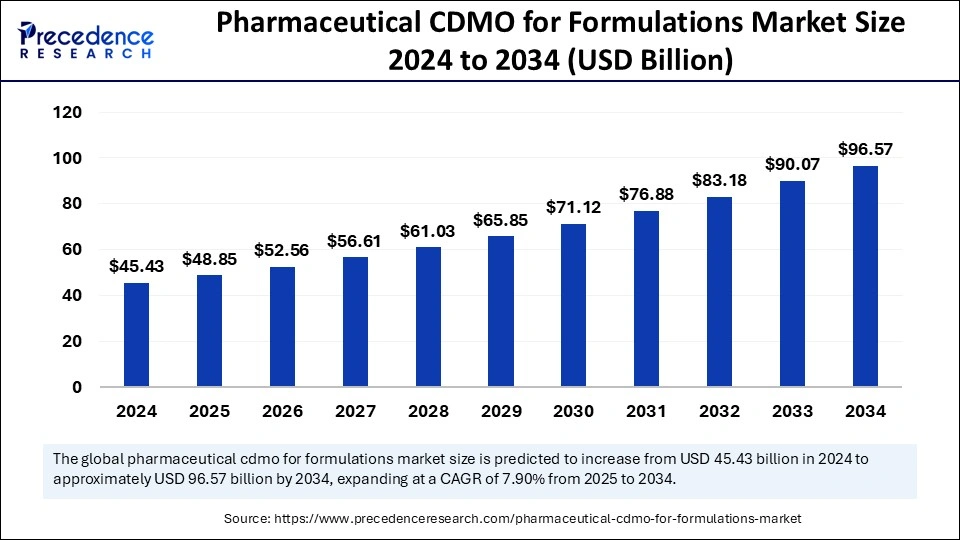

The pharmaceutical CDMO for formulations market is projected to grow from USD 45.43 Bn in 2024 to USD 96.57 Bn by 2034, with a CAGR of 7.90%.

Pharmaceutical CDMO for Formulations Market Key Takeaways

- Asia Pacific led the pharmaceutical CDMO for formulations market with the largest market share of 42% in 2024.

- Europe is expected to grow at a notable CAGR of 8.40% during the forecasted years.

- By dosage form, the oral solids segment held the biggest market share of 40% in 2024.

- By dosage form, the injectables segment is projected to grow at a solid CAGR of 8.31% over the forecast period.

- By therapeutic area, the oncology segment contributed the biggest market share of 23% in 2024.

- By therapeutic area, the infectious diseases segment is expanding at a healthy CAGR of 8.02% in the forecast period.

- By end user, the pharmaceutical companies segment contributed the highest market share of 55% in 2024.

- By end user, the biopharmaceutical companies segment is expected to expand at a considerable CAGR of 8.17% over the forecast period.

Pharmaceutical CDMO for Formulations Market Overview

The pharmaceutical CDMO for formulations market is poised for significant growth as pharmaceutical companies increasingly rely on external service providers to develop and manufacture complex drug formulations. CDMOs offer comprehensive services that encompass formulation development, analytical testing, manufacturing, and regulatory compliance, enabling pharmaceutical companies to focus on their core competencies while ensuring product quality and regulatory adherence.

The growing demand for biologics, specialty pharmaceuticals, and advanced drug delivery systems is driving the need for specialized formulation expertise and state-of-the-art manufacturing technologies. CDMOs are playing a critical role in accelerating time-to-market for novel therapies, optimizing production processes, and ensuring compliance with stringent regulatory standards. As the pharmaceutical industry continues to embrace digitalization and automation, the demand for innovative formulation services is expected to fuel the growth of the CDMO market.

Drivers

The increasing complexity of drug formulations and the growing emphasis on biologics and personalized medicine are key drivers of the pharmaceutical CDMO for formulations market. Pharmaceutical companies are seeking specialized expertise to develop complex formulations that require advanced technologies such as controlled-release systems, nanoparticle drug delivery, and biologics manufacturing. The need to accelerate drug development timelines and reduce production costs is prompting pharmaceutical companies to outsource formulation development and manufacturing to CDMOs that offer scalable and flexible solutions. Regulatory requirements are becoming more stringent, necessitating collaboration with CDMOs that can ensure compliance with global quality standards.

