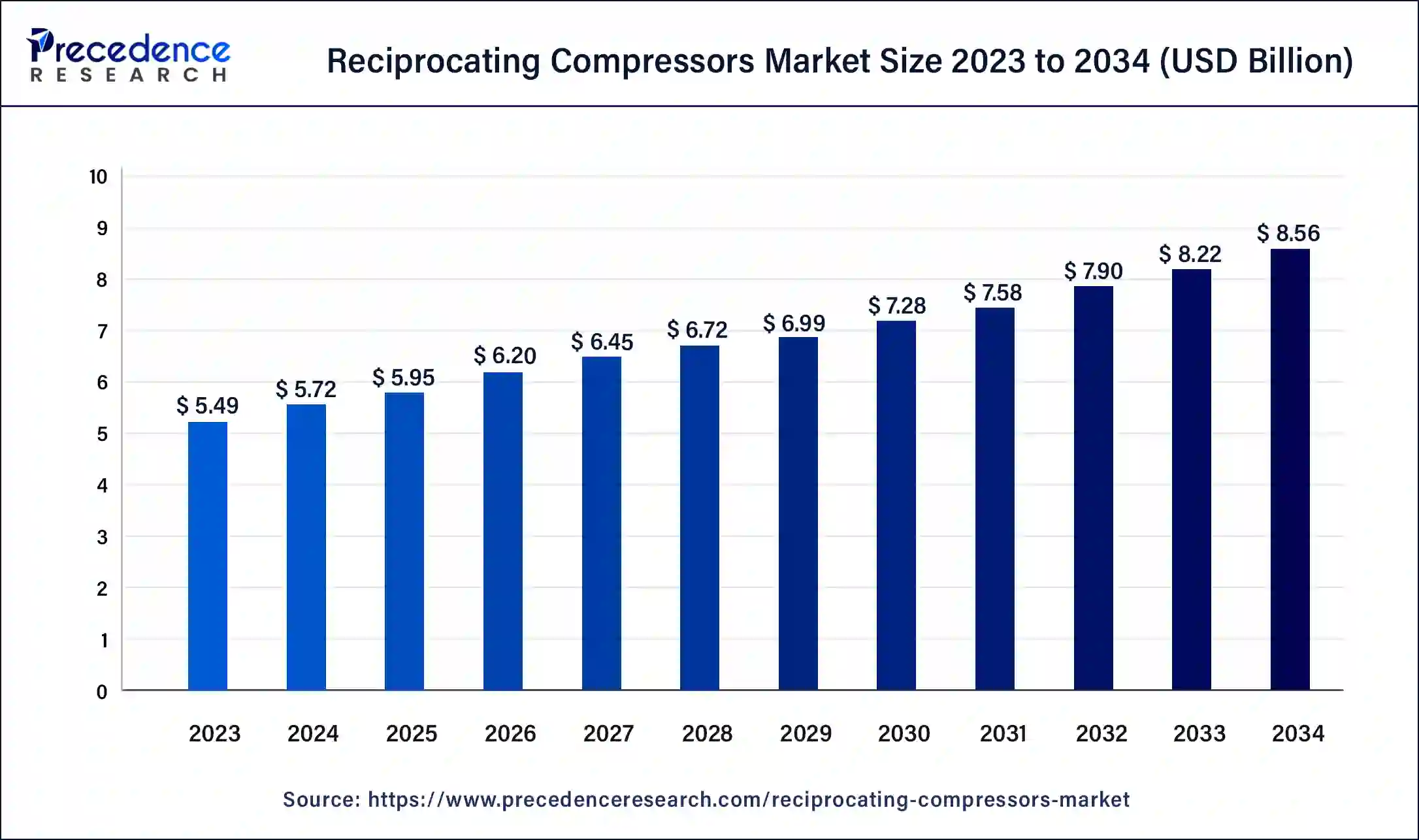

The global reciprocating compressors market size was evaluated at USD 5.49 billion by 2023 and is projected to gain around USD 8.56 billion by 2034 with a CAGR of 4.12% between 2024 and 2034.

Get Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5082

Key Takeaways

- Asia Pacific dominated the reciprocating compressors market with the highest market share of 42% in 2023.

- North America is predicted to grow at a CAGR of 3.03% during the forecast period.

- By type, the stationary segment has held a biggest market share of 58% in 2023.

- By type, the portable segment is anticipated to grow at a CAGR of 4.52% during the coming years.

- By lubrication, the oil-free segment contributed the largest market share of 63% in 2023.

- By stage type, the multi-stage segment dominated the market globally in 2023.

- By acting type, the double-acting segment dominated the reciprocating compressors market in 2023.

