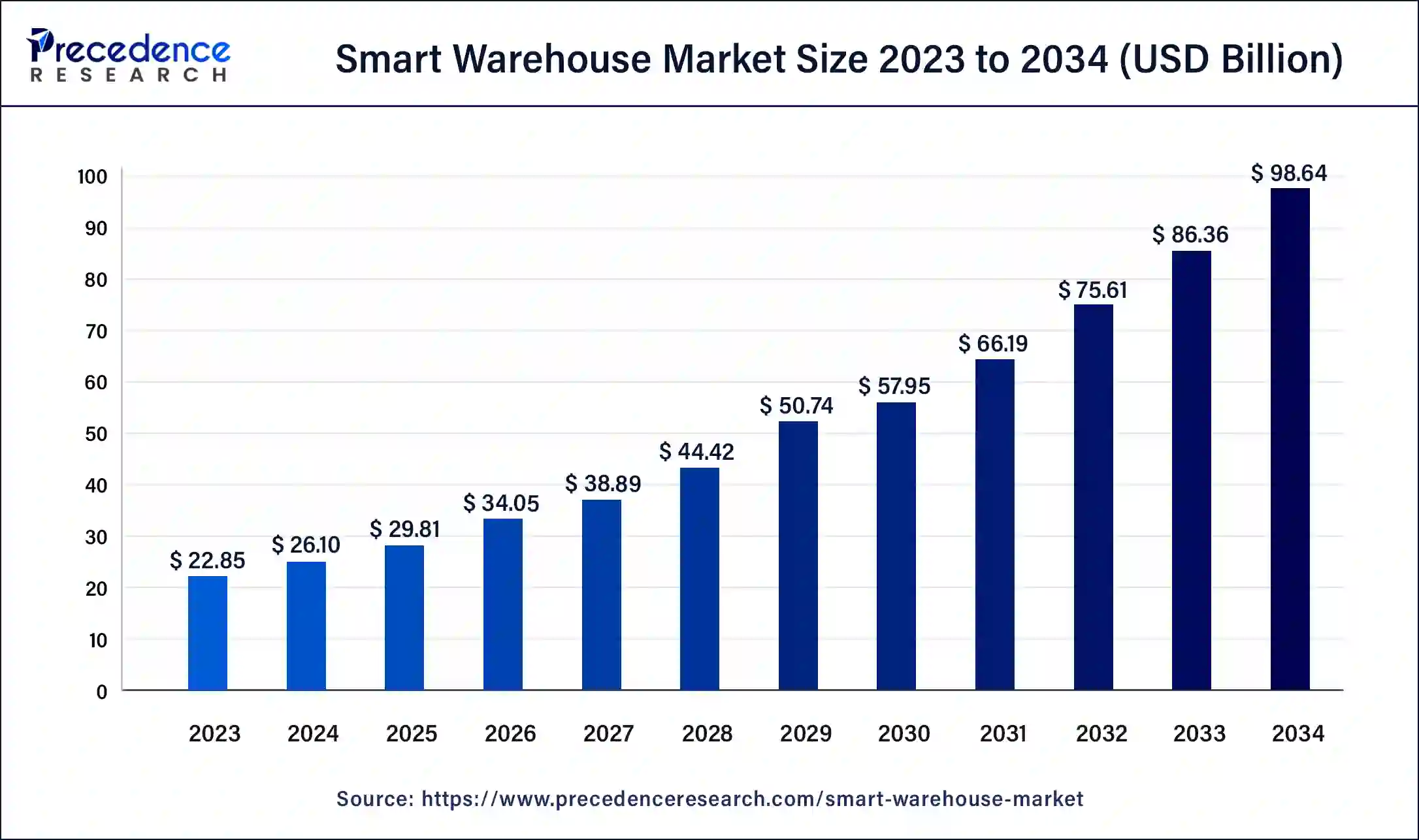

The global smart warehouse market size was exhibited at USD 22.85 billion in 2023 and is anticipated to be expanding around USD 98.64 Billion By 2034, growing at a impressive CAGR of 14.22% from 2024 to 2034.

Key Takeaways

- North America dominated the smart warehouse market with the largest market share of 32% in 2023.

- Asia Pacific is expected to expand at a during the double digit CAGR of 15.22% forecast period.

- By deployment, the on-premises segment has held the major market share of 57% in 2023.

- By deployment, the cloud storage segment is expected to grow at the significant CAGR of 15.42% during the forecast period.

- By technology, the robotics & automation segment accounted for the largest share of the market in 2023.

- By application, the order fulfillment segment contributed more than 35% of market share in 2023.

- By application, the inventory management segment is set to grow at the fastest CAGR of 14.92% over the forecast period.

- By size, the large warehouses segment accounted for the highest market share of 49% in 2023.

