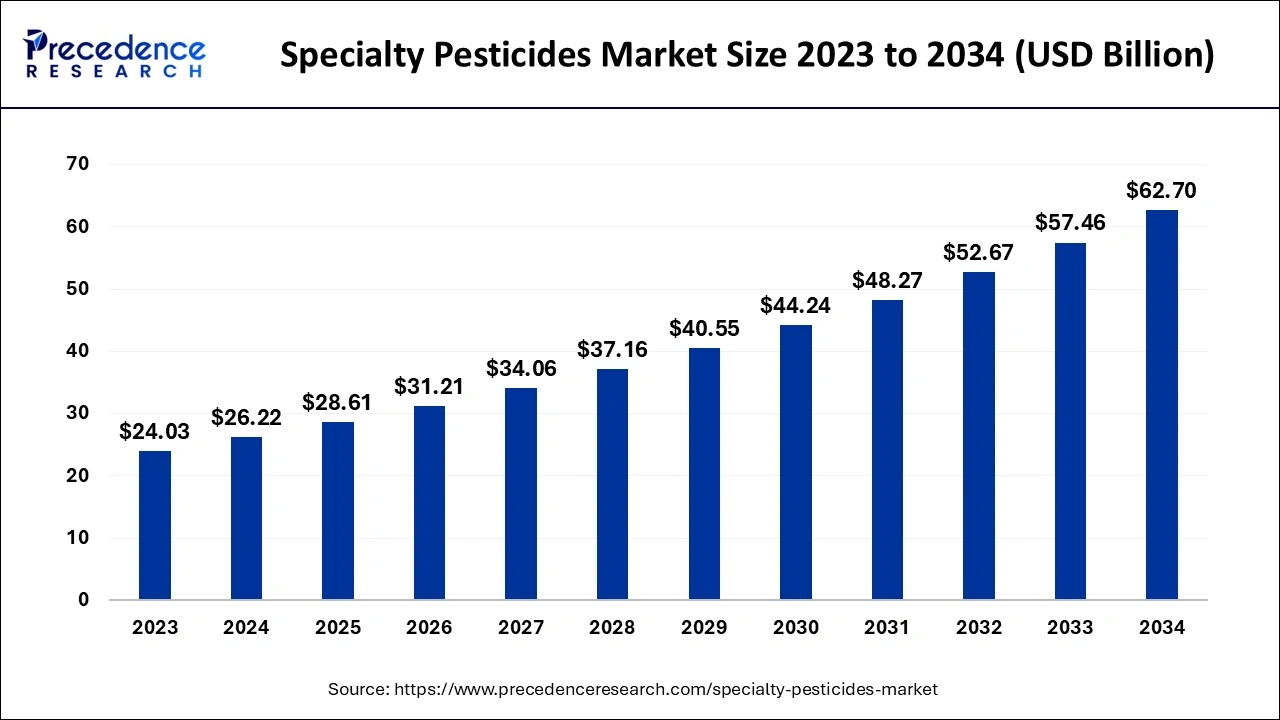

The global specialty pesticides market size was exhibited at USD 26.22 billion in 2024 and is anticipated to touch around USD 62.70 billion by 2034, growing at a impressive CAGR of 9.11% from 2024 to 2034.

Key Takeaways

- Asia Pacific dominated the global specialty pesticides market in 2023.

- North America is anticipated to register the fastest growth in the market during the forecast period of 2024 to 2034.

- By product, the herbicides segment dominated the global market in 2023.

- By product, the insecticides segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034.

- By formulation, the liquid segment led the global market in 2023.

- By formulation, the powder segment is expected to grow rapidly in the market during the forecast period of 2024 to 2034.

- By application, the crop protection segment registered its dominance over the market in 2023.

- By application, the non-crop protection segment is expected to witness the fastest growth in the market during the forecast period.

Get the Sample Copy of This Report@ https://www.precedenceresearch.com/sample/5113

Market Overview

The Specialty Pesticides Market encompasses a range of chemical and biological agents designed to target specific pests, weeds, fungi, and diseases that affect agricultural crops and non-agricultural areas such as residential lawns, golf courses, and public spaces. Unlike broad-spectrum pesticides, specialty pesticides are highly targeted, offering precision in pest management. This market is experiencing growth due to the increasing need for sustainable and efficient pest control solutions, along with rising awareness among end-users about the benefits of using specialized pesticides.