- By end-user, the manufacturing segment led the market in 2023.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5082

Market Overview

The reciprocating compressors market has seen consistent growth due to their extensive application in various industries, including oil & gas, petrochemical, food & beverage, manufacturing, and refrigeration. Reciprocating compressors, also known as piston compressors, operate by using pistons to compress gases at high pressure, making them a key component in industrial processes that require efficient gas compression. Their reliability, high-pressure capabilities, and versatility in handling a range of gases make them suitable for critical applications across different sectors. Advancements in technology and the growing need for energy-efficient solutions have led to innovations in reciprocating compressors, enhancing their performance and operational efficiency.

Growth Factors

The primary growth factor for the reciprocating compressors market is the expanding demand from the oil & gas industry, which relies heavily on these compressors for upstream, midstream, and downstream operations. Additionally, the rising need for compressed air in the manufacturing sector is fueling the demand for reciprocating compressors. The adoption of automation in industries and the increasing focus on energy efficiency are also key factors driving market growth. Moreover, as industries continue to upgrade their facilities with advanced machinery, reciprocating compressors are frequently preferred due to their durability and capacity to operate under high pressure.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.56 Billion |

| Market Size in 2024 | USD 5.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.12% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Lubrication, Stage Type, Acting Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

A significant driver of the reciprocating compressors market is the global push towards energy efficiency and emission reduction. Governments and regulatory bodies worldwide are implementing stricter environmental regulations, prompting industries to adopt compressors with lower carbon footprints. The oil & gas industry, in particular, requires reliable and durable compression solutions, which is bolstering the demand for reciprocating compressors. Additionally, advancements in technology have enabled the development of compressors with enhanced efficiency and reduced maintenance requirements, further driving their adoption.

Opportunities

The reciprocating compressors market presents numerous opportunities, particularly in emerging markets across Asia Pacific and Latin America, where rapid industrialization is underway. The growth of the natural gas sector, especially in countries like China and India, offers substantial potential for reciprocating compressors, as they are critical in gas processing and transportation. Furthermore, the ongoing shift towards clean energy sources, such as biogas and hydrogen, is expected to create opportunities for the use of reciprocating compressors in new applications. With advancements in compressor technology, manufacturers have the chance to explore innovative products that cater to the demand for energy-efficient solutions.

Challenges

One of the main challenges faced by the reciprocating compressors market is the intense competition from alternative compressor technologies, such as rotary and centrifugal compressors. These alternatives often offer lower noise levels and improved efficiency for certain applications, which can affect the demand for reciprocating compressors. Additionally, reciprocating compressors generally require more maintenance due to their complex design, which can lead to higher operational costs over time. Another challenge is the volatility of the oil & gas industry, which can impact the market demand for compressors due to fluctuating investments in this sector.

Region Insights

Regionally, Asia Pacific is anticipated to hold a significant share of the reciprocating compressors market due to rapid industrial growth, particularly in China and India. The expansion of the manufacturing and oil & gas sectors in these countries drives the demand for reliable compressor solutions. North America also presents a strong market due to advancements in shale gas extraction and the established presence of oil & gas infrastructure. Meanwhile, Europe’s market is driven by the demand for energy-efficient solutions and the presence of stringent environmental regulations. The Middle East & Africa region, with its vast oil reserves, is another key market for reciprocating compressors, mainly driven by the oil & gas sector’s ongoing developments.

Read Also: Pressure Transducer Market Size is Attain USD 29.80 Billion by 2034

Recent Developments

- In May 2024, SIAD Group company’s SIAD Macchine Impianti launched the 550-bar, oil-free, high-pressure hydrogen compressor, specially produced for the transportation and hydrogen refueling station industries. The company said it is a sustainable mobility supply chain.

- In April 2024, Frascold, an Italian compressor manufacturer, launched the TK HD series, the latest product in the transcritical CO2 (R744) semi-hermetic reciprocating compressors. The new product is available in 34 models and offers refrigeration capacities between 3.7 and 72kW with the selection of one or two motors with a power range from 3 to 50HP.

- In June 2024, Hitachi Industrial Equipment Systems Co., Ltd. announced the launch of the “Predictive Diagnosis Service” for the factory equipment. The equipment uses machine learning algorithms for detecting and analyzing the data through remote monitoring and combines the knowledge accumulated by the Hitachi Industrial Equipment Systems maintenance staff to prevent and detect abnormalities in the system that may result in equipment stoppages in advance.

Reciprocating Compressors Market Companies

- Ariel Corporation

- Atlas Copco

- Burckhardt Compression Ag

- Gardner Denver Holdings Inc.

- GE Company

- IHI Corporation Ltd.

- Siemens AG

- Mitsui E&S Holdings Co., Ltd.

- Howden Group Ltd.

- Mayekawa Mfg. Co, Ltd.

Segments Covered in the Report

By Type

- Portable

- Stationary

By Lubrication

- Oil-free

- Oil Filled

By Stage Type

- Single Stage

- Multi-stage

By Acting Type

- Single Acting

- Double Acting

- Diaphragm

By End-user

- Oil & Gas

- Pharmaceutical

- Chemical Plants

- Refrigeration Plants

- Manufacturing

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5082

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.reportsgazette.com/

Blog: https://www.businesswebwire.com/