminal activities and the need for accurate DNA analysis are boosting market growth.

-

Increasing Need for Environmental Monitoring: Environmental agencies are increasingly using PCR technology to detect microbial contamination in water bodies, soil, and air. The focus on maintaining environmental safety and preventing the spread of harmful pathogens is driving the demand for PCR-based solutions.

-

Expansion of GMO Detection in Agriculture: PCR is extensively used in agriculture to identify genetically modified organisms (GMOs) and monitor plant pathogens. The rising demand for sustainable agriculture and the need to comply with regulatory guidelines are fueling market growth.

-

Growing Emphasis on Food Safety: The food industry is adopting PCR technology to detect foodborne pathogens, ensuring compliance with safety standards and minimizing the risk of contamination. The increasing consumer awareness about food safety is propelling the adoption of PCR in the food industry.

-

Technological Advancements in PCR Techniques: Innovations in PCR technologies, including real-time PCR and digital PCR, have enhanced the accuracy and efficiency of DNA analysis in non-clinical applications. These advancements are driving the market by providing reliable and rapid results.

Market Opportunities

-

Expansion of PCR Applications in Biodefense and Biosecurity: The use of PCR technology in detecting bioterrorism agents and ensuring biosecurity presents lucrative growth opportunities for market players.

-

Integration of AI and Automation in PCR Processes: The integration of artificial intelligence (AI) and automation in PCR workflows can enhance efficiency, reduce manual errors, and streamline data analysis.

-

Increasing Adoption of PCR in Veterinary Diagnostics: The growing awareness of animal health and the need for rapid detection of infectious diseases in livestock create opportunities for PCR applications in veterinary diagnostics.

-

Development of Portable and Point-of-Use PCR Devices: The demand for portable and point-of-use PCR devices is increasing, enabling rapid DNA analysis in remote and resource-limited settings.

-

Application in Microbial Source Tracking and Wastewater Surveillance: PCR technology is being increasingly used for microbial source tracking and wastewater surveillance to monitor public health and environmental safety.

Market Challenges

-

High Cost of Advanced PCR Technologies: The cost of advanced PCR instruments and reagents remains high, limiting their adoption in low-resource settings.

-

Complexity in PCR Workflow and Interpretation: PCR processes require specialized expertise for accurate interpretation of results, posing challenges in resource-constrained environments.

-

Risk of Cross-Contamination and False Positives: PCR assays are susceptible to cross-contamination, which can lead to false-positive results, impacting the reliability of the analysis.

-

Stringent Regulatory Compliance and Quality Standards: Compliance with stringent regulatory guidelines and quality standards can be challenging for manufacturers and end-users.

-

Limited Awareness and Expertise in Emerging Markets: The lack of awareness and expertise regarding PCR applications in non-clinical settings hinders market penetration in developing regions.

Regional Insights

-

North America: North America dominates the non-clinical PCR market due to the strong presence of forensic laboratories, advanced research facilities, and stringent regulatory frameworks. The US leads the region in terms of technological advancements and adoption of PCR technology.

-

Europe: Europe is witnessing significant growth driven by the increasing adoption of PCR technology in environmental monitoring, agriculture, and food safety. Countries such as Germany, France, and the UK are leading contributors to regional growth.

-

Asia-Pacific: The Asia-Pacific region is experiencing rapid market expansion due to the growing awareness of DNA-based analysis in agriculture and environmental monitoring. China, India, and Japan are emerging as key markets for non-clinical PCR applications.

-

Latin America: Latin America is gradually embracing PCR technology in forensic science and food safety applications. Brazil and Mexico are driving regional growth with increasing investments in molecular diagnostics.

-

Middle East and Africa: The Middle East and Africa region is adopting PCR technology for environmental monitoring and biosecurity applications, driven by the need to safeguard public health and environmental integrity.

Recent Developments

-

February 2025: A leading molecular diagnostics company launched a portable PCR device designed for rapid DNA analysis in field applications, enhancing accessibility to remote regions.

-

January 2025: A European biotechnology firm introduced a new real-time PCR assay for detecting GMOs in agricultural samples, addressing regulatory requirements and enhancing food safety compliance.

Non-clinical PCR Market Companies

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bioer Technology Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Eppendorf AG

- Promega Corporation

- Qiagen N.V.

- Roche Diagnostics

- Takara Bio USA, Inc.

Segments Covered in the Report

By Application Area

- Basic Research

- Gene Expression Analysis

- Genotyping

- Cloning & Mutagenesis

- Methylation Analysis

- Others

- Applied Research

- Agricultural Genomics

- Environmental Testing

- Others

- Pharmaceutical Research

- Drug Discovery & Development

- Pharmacogenomics

- Biomarker Identification

- Others

By Product Type

- Instrumentation

- Thermal Cyclers

- Real-Time PCR Systems

- Digital PCR Systems

- Assays and Kits

- Gene Expression Assays

- Genotyping Assays

- Mutation Detection Kits

- DNA/RNA Extraction Kits

- Reagents & Consumables

- Enzymes

- Nucleotides

- Primers & Probes

- Buffers and Master Mixes

- Software & Services

- Analytical Software for Data Interpretation

- Custom Assay Design Services

- Maintenance & Technical Support

By End-Use

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Government and Regulatory Laboratories

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!