Growth Factors

The growth of the Specialty Pesticides Market is largely driven by increasing agricultural productivity demands and the shift towards sustainable farming practices. The development of advanced pest control products with enhanced effectiveness and minimal environmental impact is also fueling market expansion. Moreover, the trend toward organic farming and reduced chemical residues in food products has encouraged the adoption of bio-based specialty pesticides, which are perceived as safer for the environment and human health.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 62.70 Billion |

| Market Size in 2024 | USD 26.22 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.11% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Formulation, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Several key drivers propel the Specialty Pesticides Market. Growing concerns over food security and the need to protect crops from pests and diseases are central motivators for this market. Additionally, innovations in agricultural technology, such as precision farming and integrated pest management (IPM), have boosted demand for specialty pesticides that offer targeted, efficient solutions. Regulatory pressure for more environmentally friendly products has further spurred the development and adoption of these pesticides, as governments implement stringent guidelines on pesticide usage.

Opportunities

The Specialty Pesticides Market presents numerous opportunities, especially with the increasing global demand for food and the rising trend towards organic farming. This shift opens up significant avenues for bio-based specialty pesticides, as they align with organic standards and are more widely accepted by environmentally-conscious consumers. Furthermore, the expansion of precision agriculture offers opportunities for market growth, as it enables the application of pesticides in a more controlled and precise manner, thus enhancing crop yields and reducing waste.

Challenges

Despite the growth potential, the Specialty Pesticides Market faces several challenges. Regulatory hurdles are a significant barrier, as the development of specialty pesticides requires substantial investment to meet stringent safety standards and approval processes. Additionally, the high cost of specialty pesticides compared to traditional options can limit adoption among small-scale farmers. The market also faces challenges from consumer concerns over chemical residues and environmental impacts, necessitating continuous innovation to create safer, more effective products.

Regional Insights

Regionally, North America and Europe are prominent markets for specialty pesticides due to the established agricultural sectors and high regulatory standards favoring eco-friendly pest control solutions. The Asia-Pacific region, however, is expected to witness rapid growth, driven by increasing agricultural activities, rising population, and supportive government initiatives. In regions like Latin America and Africa, where agriculture is a critical economic sector, the demand for specialty pesticides is also increasing, although growth is tempered by economic constraints and regulatory frameworks. Overall, regional trends reflect varying degrees of adoption influenced by local agricultural practices, regulatory environments, and market demands.

Read Also: Truck Rental Market Size is Reach USD 269.57 Billion by 2034

Specialty Pesticides Market Companies

- Bayer AG

- Syngenta AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Limited

- Sumitomo Chemical

- Monsanto Company

- UPL Limited

- Lanxess AG

- Nippon Soda CO, Ltd

- Zhejiang Jianfeng Chemical Co, Ltd

- Hanfeng Evergreen Inc.

- American Vanguard Corporation

- Arysta LifeScience Corporation

- Mitsui Chemicals, Inc

- SABIC

- Kumiai Chemical Industry CO, Ltd

- Rallis India, Ltd

- BASF SE

- Adama Agricultural Solutions Ltd.

Recent Developments

- In June 2024, Best Agrolife announced the launch of its patented insecticide ‘Nemagen,’ targeting lepidopteran pests with a market goal of 500 crore Indian rupees.

- In June 2024, MOA Technology announced a collaboration with Nufarm to develop an innovative herbicide solution to tackle weed-related issues.

- In June 2024, FMC, an agricultural sciences company, obtained registration in India for Isoflex active and Ambriva herbicide, offering effective control against Phalaris minor in wheat cultivation.

Segments Covered in the Report

By Product

- Herbicides

- Insecticides

- Fungicides

- Others

By Formulation

- Liquid

- Granular

- Powder

By Application

- Crop Protection

- Non-Crop Protection

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/5113

Contact Us:

Mr. Alex

Sales Manager

Call: + 1 804 441 9344

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailystatsnews.com/

Blog: https://www.dailytechbulletin.com/