Plant Asset Management Market Key Takeaways

- North America dominated the global plant asset management market with the largest market share of 37% in 2023.

- The U.S. is projected to expand at a double-digit CAGR of 14.72% during the forecast period.

- The Asia Pacific is anticipated to grow at a notable CAGR of 16.44% during the forecast period.

- By component, the solution segment accounted for the biggest market share of 64% in 2023.

- By component, the services segment is representing a solid CAGR of 15.93 during the forecast period.

- By deployment, the cloud segment stood the dominant in the global market in 2023.

- By deployment, the on-premise segment is anticipated to at the fastest CAGR of 14.82% during the forecast period.

- By asset type, the production assets segment contributed more than 55% of market share in 2023.

- By asset type, the automation assets segment is anticipated to grow at the highest CAGR of 15.82% during the forecast period.

- By end-user, the energy and power segment held the largest market share of 24% in 2023.

- By end-user, the manufacturing segment is expected to grow at a remarkable CAGR of 16.72% during the forecast period.

Market Overview

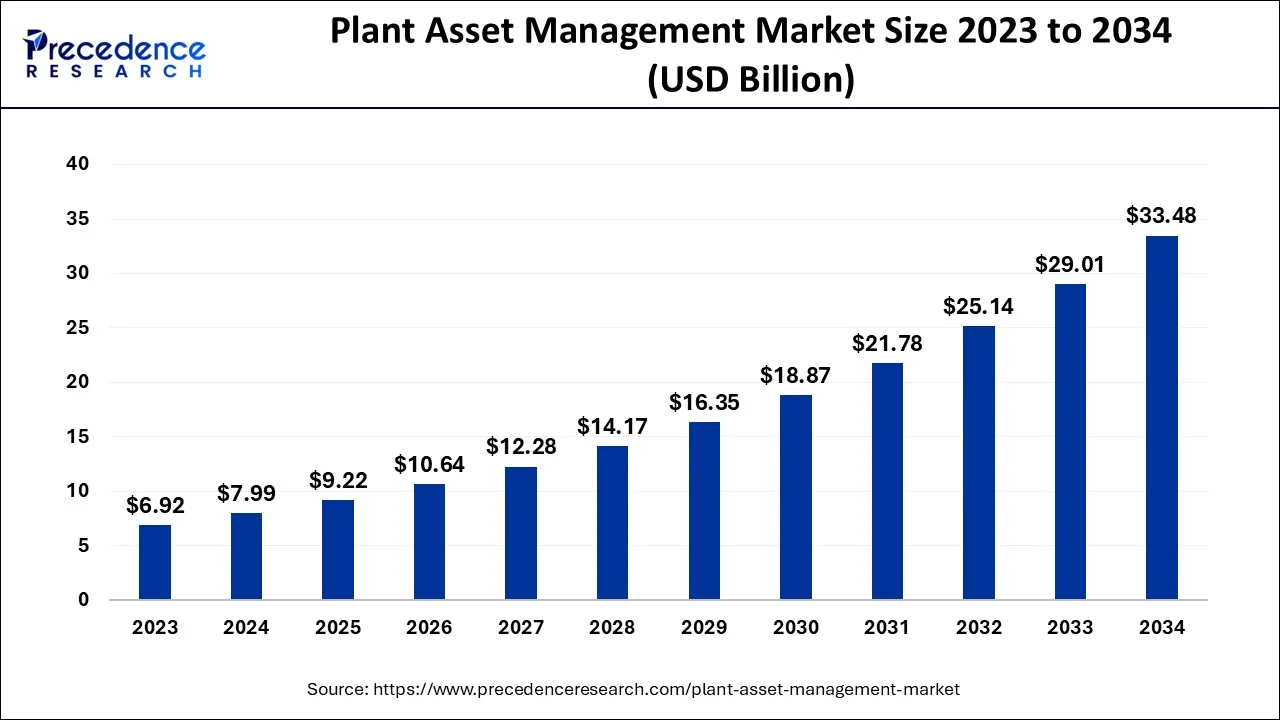

The Plant Asset Management (PAM) market is experiencing significant growth, driven by the increasing need for operational efficiency and the integration of advanced technologies. PAM involves the systematic process of managing and optimizing the lifecycle of physical assets in industrial plants, including machinery, equipment, and infrastructure. The global PAM market was valued at approximately USD 9.2 billion in 2024 and is projected to reach USD 17.4 billion by 2033, growing at a CAGR of 7.4% during the forecast period. This growth is attributed to the rising demand for real-time asset monitoring, predictive maintenance, and the adoption of Industry 4.0 practices across various industries.

Drivers

Key drivers propelling the PAM market include the increasing focus on operational efficiency, the need to reduce unplanned downtime, and the integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and machine learning. These technologies enable real-time monitoring and predictive analytics, allowing for proactive maintenance and reduced operational costs. Additionally, the growing complexity of industrial operations necessitates robust asset management strategies to ensure equipment reliability and compliance with regulatory standards.

Opportunities

The PAM market presents numerous opportunities, particularly in the adoption of cloud-based solutions and the integration of AI and IoT technologies. Cloud-based PAM solutions offer scalability, cost-effectiveness, and ease of access, making them attractive to small and medium-sized enterprises. The integration of AI and IoT enables advanced analytics and real-time monitoring, facilitating predictive maintenance and improved decision-making. Furthermore, the increasing emphasis on sustainability and energy efficiency opens avenues for PAM solutions that contribute to environmental goals.

Challenges

Despite the promising outlook, the PAM market faces challenges such as the high initial investment required for implementing advanced asset management systems and the need for skilled personnel to manage and interpret complex data. Additionally, concerns regarding data security and privacy in cloud-based solutions may hinder adoption. The integration of PAM systems with existing legacy infrastructure also poses technical challenges that need to be addressed to ensure seamless operation.

Regional Insights

Regionally, North America holds a significant share of the PAM market, driven by the presence of advanced industrial infrastructure and early adoption of digital technologies. The United States, in particular, is a major contributor, with a market size projected to grow from USD 2.22 billion in 2024 to USD 9.35 billion by 2034, at a CAGR of 15.47%. The Asia-Pacific region is expected to witness the highest growth rate, fueled by rapid industrialization, increasing investments in manufacturing, and the adoption of smart technologies in countries like China, India, and Southeast Asian nations. Europe also demonstrates steady growth, supported by stringent regulatory standards and a strong focus on operational efficiency.

Recent Developments

Recent developments in the PAM market include significant investments and technological advancements. For instance, in June 2024, Holcim announced a transformative AI plan to expand its predictive maintenance technology across more than 100 plants worldwide. This initiative aims to enhance operational efficiency and reduce downtime through advanced analytics and real-time monitoring. Additionally, the increasing adoption of cloud-based PAM solutions and the integration of AI and IoT technologies continue to shape the market landscape, offering enhanced capabilities and improved asset management strategies.

Plant Asset Management Market Companies

- Siemens AG, ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

- General Electric (GE)

- IBM Corporation

- Bentley Systems, Inc.

- Yokogawa Electric Corporation

Segments Covered in the Report

By Component

- Solution

- Asset Lifecycle Management

- Predictive Maintenance

- Work Order Management

- Inventory Management

- Services

- Professional Service

- Managed Service

By Deployment

- Cloud

- On-Premises

By Asset Type

- Production Assets

- Automation Assets

By End-user

- Energy and Power

- Oil and Gas

- Manufacturing

- Mining and Metal

- Aerospace and Defense

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!