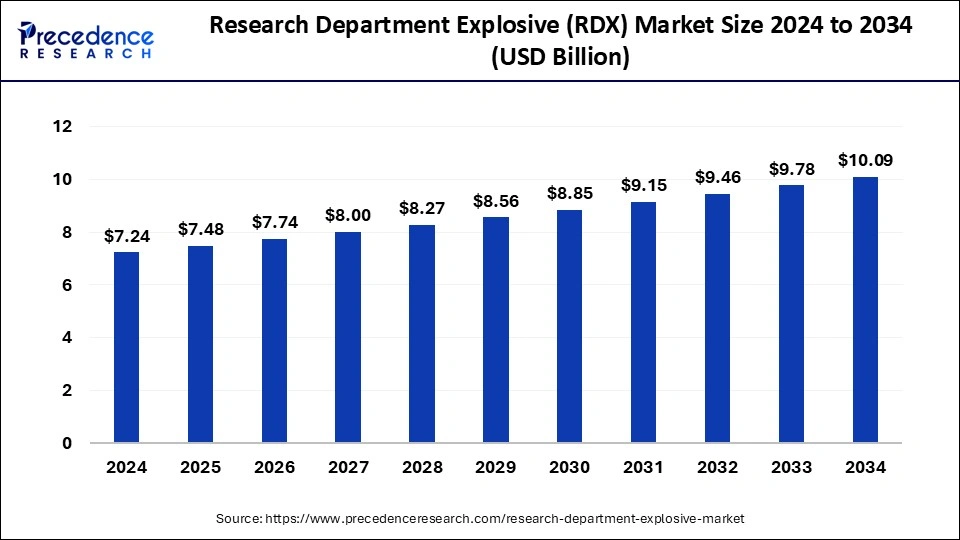

With a projected CAGR of 3%, the Research Department Explosive market (RDX) is set to expand from USD 7.24 billion in 2024 to USD 10.09 billion by 2034

Table of Contents

ToggleResearch Department Explosive (RDX) Market Key Takeaways

- In 2023, North America dominated the global RDX market, driven by high defense spending and military applications.

- The pyrotechnics segment accounted for the largest market share by type in 2023.

- The military sector remained the leading end-user of RDX, fueling market demand worldwide.

Overview

The Research Department Explosive (RDX) market is witnessing steady expansion due to its critical role in defense, security, and industrial applications. RDX, a highly powerful and stable explosive, is widely utilized in military-grade explosives, including warheads, grenades, and detonation cords, as well as in mining, demolition, and construction industries. As nations strengthen their military capabilities and invest in modern weaponry, the demand for RDX continues to rise. Additionally, research efforts focused on improving explosive efficiency, reducing environmental impact, and enhancing safety features are shaping the future of the RDX market.

Market Drivers

Several factors are driving the growth of the RDX market. Increasing military conflicts and security concerns are prompting governments to enhance their defense infrastructure, leading to a rise in the procurement of RDX-based munitions. The growth of the mining and construction industries, where controlled blasting operations require high-powered explosives, is another significant driver. Technological advancements in explosive compositions, aimed at improving stability and reducing unintended detonations, are further contributing to market growth. Additionally, government funding for defense research and development (R&D) is supporting innovation in explosive technologies, increasing the efficiency and reliability of RDX.

Opportunities in the Market

The RDX market offers various opportunities for innovation and expansion. Ongoing research in developing safer and eco-friendly explosive alternatives presents new growth prospects for manufacturers. With increasing concerns over environmental pollution caused by explosive residues, companies are investing in biodegradable explosive formulations. Additionally, partnerships between defense organizations and private sector firms are fostering advancements in high-precision explosives and smart detonation systems. The demand for modernized weaponry and explosive devices in emerging markets is another lucrative opportunity, as developing nations ramp up their defense investments.

Challenges Facing the Market

Despite promising growth, the RDX market faces challenges that could impact its long-term expansion. Strict regulatory frameworks governing the production, transportation, and usage of high-energy explosives create compliance burdens for manufacturers. Environmental and health concerns related to explosive residues and contamination risks are leading to tighter restrictions on RDX usage. Additionally, fluctuating prices of key raw materials, including nitric acid and hexamine, can impact production costs and profitability. The growing shift toward alternative explosive technologies, such as insensitive munitions and novel synthetic compounds, poses another challenge for traditional RDX manufacturers.

Regional Insights

The RDX market exhibits varying growth patterns across different regions. North America remains a dominant player due to its high military expenditure, strong defense manufacturing capabilities, and extensive mining operations. The United States leads in both RDX production and consumption, with continuous investments in military R&D and advanced explosives. Europe is also a significant market, driven by defense initiatives and security measures across major nations. The Asia-Pacific region is experiencing rapid growth, with countries like China and India investing heavily in military modernization and infrastructure projects. Meanwhile, the Middle East and Africa are witnessing an increasing demand for RDX, influenced by regional conflicts and rising defense budgets.

Recent Developments

The RDX market has seen key developments, including technological advancements aimed at enhancing the efficiency and safety of explosive materials. Research into next-generation explosives with reduced environmental impact is gaining momentum, as governments impose stricter regulations on traditional explosives. Defense contractors and technology firms are collaborating on high-precision detonation systems to improve the effectiveness of RDX-based munitions. Additionally, the rising demand for advanced explosives in counter-terrorism operations and homeland security is shaping market trends, leading to increased procurement of modern explosive solutions. The market is expected to continue evolving as innovation and regulatory changes drive the next phase of growth in RDX applications.

Research Department Explosive (RDX) Market Companies

- BAE Systems

- Austin Powder

- Enaex S.A.

- Nelson Brothers

- Dyno Nobel

- Eurenco

- Chemring Group PLC

Segments Covered in the Report

By Type

- Explosives

- Pyrotechnics

- Others

By End-Use

- Military

- Warheads

- Booster material

- Artillery, tank and mortar shells

- Military Pyrotechnics

- Detonators

- Others

- Civilian

- Mining

- Fireworks & Pyrotechnics

- Construction

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- U.K.

- Spain

- Russia

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- GCC

- South Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/