Additionally, the rising prevalence of chronic diseases and the increasing demand for targeted therapies are driving the need for innovative formulation solutions, further boosting the demand for CDMO services.

Opportunities

The pharmaceutical CDMO for formulations market offers vast opportunities for growth, particularly in the development of complex formulations and specialized drug delivery systems. The increasing adoption of biologics, biosimilars, and gene therapies presents significant potential for CDMOs with expertise in handling advanced formulations. The rising demand for high-potency active pharmaceutical ingredients (HPAPIs) and personalized medicine creates opportunities for CDMOs to expand their service offerings.

Additionally, the integration of artificial intelligence, machine learning, and data analytics in formulation development and manufacturing is creating opportunities for CDMOs to enhance process efficiency, improve product quality, and optimize production timelines. The growing emphasis on digitalization and automation in pharmaceutical manufacturing is expected to drive the adoption of advanced formulation services, creating new avenues for growth in the CDMO market.

Challenges

Despite the promising growth prospects, the pharmaceutical CDMO for formulations market faces challenges related to regulatory compliance, quality assurance, and operational scalability. Adhering to stringent regulatory standards and ensuring compliance with Good Manufacturing Practices (GMP) requires significant investment in quality control systems, workforce training, and process optimization. The high cost of adopting advanced formulation technologies and maintaining state-of-the-art manufacturing facilities adds to the operational burden for CDMOs.

Additionally, the increasing competition in the CDMO space and the growing demand for faster turnaround times and cost efficiency place additional pressure on service providers to deliver high-quality solutions while maintaining profitability. Overcoming these challenges will require continuous investment in technology, innovation, and regulatory expertise.

Regional Insights

North America dominates the pharmaceutical CDMO for formulations market, with the United States driving growth through its strong regulatory framework, advanced healthcare infrastructure, and high demand for complex formulations.

Europe is another key market, with countries such as Germany, France, and the United Kingdom leading the adoption of CDMO services.

The Asia Pacific region is witnessing rapid growth, fueled by increasing pharmaceutical manufacturing activity in countries such as China and India, where cost-effective CDMO services and a skilled workforce are attracting pharmaceutical companies.

Latin America and the Middle East & Africa are gradually expanding their pharmaceutical capabilities, creating opportunities for CDMOs to establish a presence in these regions.

Recent Developments

Recent developments in the pharmaceutical CDMO for formulations market include investments in cutting-edge formulation technologies, strategic collaborations, and the integration of digital platforms for process optimization. Leading CDMOs are enhancing their capabilities in biologics formulation, high-potency drug manufacturing, and innovative drug delivery systems to meet the evolving demands of the pharmaceutical industry. Strategic partnerships between CDMOs and pharmaceutical companies are driving the development of novel therapies and accelerating commercialization timelines.

The use of artificial intelligence and data analytics in formulation processes is enabling CDMOs to optimize manufacturing efficiency and improve product quality. Additionally, CDMOs are expanding their global footprint by establishing new facilities in emerging markets to cater to the growing demand for formulation services.

Pharmaceutical CDMO for Formulations Market Companies

- Lonza

- Thermo Fisher Scientific, Inc.

- Recipharm AB

- Laboratory Corporation of America Holdings (LabCorp)

- Catalent, Inc.

- WuXi AppTec, Inc.

- Piramal Pharma Solutions

- Siegfried Holding AG

- CordenPharma International

- Cambrex Corporation

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- EuroAPI

- Hovione

- Curia

Segments Covered in the Report

By Dosage Form

- Oral Solids

- Oral Liquids

- Injectables

- Topicals

- Inhalation Products

- Transdermal And Patches

- Others

By Therapeutic Area

- Oncology

- Cardiology

- Central Nervous System

- Gastroenterology

- Infectious Diseases

- Endocrinology (Diabetes, Hormonal Therapy)

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!