- By size, the medium warehouse segment is projected grow at a solid CAGR of 14.92% forecast period.

- By vertical outlook, the transportation & logistics segment dominated the market in 2023.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5084

Market Overview

The Smart Warehouse Market refers to the integration of advanced technologies, such as automation, artificial intelligence (AI), the Internet of Things (IoT), and data analytics, to optimize warehouse operations. Smart warehouses enhance inventory management, streamline order fulfillment, and improve overall efficiency by using automated systems, robotics, and real-time data insights. This market has gained significant traction due to the increasing demand for efficiency in logistics and supply chain management, particularly in e-commerce and retail sectors. The rise in e-commerce has prompted companies to invest in smart warehouse technologies to meet customer demands for faster delivery and accurate inventory management.

Growth Factors

Several growth factors are driving the expansion of the smart warehouse market. The rapid growth of e-commerce is a significant contributor, as companies seek to optimize their supply chains and manage inventory effectively to cater to customer expectations for quick deliveries. Furthermore, the increasing complexity of supply chains and the demand for real-time data visibility compel organizations to adopt advanced technologies. Additionally, advancements in robotics and automation technologies have made it feasible for warehouses to implement smart systems that reduce manual labor, enhance accuracy, and minimize operational costs.

Smart Warehouse Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.64 Billion |

| Market Size in 2024 | USD 26.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.22% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Technology, Application, Warehouse, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Smart Warehouse Market Dynamics

Drivers

Key drivers of the smart warehouse market include the increasing need for operational efficiency, cost reduction, and improved customer satisfaction. Companies are striving to streamline their logistics operations to cope with rising demand and heightened competition. The growing trend of digital transformation in the supply chain and the adoption of Industry 4.0 principles have also catalyzed the integration of smart technologies in warehouses. Moreover, the necessity to manage large volumes of data and the shift towards data-driven decision-making underscore the importance of smart warehouse solutions.

Opportunities

The smart warehouse market presents several opportunities for growth and innovation. As technology continues to evolve, there is potential for the development of more sophisticated automation solutions, such as autonomous mobile robots (AMRs) and drones, which can further enhance warehouse efficiency. Furthermore, the integration of AI and machine learning can lead to predictive analytics, enabling warehouses to forecast inventory needs and optimize operations proactively. Additionally, the increasing focus on sustainability and green logistics offers opportunities for smart warehouses to implement eco-friendly practices, such as energy-efficient systems and waste reduction strategies.

Challenges

Despite the promising outlook, the smart warehouse market faces several challenges. The initial investment costs for implementing smart technologies can be high, which may deter smaller businesses from adopting these solutions. Additionally, the complexity of integrating new technologies with existing systems can pose significant operational hurdles. Concerns regarding data security and privacy also present challenges, as smart warehouses rely heavily on data collection and connectivity. Moreover, the ongoing skills gap in the workforce regarding the management of advanced technologies can hinder the effective deployment and utilization of smart warehouse systems.

Region Insights

Geographically, the smart warehouse market is witnessing varied growth trends across regions. North America, particularly the United States, is a leader in adopting smart warehouse technologies, driven by the presence of major e-commerce players and logistics companies. The region’s advanced technological infrastructure and strong investment in R&D further support market growth. In Europe, countries such as Germany and the UK are increasingly investing in automation and AI solutions to enhance logistics efficiency. The Asia-Pacific region is also emerging as a significant market, with rapid industrialization and the growth of e-commerce in countries like China and India driving demand for smart warehouse solutions. Overall, the market is expected to see substantial growth globally, influenced by regional economic factors and technological advancements.

Read Also: Albumin Market Size to Touch USD 11.64 Billion by 2034

Recent Developments

- In June 2024, Chhattisgarh Medical Services Corporation Limited successfully implemented a GPS-based tracking system for medicine storage and delivery, enhancing supply chain efficiencies. The system supports tracking and monitoring of shipments in real-time from warehouses to healthcare providers.

- In April 2024, Amazon Australia announced the development of two new super-scale robotics-led centers, with the company investing $490 million into the project. The 685,000-square-foot warehouses will reportedly rely on robot workers to assist human workers and automate order fulfillment tasks.

Smart Warehouse Markets Top Companies

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-premises

By Technology

- IoT

- Robotics and Automation

- AI & Analytics

- Networking & Communication

- AR & VR

- Others

By Application

- Inventory Management

- Order Fulfillment

- Asset Tracking

- Predictive Analytics

- Others

By Warehouse

- Small

- Medium

- Large

By Vertical

- Transportation & Logistics

- Retail & E-commerce

- Manufacturing

- Healthcare

- Energy and Utilities

- Automotive

- Food & Beverages

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5084

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/